- United States

- /

- Biotech

- /

- NasdaqGS:ONC

Will BeOne Medicines’ (ONC) Pipeline Progress Reshape Its Competitive Edge in Blood Cancer Therapies?

Reviewed by Simply Wall St

- BeOne Medicines recently announced positive topline results from a Phase 1/2 study of sonrotoclax, its investigational BCL2 inhibitor, in adult patients with relapsed or refractory mantle cell lymphoma who had already undergone Bruton's tyrosine kinase inhibitor and anti-CD20 treatment.

- This milestone strengthens BeOne’s hematology portfolio, highlights ongoing regulatory progress, and supports efforts to address high unmet needs in aggressive B-cell malignancies.

- We’ll assess how these encouraging clinical results and the start of a pivotal Phase 3 trial could influence BeOne Medicines' wider investment outlook.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

BeOne Medicines Investment Narrative Recap

To believe in BeOne Medicines as a shareholder, you need to trust in the company's ability to deliver new, differentiated oncology therapies and diversify beyond its current revenue concentration. The recent positive clinical results for sonrotoclax could be a meaningful short-term catalyst, bringing the potential for accelerated regulatory approvals and pipeline momentum. However, it does not immediately resolve the key risk: heavy reliance on a limited set of products, where regulatory delays or competitor advances could still cause revenue volatility.

Among recent announcements, the acceptance of new drug applications for sonrotoclax in both the US and China is directly relevant, signaling ongoing regulatory progress and the possibility of earlier market entry as a catalyst. This aligns with BeOne’s efforts to expand its hematology franchise, but eyes will remain on upcoming pivotal trial data and review outcomes that could impact future growth.

Yet in contrast to recent clinical successes, the risk from competition and revenue concentration is information investors should be aware of…

Read the full narrative on BeOne Medicines (it's free!)

BeOne Medicines' outlook anticipates $7.6 billion in revenue and $1.3 billion in earnings by 2028. This scenario assumes 18.6% annual revenue growth and a $1.48 billion increase in earnings from the current level of -$177.6 million.

Uncover how BeOne Medicines' forecasts yield a $363.30 fair value, a 16% upside to its current price.

Exploring Other Perspectives

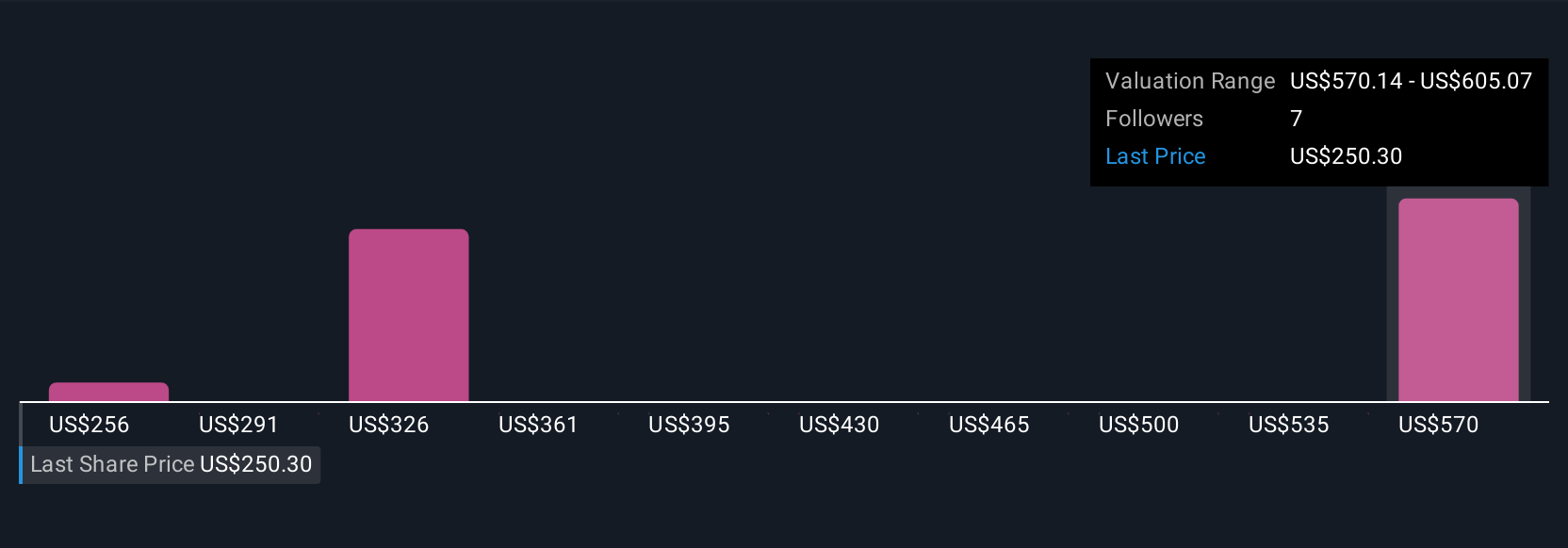

Four private investors in the Simply Wall St Community estimated BeOne's fair value from US$255.78 up to US$770.74. Alongside these varied opinions, looming competition in oncology remains a central factor shaping the company's future prospects. Explore several alternative viewpoints to inform your outlook.

Explore 4 other fair value estimates on BeOne Medicines - why the stock might be worth 19% less than the current price!

Build Your Own BeOne Medicines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BeOne Medicines research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BeOne Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BeOne Medicines' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeOne Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeOne Medicines

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives