- United States

- /

- Biotech

- /

- NasdaqGS:ORIC

Does ORIC (ORIC) Have the Scientific Depth to Turn Enozertinib Data Into Lasting Value?

Reviewed by Sasha Jovanovic

- ORIC Pharmaceuticals is preparing to present new Phase 1b data for its brain-penetrant EGFR/HER2 inhibitor enozertinib (ORIC-114) in previously treated HER2 exon 20 mutant non-small cell lung cancer at the ESMO Asia Congress 2025 in Singapore, with a follow-up investor webcast on December 6, 2025.

- The upcoming data disclosure is important because it centers on a genetically defined, hard-to-treat lung cancer subset where targeted treatment options remain limited, making trial design details and early clinical signals closely watched by investors and clinicians.

- We’ll examine how anticipation around the enozertinib (ORIC-114) Phase 1b data in HER2 exon 20 mutant NSCLC shapes ORIC’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is ORIC Pharmaceuticals' Investment Narrative?

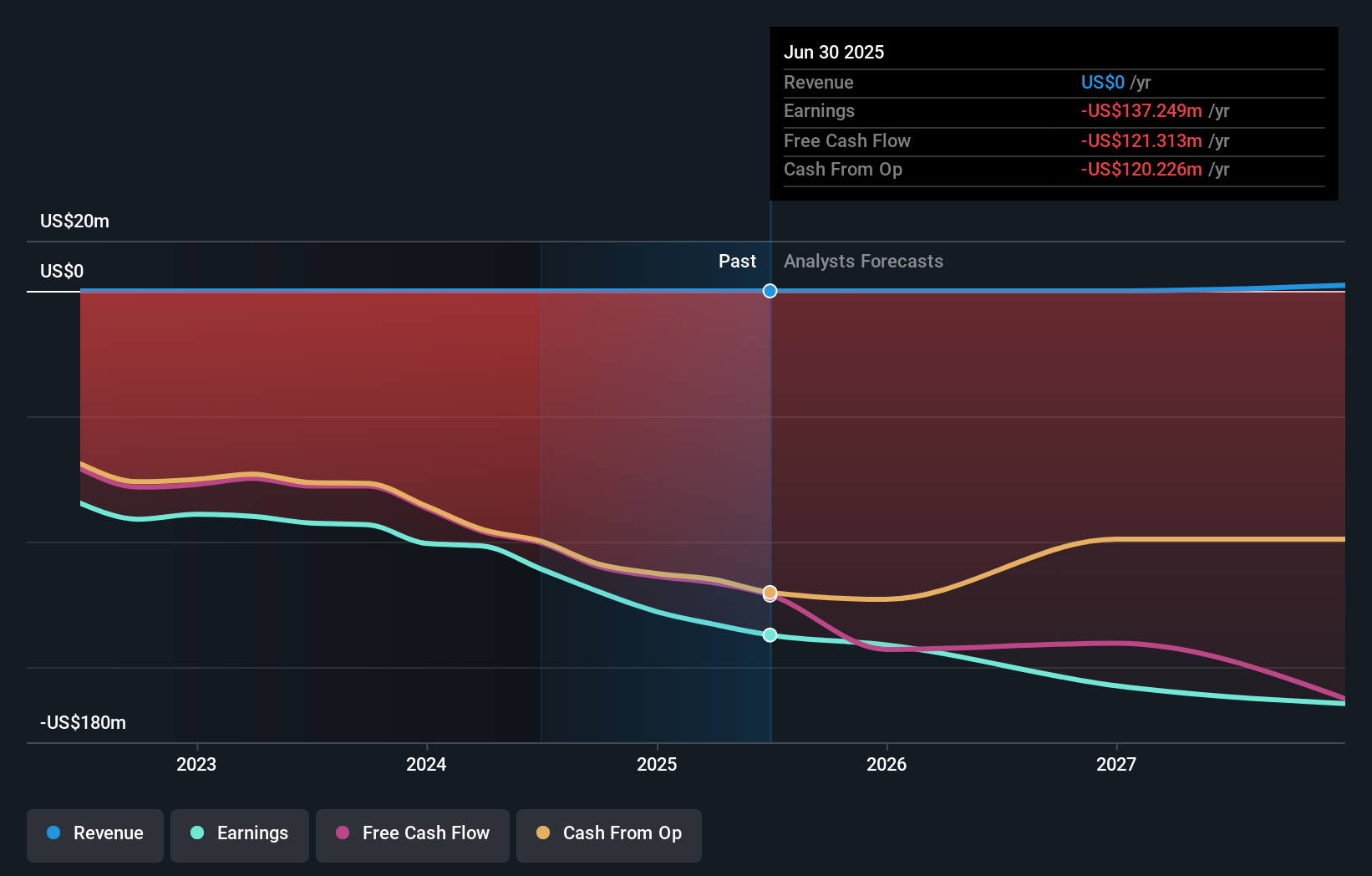

To own ORIC Pharmaceuticals, you really have to believe that its pipeline, and especially enozertinib (ORIC-114), can eventually turn a history of widening losses into a viable commercial story, despite zero revenue and no clear path to profitability over the next few years. The recent news around the upcoming Phase 1b HER2 exon 20 NSCLC data at ESMO Asia 2025 fits squarely into that thesis: it sharpens the near term catalyst stack around ORIC-114 readouts and investor communication, but by itself does not change the fact that this is still an early stage, cash burning biotech that recently raised about US$159,000,000 in dilutive financing to keep trials funded. With shares well below consensus fair value estimates and volatile recent price moves, the biggest swing factors remain trial quality, safety and efficacy signals, and the company’s ability to avoid further heavy dilution if timelines slip or results disappoint.

However, funding runway and dilution risk are areas investors might want to examine more closely. Our valuation report unveils the possibility ORIC Pharmaceuticals' shares may be trading at a premium.Exploring Other Perspectives

The single fair value estimate of about US$19.92 from the Simply Wall St Community points to a very large potential upside from recent trading levels, but it is only one private investor’s view. Set that alongside the company’s continued losses and reliance on capital raises, and it becomes clear why different market participants can reach very different conclusions about how ORIC’s clinical data and funding risks might shape its longer term performance.

Explore another fair value estimate on ORIC Pharmaceuticals - why the stock might be worth just $19.92!

Build Your Own ORIC Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ORIC Pharmaceuticals research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free ORIC Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ORIC Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORIC

ORIC Pharmaceuticals

A clinical-stage biopharmaceutical company, engages in the discovery and development of therapies to counter the resistance mechanisms cancers in the United States.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026