- United States

- /

- Biotech

- /

- NasdaqGS:OVID

Would Shareholders Who Purchased Ovid Therapeutics' (NASDAQ:OVID) Stock Three Years Be Happy With The Share price Today?

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Ovid Therapeutics Inc. (NASDAQ:OVID) investors who have held the stock for three years as it declined a whopping 73%. That would be a disturbing experience. And the ride hasn't got any smoother in recent times over the last year, with the price 41% lower in that time. Furthermore, it's down 57% in about a quarter. That's not much fun for holders.

Check out our latest analysis for Ovid Therapeutics

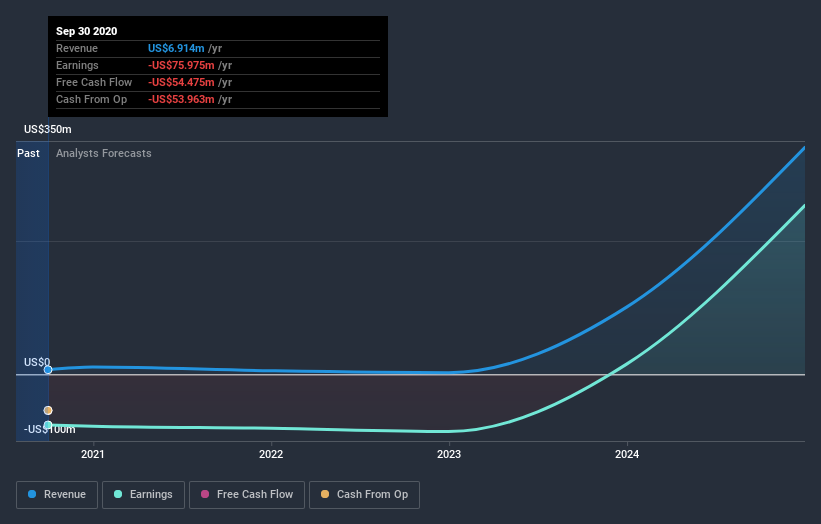

Because Ovid Therapeutics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The last twelve months weren't great for Ovid Therapeutics shares, which cost holders 41%, while the market was up about 24%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 20% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Ovid Therapeutics better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Ovid Therapeutics you should know about.

Of course Ovid Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Ovid Therapeutics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:OVID

Ovid Therapeutics

A biopharmaceutical company, engages in the development of impactful medicines for patients and families with epilepsies and seizure-related neurological disorders in the United States.

Adequate balance sheet slight.