- United States

- /

- Biotech

- /

- NasdaqGS:GILD

High Growth Tech Stocks in the United States to Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.2%, contributing to a substantial climb of 24% over the past year, with earnings anticipated to grow by 15% annually. In such a robust market environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability in rapidly evolving sectors.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.07% | 27.57% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 29.48% | 53.73% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.83% | 59.08% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Appian (NasdaqGM:APPN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Appian Corporation is a software company offering a low-code design platform across the United States, Mexico, Portugal, and internationally with a market cap of $2.33 billion.

Operations: Appian generates revenue primarily through its low-code design platform, which enables businesses to develop applications with minimal coding. The company's business model focuses on subscription fees from its software offerings, supplemented by professional services.

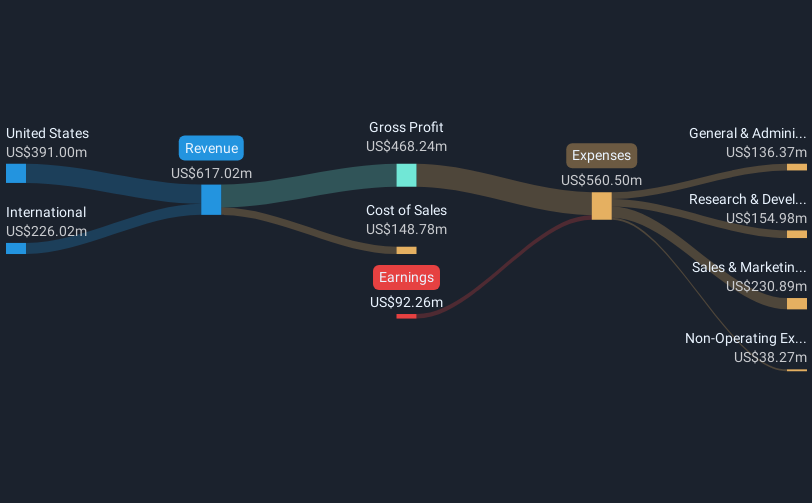

Appian's recent performance and strategic initiatives underscore its adaptability and potential within the tech sector. In 2024, the company reported a revenue increase to $617.02 million from $545.36 million in the previous year, although it still posted a net loss of $92.26 million, an improvement over the prior year's $111.44 million loss. Notably, Appian is enhancing client engagement through its innovative platform; for instance, AGL’s adoption has already automated over 70% of tasks that were previously manual, showcasing Appian’s capability to transform enterprise operations significantly. This aligns with broader industry trends towards digital transformation and process automation, positioning Appian at the forefront of facilitating substantial efficiency gains for businesses transitioning towards more advanced tech solutions.

- Click here and access our complete health analysis report to understand the dynamics of Appian.

Assess Appian's past performance with our detailed historical performance reports.

Gilead Sciences (NasdaqGS:GILD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gilead Sciences, Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing medicines for unmet medical needs globally, with a market cap of $131.17 billion.

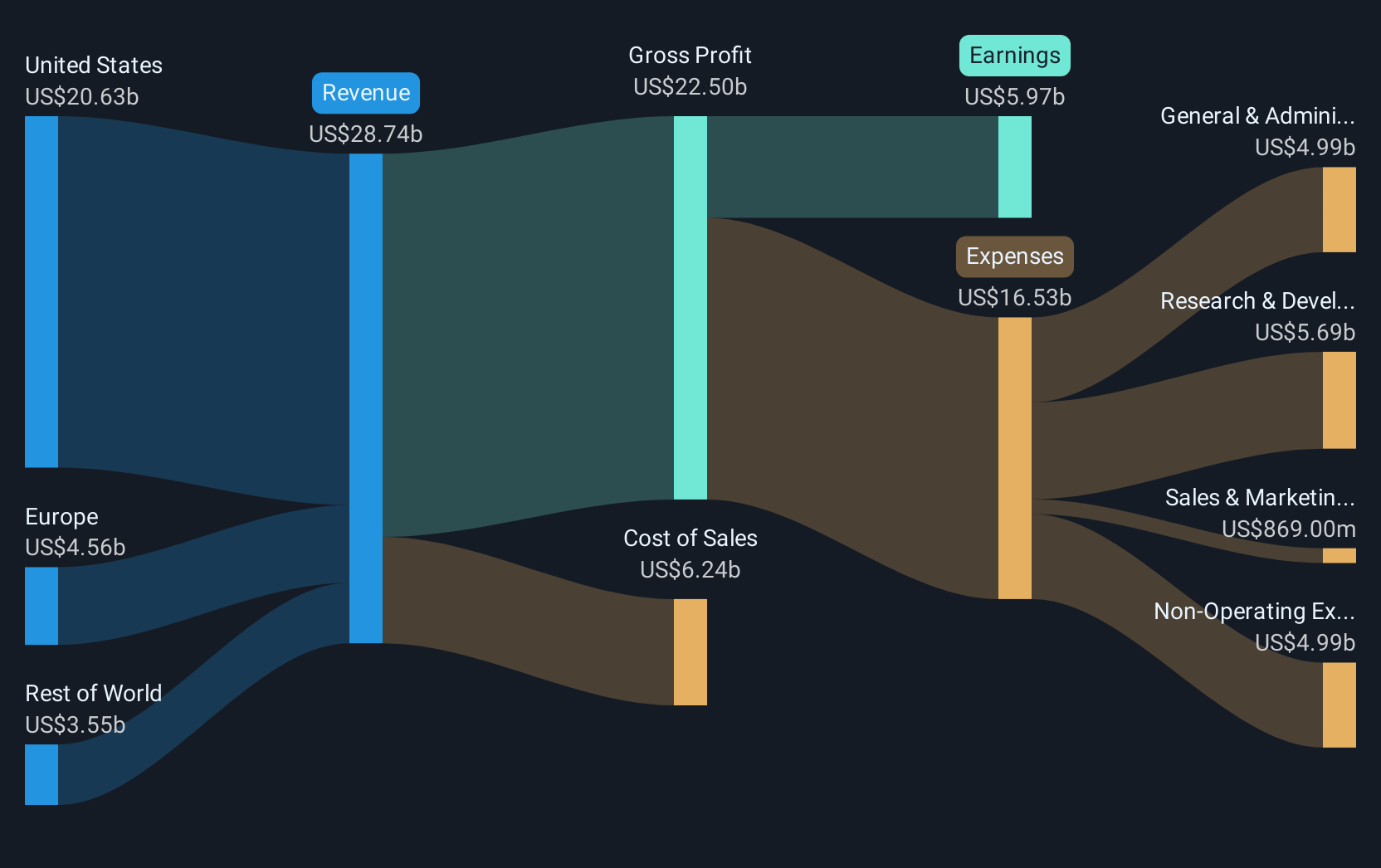

Operations: Gilead Sciences generates revenue primarily through the discovery, development, and commercialization of innovative medicines, amounting to $28.75 billion. The company operates internationally, focusing on addressing unmet medical needs across various regions.

Gilead Sciences has shown a robust commitment to innovation, particularly in the biopharmaceutical sector, with recent FDA priority review acceptance of its HIV prevention drug lenacapavir indicating potential market expansion. In 2024, Gilead reported a significant revenue increase to $28.75 billion from $27.12 billion the previous year, underscoring its financial growth amidst challenging conditions. The company's strategic alliances and R&D focus are further evidenced by its collaboration with IDEAYA Biosciences to enhance cancer treatment solutions, demonstrating Gilead’s proactive approach in addressing complex health challenges through advanced therapies and strategic partnerships.

- Dive into the specifics of Gilead Sciences here with our thorough health report.

Gain insights into Gilead Sciences' historical performance by reviewing our past performance report.

BeiGene (NasdaqGS:ONC)

Simply Wall St Growth Rating: ★★★★★☆

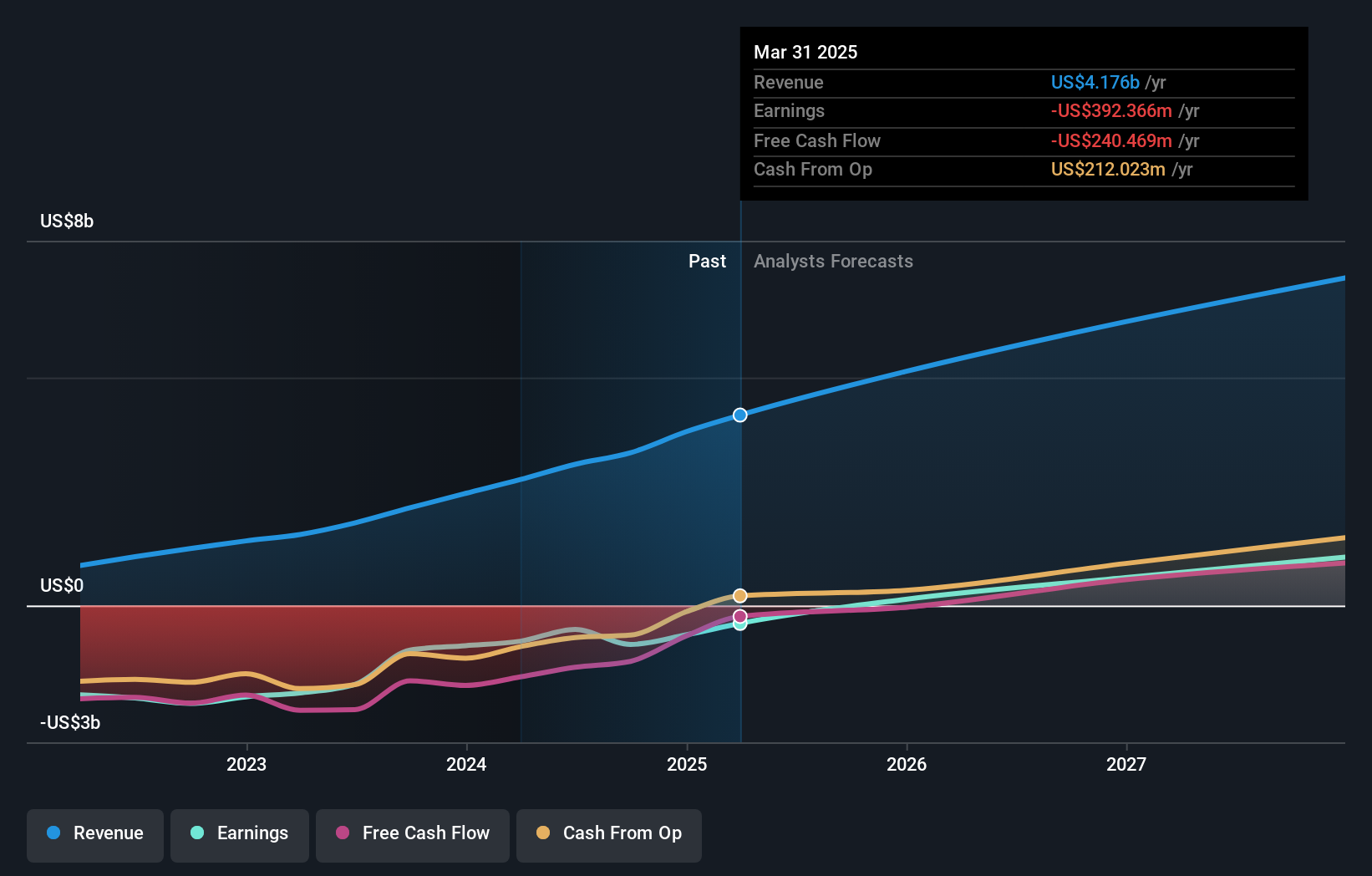

Overview: BeiGene, Ltd. is an oncology company focused on discovering and developing cancer treatments for patients across the United States, China, Europe, and other international markets with a market cap of approximately $25.41 billion.

Operations: BeiGene generates revenue primarily from its pharmaceutical products, amounting to approximately CN¥23.51 billion. The company's efforts are concentrated on developing innovative cancer treatments for a global market, including the United States, China, and Europe.

BeiGene's recent strategic collaboration with BostonGene to identify biomarkers in Mantle Cell Lymphoma underscores its commitment to advancing precision medicine. This partnership, leveraging next-generation sequencing and AI, aims to enhance treatment efficacy against high relapse rates in this aggressive cancer subtype. BeiGene's dedication is further highlighted by its significant R&D investment, which has consistently grown, reflecting a strong focus on innovation and development of novel therapies in oncology.

- Unlock comprehensive insights into our analysis of BeiGene stock in this health report.

Understand BeiGene's track record by examining our Past report.

Where To Now?

- Gain an insight into the universe of 233 US High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Undervalued moderate and pays a dividend.

Similar Companies

Market Insights

Community Narratives