- United States

- /

- Biotech

- /

- NasdaqGS:ONC

BeiGene (NasdaqGS:ONC) Sees Revenue Growth As Quarterly Revenue Hits US$1,128M Despite US$152M Net Loss

Reviewed by Simply Wall St

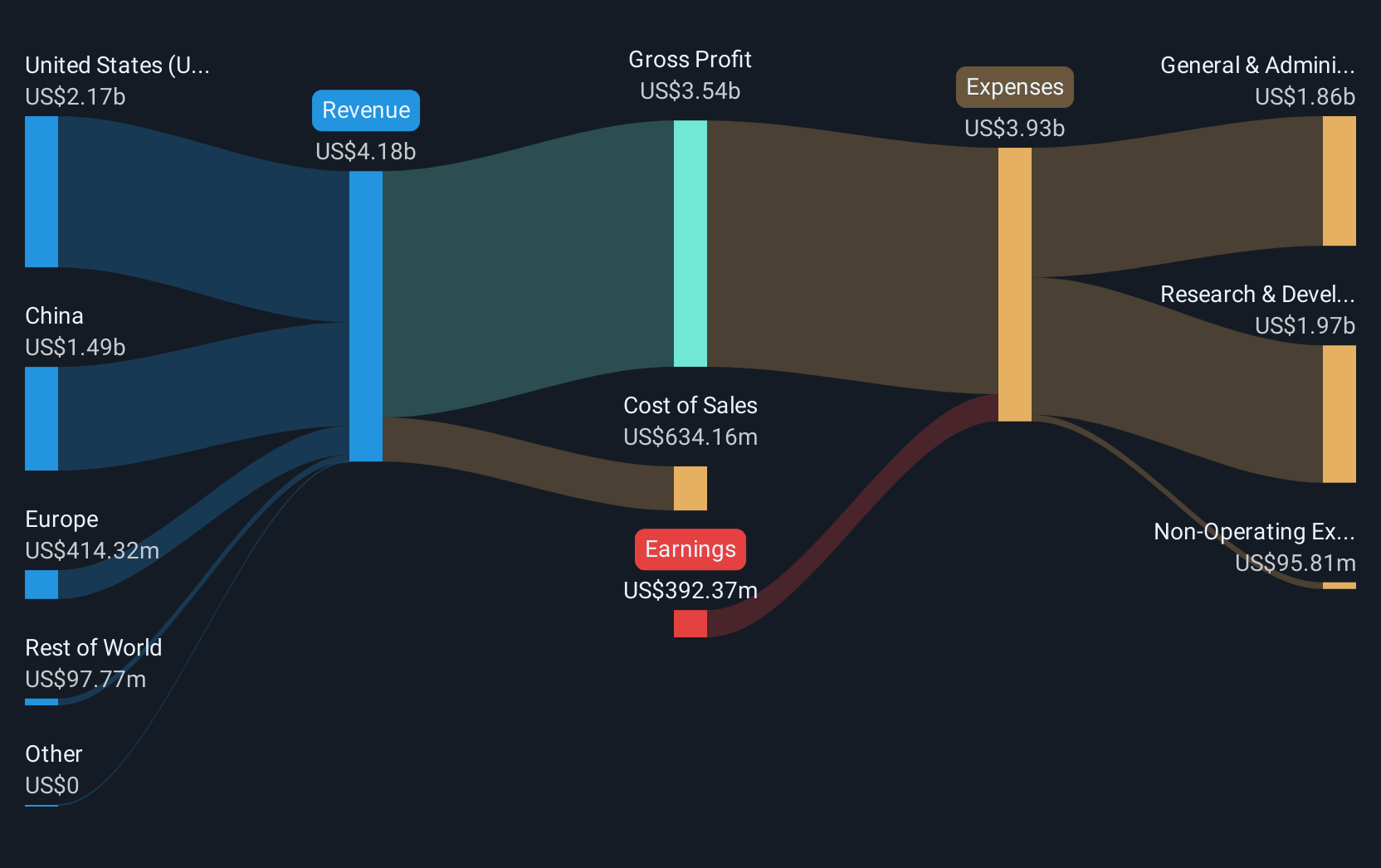

BeiGene (NasdaqGS:ONC) recently announced promising earnings guidance, forecasting 2025 revenues between $4.9 billion to $5.3 billion, alongside their fourth-quarter earnings revealing a significant revenue increase to $1,128 million from $634 million year-over-year. These developments, including a narrower net loss and earnings improvements, may have influenced BeiGene's stock price rise of approximately 26% over the last quarter. This significant increase contrasts with the broader market dynamics, which have experienced volatility with a recent 3.6% decline despite a robust 17% uplift over the past year. Furthermore, BeiGene's collaborative efforts, such as the partnership with BostonGene to enhance precision medicine, and the positive annual revenue growth, add momentum to their market performance. As investors continue to assess these comprehensive metrics, BeiGene's performance against a backdrop of a mixed equities market captures a compelling narrative within the healthcare sector.

Click to explore a detailed breakdown of our findings on BeiGene.

Over the past five years, BeiGene, Ltd. achieved a total shareholder return of 64.04%. This positive growth reflects a series of transformative actions that have bolstered the company's standing in the competitive biotech landscape. A standout moment was the approval of TEVIMBRA (tislelizumab) in the EU for esophageal cancers in December 2024, allowing the company to expand its international presence. Further enhancing its portfolio, the presentation of long-term clinical data and pipeline product advances in late 2024 spotlighted the potential value embedded in its ongoing research initiatives.

The company has also strategically expanded its capabilities through collaborations, such as the partnership with ImmunityBio in January 2025 for trials in advanced NSCLC. Importantly, the $800 million investment in a New Jersey manufacturing facility in 2024 is poised to boost production capabilities. Despite past challenges, these efforts, combined with impressive revenue growth, have positioned BeiGene well in the biotech industry, reflected in its share performance exceeding market expectations in the past year.

- Discover whether BeiGene is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the potential risks impacting BeiGene's growth trajectory—explore our risk evaluation report.

- Is BeiGene part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeiGene might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeiGene

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives