- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Why Novavax (NVAX) Is Down 5.1% After Maryland Site Sale and Cost-Saving Restructuring News

Reviewed by Sasha Jovanovic

- Novavax recently announced definitive agreements to transfer a Maryland-based facility and sell equipment, generating US$60 million in cash and projecting future cost savings of US$230 million as part of a broader site consolidation strategy.

- This operational restructuring positions Novavax to reduce lease liabilities and operating costs, signaling a sharpened focus on research, development, and external partnerships while retaining its Gaithersburg, Maryland headquarters.

- We'll explore how Novavax's move to streamline operations and realize significant cost savings might reshape its investment narrative going forward.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Novavax Investment Narrative Recap

To own Novavax stock, investors need confidence in the company's shift toward a leaner, partner-driven model that leverages external collaborations and new vaccine markets. While the recent US$60 million facility transfer and projected US$230 million in cost savings support reduced operating costs, this move does not change the near-term catalyst: progress on commercial execution and royalty streams from Sanofi and Takeda. The main risk, that weak COVID-19 vaccine sales or delayed milestone payments threaten revenue stability, remains unchanged by this news.

Of the recent announcements, the transfer of EU marketing authorization for Nuvaxovid to Sanofi stands out as most relevant, triggering immediate milestone payments and positioning Novavax to benefit from Sanofi’s broader scale in commercializing COVID-19 and combination vaccines. This tangible step aligns with the key catalysts for the company, particularly the drive to unlock recurring revenue via partnerships despite ongoing market uncertainties.

However, investors should also recognize the contrasting risk: if commercial partners underperform or vaccine demand drops, Novavax’s financial outlook could shift quickly...

Read the full narrative on Novavax (it's free!)

Novavax's outlook projects $348.5 million in revenue and $55.9 million in earnings by 2028. This assumes a yearly revenue decline of 31.4% and an earnings decrease of $366.9 million from current earnings of $422.8 million.

Uncover how Novavax's forecasts yield a $12.50 fair value, a 48% upside to its current price.

Exploring Other Perspectives

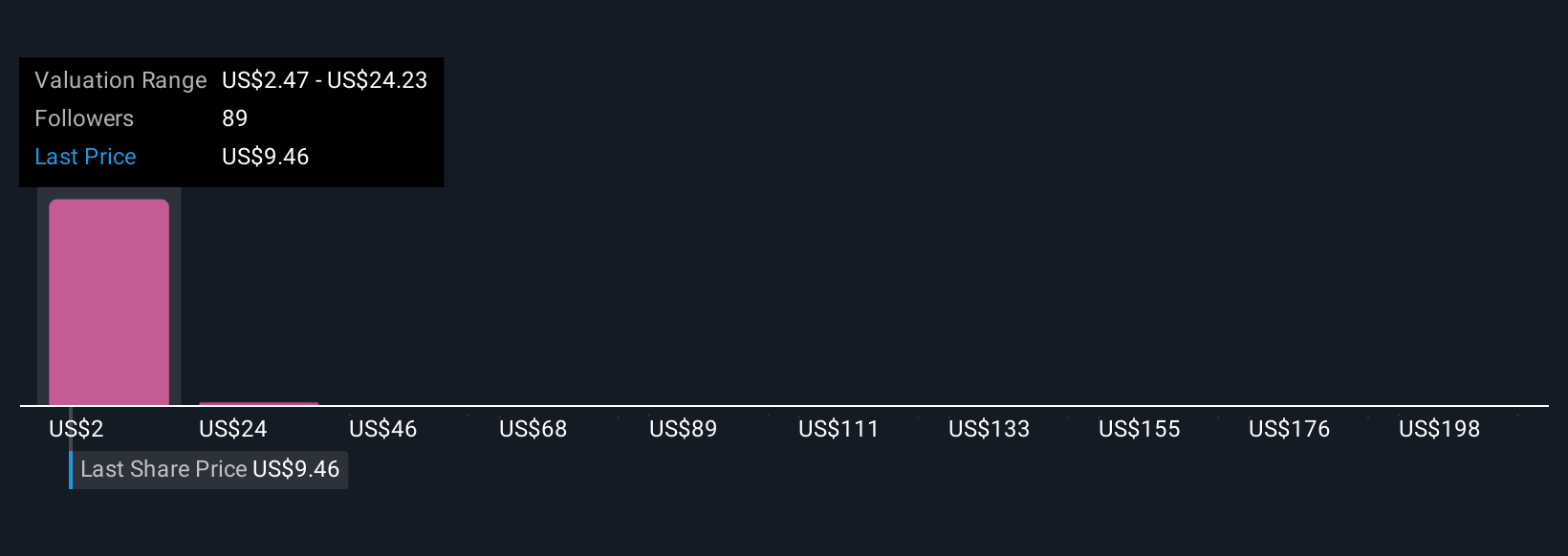

Eleven fair value estimates from the Simply Wall St Community range widely from US$2.46 to US$100 per share. While many expect future growth from external partnerships, your view on Novavax’s revenue reliability could change the outlook considerably, see what others are watching and share your perspective.

Explore 11 other fair value estimates on Novavax - why the stock might be worth less than half the current price!

Build Your Own Novavax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Novavax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novavax's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives