- United States

- /

- Pharma

- /

- NasdaqGS:OPTN

The Consensus EPS Estimates For OptiNose, Inc. (NASDAQ:OPTN) Just Fell Dramatically

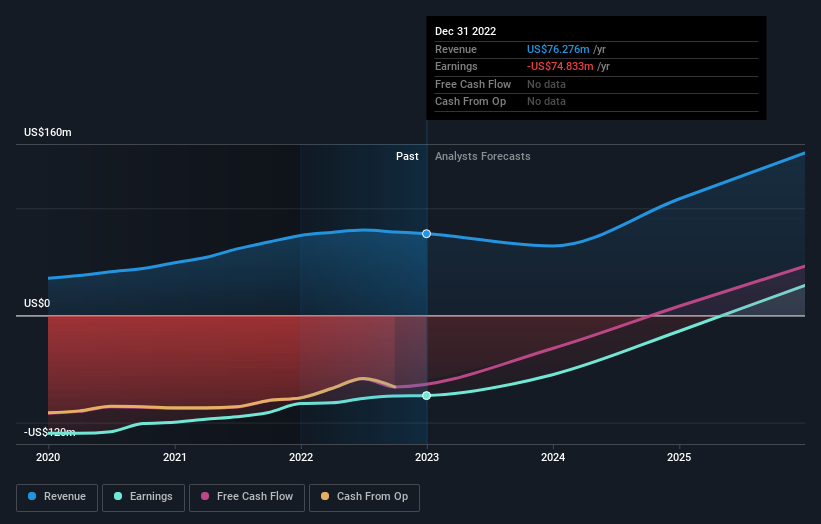

The latest analyst coverage could presage a bad day for OptiNose, Inc. (NASDAQ:OPTN), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

Following the downgrade, the consensus from four analysts covering OptiNose is for revenues of US$65m in 2023, implying a chunky 15% decline in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 20% to US$0.53. However, before this estimates update, the consensus had been expecting revenues of US$89m and US$0.46 per share in losses. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

See our latest analysis for OptiNose

The consensus price target fell 18% to US$4.13, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values OptiNose at US$5.00 per share, while the most bearish prices it at US$3.50. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 15% by the end of 2023. This indicates a significant reduction from annual growth of 46% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 4.9% annually for the foreseeable future. It's pretty clear that OptiNose's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with OptiNose, including recent substantial insider selling. For more information, you can click here to discover this and the 2 other warning signs we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPTN

OptiNose

A specialty pharmaceutical company, focuses on the development and commercialization of products for patients treated by ear, nose, throat, and allergy specialists in the United States.

Undervalued moderate.