- United States

- /

- Life Sciences

- /

- NasdaqGS:PACB

The Price Is Right For Pacific Biosciences of California, Inc. (NASDAQ:PACB) Even After Diving 27%

Pacific Biosciences of California, Inc. (NASDAQ:PACB) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 70%, which is great even in a bull market.

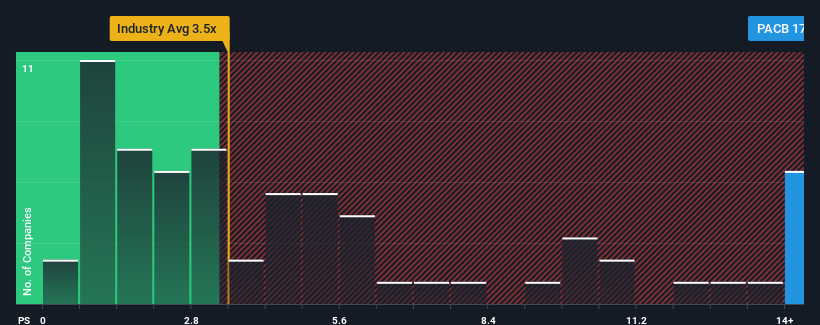

Even after such a large drop in price, you could still be forgiven for thinking Pacific Biosciences of California is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 17x, considering almost half the companies in the United States' Life Sciences industry have P/S ratios below 3.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Pacific Biosciences of California

How Pacific Biosciences of California Has Been Performing

Recent times have been advantageous for Pacific Biosciences of California as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Pacific Biosciences of California's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Pacific Biosciences of California's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.7% gain to the company's revenues. Pleasingly, revenue has also lifted 77% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 47% per annum as estimated by the ten analysts watching the company. With the industry only predicted to deliver 7.5% each year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Pacific Biosciences of California's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Pacific Biosciences of California's P/S

Even after such a strong price drop, Pacific Biosciences of California's P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Pacific Biosciences of California's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Pacific Biosciences of California has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Pacific Biosciences of California's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PACB

Pacific Biosciences of California

Designs, develops, and manufactures sequencing solution to resolve genetically complex problems.

Undervalued low.