- United States

- /

- Pharma

- /

- NasdaqGS:OPTN

OptiNose, Inc. (NASDAQ:OPTN) Might Not Be As Mispriced As It Looks After Plunging 29%

OptiNose, Inc. (NASDAQ:OPTN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

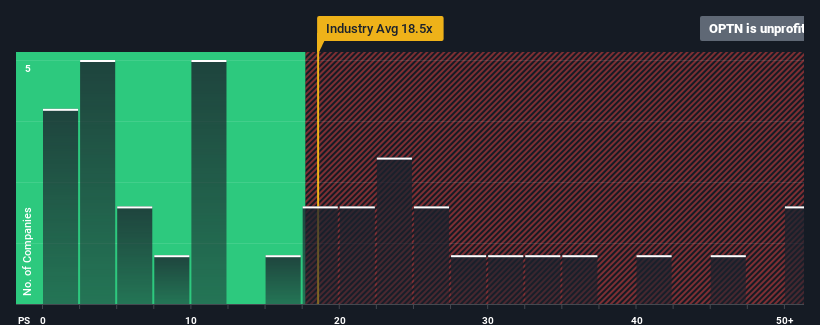

After such a large drop in price, OptiNose may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -2.2x, since almost half of all companies in the United States have P/E ratios greater than 15x and even P/E's higher than 30x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, OptiNose has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for OptiNose

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like OptiNose's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 42% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 45% over the next year. With the market only predicted to deliver 5.9%, the company is positioned for a stronger earnings result.

With this information, we find it odd that OptiNose is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

OptiNose's P/E looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of OptiNose's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - OptiNose has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If these risks are making you reconsider your opinion on OptiNose, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPTN

OptiNose

A specialty pharmaceutical company, focuses on the development and commercialization of products for patients treated by ear, nose, throat, and allergy specialists in the United States.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives