- United States

- /

- Biotech

- /

- NasdaqGS:ONC

FDA Approval For BeiGene (NasdaqGS:ONC) TEVIMBRA In ESCC Shows 34 Percent Death Risk Reduction

Reviewed by Simply Wall St

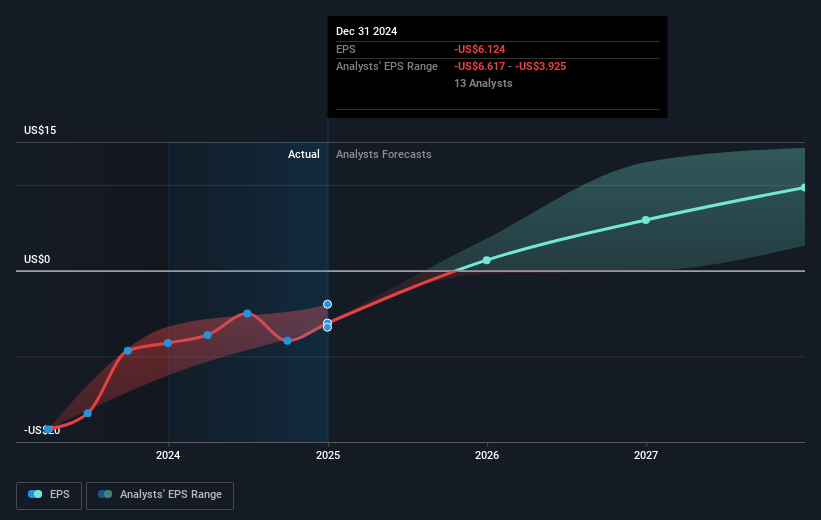

BeiGene (NasdaqGS:ONC) experienced a significant 29% price increase over the last quarter, supported by the FDA approval of TEVIMBRA for treating esophageal squamous cell carcinoma, a key development signalling the company's progress in oncology. This approval was based on favorable results from the RATIONALE-306 trial, demonstrating improved overall survival for patients. Further bolstering investor confidence were BeiGene's improved financial reports, showcasing a rise in revenue to $3.8 billion and a reduced net loss compared to the previous year. Additionally, the company's strategic partnerships, such as the collaboration with BostonGene, contributed positively to its growth narrative. These factors contrasted with broader market trends where major indexes reflected slight wavers amid global trade tensions. Compared to a 3.1% market drop recently, BeiGene's robust returns illustrate its ability to navigate challenges while leveraging key advancements in cancer treatment, showing resilience despite economic uncertainties.

Get an in-depth perspective on BeiGene's performance by reading our analysis here.

Over the past five years, BeiGene's shareholders have witnessed a total return of 64.66%. This impressive performance contrasts with the broader biotech industry, which faced challenges, with some industry barometers reflecting declines over the same period. A key factor contributing to BeiGene's growth is its consistent increase in revenue, highlighted by 2024 figures reaching US$3.81 billion, a significant rise from prior years. Strategic collaborations played a crucial role, exemplified by its partnership with Novartis in 2021 for the global development of tislelizumab, a pivotal step in broadening its market reach beyond China.

In addition, positive responses to product developments were paramount, such as the FDA's 2021 acceptance of additional applications for BRUKINSA, anticipating broader therapeutic use. Such regulatory progress reinforces investor confidence in BeiGene's innovative pipeline. Despite recent challenges, such as insider selling, the company's undervaluation based on price-to-sales ratios suggests potential positive investor sentiment relative to peers and the industry.

- Learn how BeiGene's intrinsic value compares to its market price with our detailed valuation report.

- Understand the uncertainties surrounding BeiGene's market positioning with our detailed risk analysis report.

- Is BeiGene part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeiGene might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeiGene

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Very undervalued with high growth potential.