- United States

- /

- Life Sciences

- /

- NasdaqGS:PACB

Take Care Before Jumping Onto Pacific Biosciences of California, Inc. (NASDAQ:PACB) Even Though It's 33% Cheaper

Unfortunately for some shareholders, the Pacific Biosciences of California, Inc. (NASDAQ:PACB) share price has dived 33% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 91% share price decline.

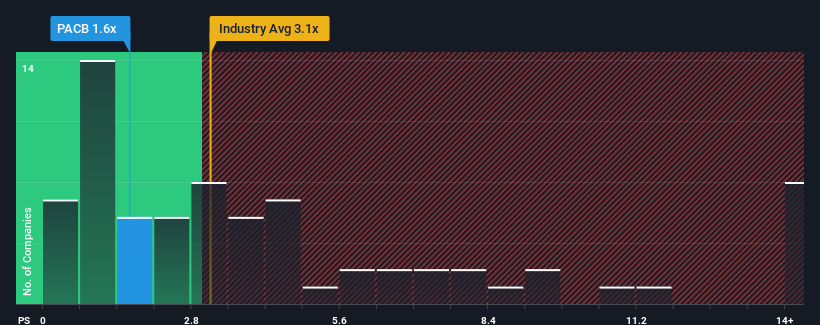

After such a large drop in price, Pacific Biosciences of California may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.6x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.1x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Pacific Biosciences of California

How Has Pacific Biosciences of California Performed Recently?

Recent times have been pleasing for Pacific Biosciences of California as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pacific Biosciences of California.How Is Pacific Biosciences of California's Revenue Growth Trending?

Pacific Biosciences of California's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 50% last year. The strong recent performance means it was also able to grow revenue by 117% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 17% each year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 6.8% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Pacific Biosciences of California's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The southerly movements of Pacific Biosciences of California's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Pacific Biosciences of California's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You need to take note of risks, for example - Pacific Biosciences of California has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PACB

Pacific Biosciences of California

Designs, develops, and manufactures sequencing solution to resolve genetically complex problems.

Undervalued low.