- United States

- /

- Biotech

- /

- NasdaqGS:ONC

BeOne Medicines (ONC) Resolves Patent Dispute With Pharmacyclics How Secure Is Its Competitive Moat?

Reviewed by Sasha Jovanovic

- BeOne Medicines announced that Pharmacyclics has chosen not to appeal a U.S. Patent Office decision invalidating all challenged claims of the `803 patent, and both companies have jointly moved to dismiss their related U.S. court litigation with prejudice, fully resolving the dispute.

- This legal resolution eliminates a significant uncertainty surrounding BeOne's intellectual property, strengthening its position in the oncology sector and clarifying its freedom to operate.

- We'll explore how the resolution of this patent litigation removes a substantial legal risk and might influence BeOne's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BeOne Medicines Investment Narrative Recap

Shareholders in BeOne Medicines are typically drawn to its potential for innovative oncology treatments and robust pipeline momentum, betting on expansion in both clinical assets and revenue. The recent resolution of its patent dispute with Pharmacyclics eliminates a critical legal overhang, but does not directly alter the immediate, key catalyst: pivotal clinical trial readouts and approvals for major pipeline assets, especially as competitive and regulatory risks remain front and center for the business.

Among the company's recent announcements, the release of positive topline results from the Phase 1/2 sonrotoclax study is most directly relevant. The outcome underscores BeOne's ongoing ability to advance late-stage oncology assets that could drive future growth, even as issues like market concentration and upcoming competitive launches continue to influence sentiment. In contrast, investors should also be aware of pressures from intensifying competition and risks to key drug franchises if...

Read the full narrative on BeOne Medicines (it's free!)

BeOne Medicines' outlook anticipates $7.6 billion in revenue and $1.3 billion in earnings by 2028. This relies on an 18.6% annual revenue growth rate and an earnings improvement of $1.48 billion, up from current earnings of -$177.6 million.

Uncover how BeOne Medicines' forecasts yield a $372.97 fair value, a 17% upside to its current price.

Exploring Other Perspectives

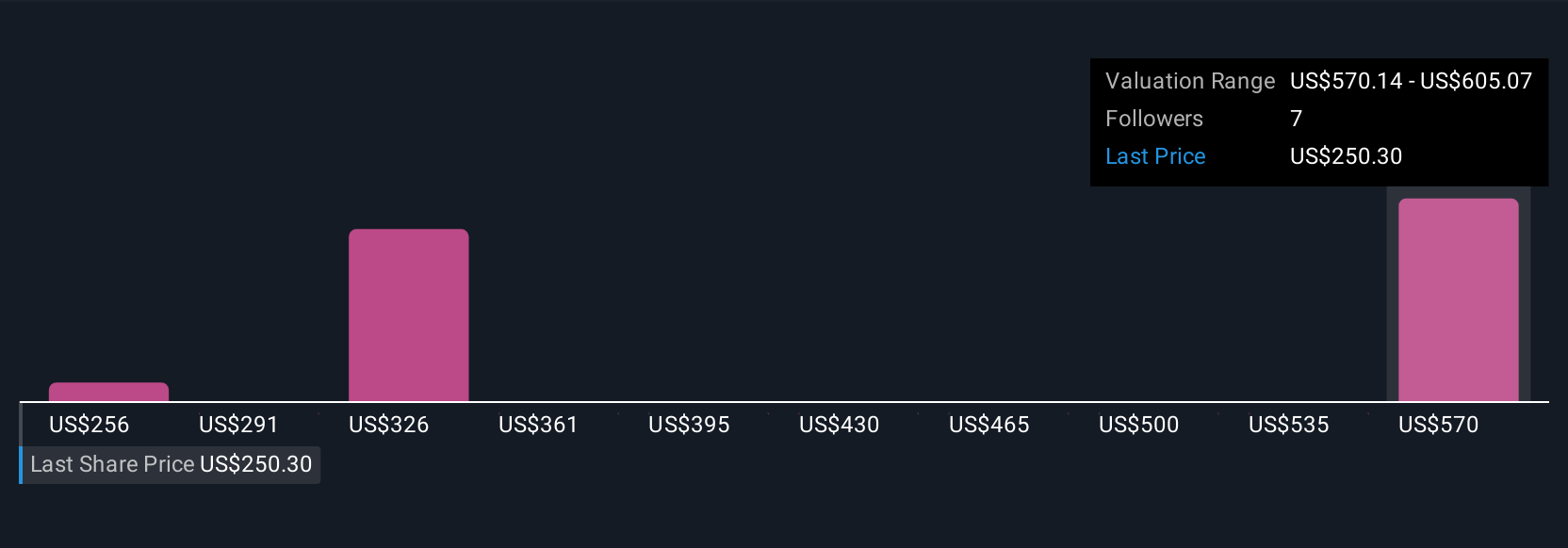

Four fair value estimates from the Simply Wall St Community placed BeOne’s worth between US$255.78 and US$750.24. While many anticipate pipeline momentum, the risk of concentrated revenue and market challengers remains a central debate investors should consider as they compare viewpoints.

Explore 4 other fair value estimates on BeOne Medicines - why the stock might be worth over 2x more than the current price!

Build Your Own BeOne Medicines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BeOne Medicines research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free BeOne Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BeOne Medicines' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeOne Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeOne Medicines

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives