- United States

- /

- Biotech

- /

- NasdaqGS:ONC

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.8% and over the past 12 months, it is up by 7.6%, with earnings expected to grow by 14% per annum over the next few years. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and robust financial health to capitalize on these market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 26.18% | 37.61% | ★★★★★★ |

| Alkami Technology | 20.45% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.82% | 58.64% | ★★★★★★ |

| AVITA Medical | 27.75% | 55.36% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

| TKO Group Holdings | 22.54% | 25.17% | ★★★★★★ |

| Lumentum Holdings | 21.55% | 119.67% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 240 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Trade Desk (NasdaqGM:TTD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform for buyers and has a market cap of approximately $27.44 billion.

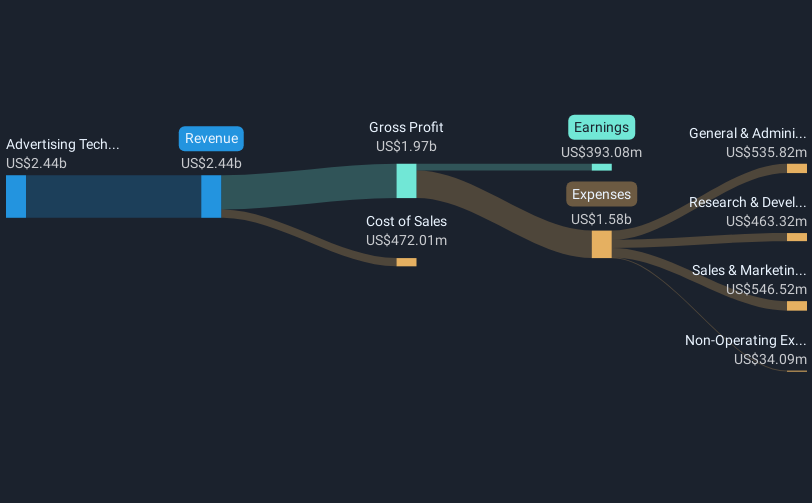

Operations: The Trade Desk generates revenue primarily through its advertising technology platform, which brought in approximately $2.44 billion. The company's business model focuses on offering a comprehensive platform for digital ad buyers worldwide, leveraging advanced data analytics and real-time bidding capabilities.

The Trade Desk's recent strategic maneuvers, including the appointment of Preetha Athrey as Director of Brand Marketing and the integration of OpenPath with Cineverse's ad tech platform, underscore its commitment to enhancing digital advertising efficiency. These developments are pivotal as the company navigates a dynamic ad tech landscape marked by increasing demand for transparency and effectiveness in ad spending. Notably, The Trade Desk reported a robust annual revenue growth of 16.1% and an impressive earnings growth rate of 22.3%, reflecting its strong operational execution and innovative edge in programmatic advertising solutions. Furthermore, its significant investment in R&D has fortified its competitive position, ensuring sustained innovation and adaptation in a rapidly evolving market.

- Get an in-depth perspective on Trade Desk's performance by reading our health report here.

Gain insights into Trade Desk's historical performance by reviewing our past performance report.

BeiGene (NasdaqGS:ONC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BeiGene, Ltd. is an oncology-focused company involved in the discovery and development of cancer treatments across the United States, China, Europe, and other international markets with a market cap of approximately $28.53 billion.

Operations: The company's primary revenue stream is derived from pharmaceutical products, generating approximately $3.81 billion.

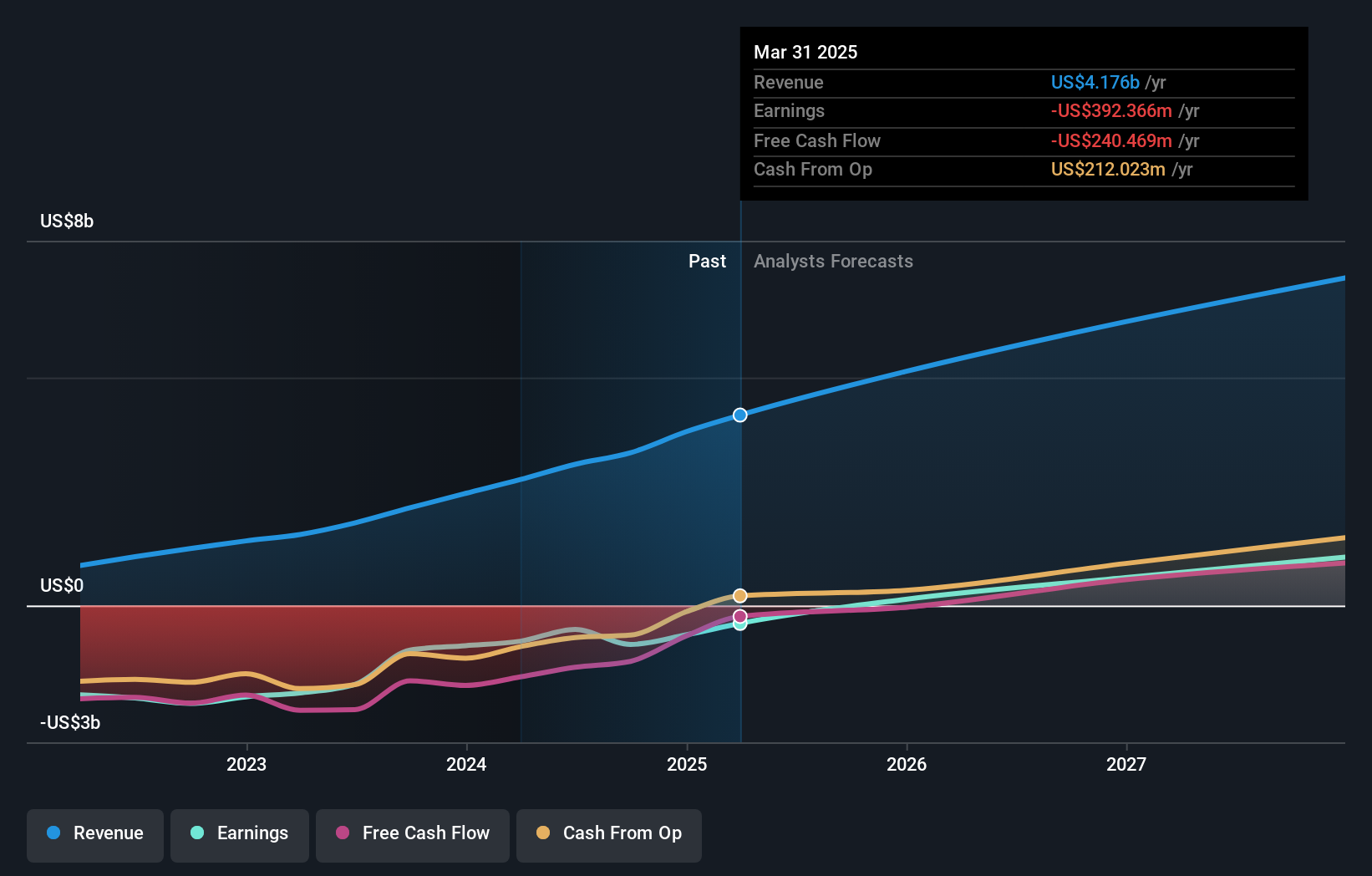

BeiGene, a player in the biotech sector, is making significant strides with its recent FDA approval of TEVIMBRA® for esophageal squamous cell carcinoma, showcasing a robust median OS improvement. This achievement underpins BeiGene's commitment to addressing critical medical needs through innovative therapies. Financially, the company reported a substantial revenue increase to $3.81 billion in 2024 from $2.46 billion the previous year, although it still operates at a loss. Looking ahead, BeiGene anticipates revenues between $4.9 billion and $5.3 billion for 2025, reflecting its optimistic outlook driven by new product launches and expanded market presence.

- Take a closer look at BeiGene's potential here in our health report.

Examine BeiGene's past performance report to understand how it has performed in the past.

Roku (NasdaqGS:ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market capitalization of approximately $10.53 billion.

Operations: The company generates revenue primarily through its Platform segment, which accounts for $3.52 billion, and its Devices segment, contributing $590.12 million. The Platform segment significantly outweighs the Devices in terms of revenue generation.

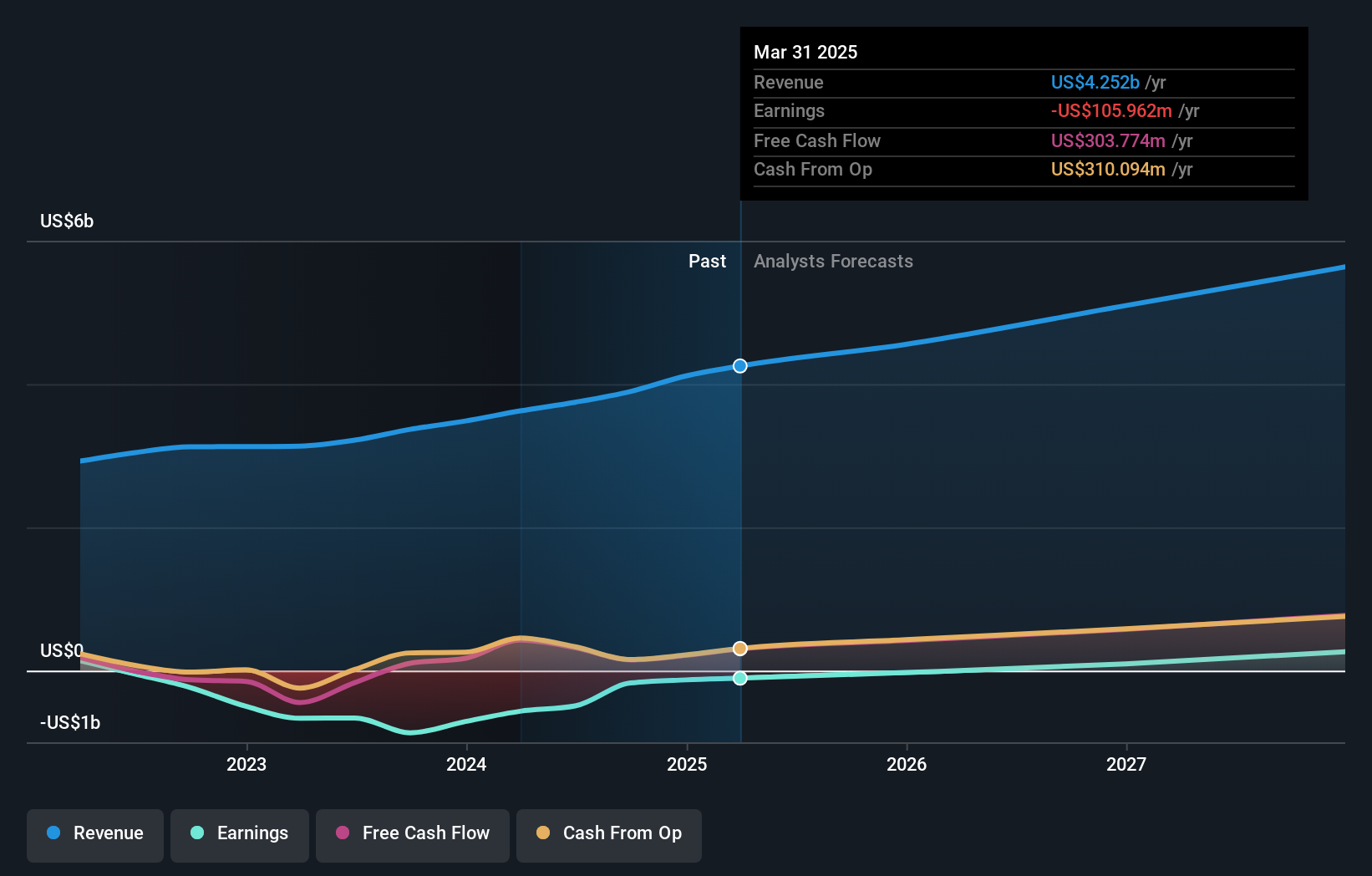

Roku's strategic partnership with Monster Jam to launch a dedicated FAST channel underscores its innovative approach to content diversification and audience engagement, tapping into the burgeoning demand for accessible, high-energy entertainment. This move is part of Roku's broader strategy to enhance its platform's appeal and drive viewership, as evidenced by the impressive 255 million minutes watched since the channel's inception last year. Financially, Roku is navigating towards profitability with a notable reduction in net loss from $709.56 million in 2023 to $129.39 million in 2024 while boosting revenue from $3.48 billion to $4.11 billion over the same period. The company forecasts further revenue growth up to $4.61 billion by end-2025, reflecting its optimistic outlook fueled by strategic expansions and content innovations.

Taking Advantage

- Access the full spectrum of 240 US High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade BeiGene, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BeiGene might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeiGene

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives