- United States

- /

- Pharma

- /

- NasdaqGS:OPTN

Slammed 34% OptiNose, Inc. (NASDAQ:OPTN) Screens Well Here But There Might Be A Catch

OptiNose, Inc. (NASDAQ:OPTN) shareholders that were waiting for something to happen have been dealt a blow with a 34% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

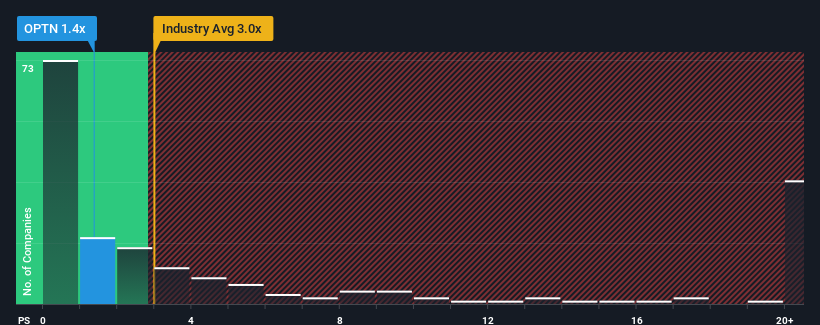

Since its price has dipped substantially, OptiNose's price-to-sales (or "P/S") ratio of 1.4x might make it look like a buy right now compared to the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 3x and even P/S above 11x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for OptiNose

What Does OptiNose's P/S Mean For Shareholders?

Recent times haven't been great for OptiNose as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OptiNose.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like OptiNose's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.9% last year. The latest three year period has also seen a 21% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 38% per annum as estimated by the four analysts watching the company. With the industry only predicted to deliver 17% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that OptiNose's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does OptiNose's P/S Mean For Investors?

OptiNose's recently weak share price has pulled its P/S back below other Pharmaceuticals companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at OptiNose's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 3 warning signs for OptiNose (1 doesn't sit too well with us!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPTN

OptiNose

A specialty pharmaceutical company, focuses on the development and commercialization of products for patients treated by ear, nose, throat, and allergy specialists in the United States.

Undervalued moderate.