- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX) Valuation in Focus After Japanese Approval and New Royalty Stream from Takeda Deal

Reviewed by Simply Wall St

If you have been watching Novavax (NVAX) lately, the company’s latest announcement may have prompted a closer look. Novavax is set to receive a milestone payment from Takeda after securing regulatory approval in Japan for its Nuvaxovid vaccine, now formulated to target Omicron LP.8.1. The deal also opens up a potential stream of royalties tied to sales for the upcoming vaccination season. It is all part of a revamped collaboration with Takeda, which includes better terms for Novavax. These are clear signals that management is working to strengthen the company’s revenue outlook.

This positive regulatory milestone arrives during a year that has tested the patience of Novavax shareholders. While the stock has seen some rebound in the past three months with a 7% gain, it is still down nearly 10% since the start of the year and remains deeply underwater over one year and longer periods. Recent events, from successful product approvals to conference appearances, help the narrative but have not yet translated into a lasting shift in momentum.

After a series of ups and downs, the question for investors is whether these milestone payments and fresh royalty streams signal that Novavax is undervalued at today’s levels, or if the market is already anticipating further growth ahead.

Most Popular Narrative: 38.2% Undervalued

The most widely followed narrative sees Novavax as deeply undervalued, highlighting potential upside driven by future milestone payments, partnerships, and expansion into new vaccine markets.

"The successful commercialization of the R21 Matrix-M malaria vaccine, already deployed in 12 African countries with over 20 million doses sold, showcases the potential for expanding sales in underserved infectious disease markets. This could likely increase both revenues and operating leverage through economies of scale."

Craving the real story powering this valuation? Underneath the headlines, analysts are betting on rapid business transformation and aggressive assumptions around future profitability. There is a dramatic narrative twist you will not want to miss. Could Novavax defy the odds with a financial turnaround the market is not expecting?

Result: Fair Value of $12.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower-than-expected partner commercialization or declining COVID-19 vaccine demand could create challenges for Novavax's pathway to sustained growth and reliable revenue streams.

Find out about the key risks to this Novavax narrative.Another View: The SWS DCF Model Weighs In

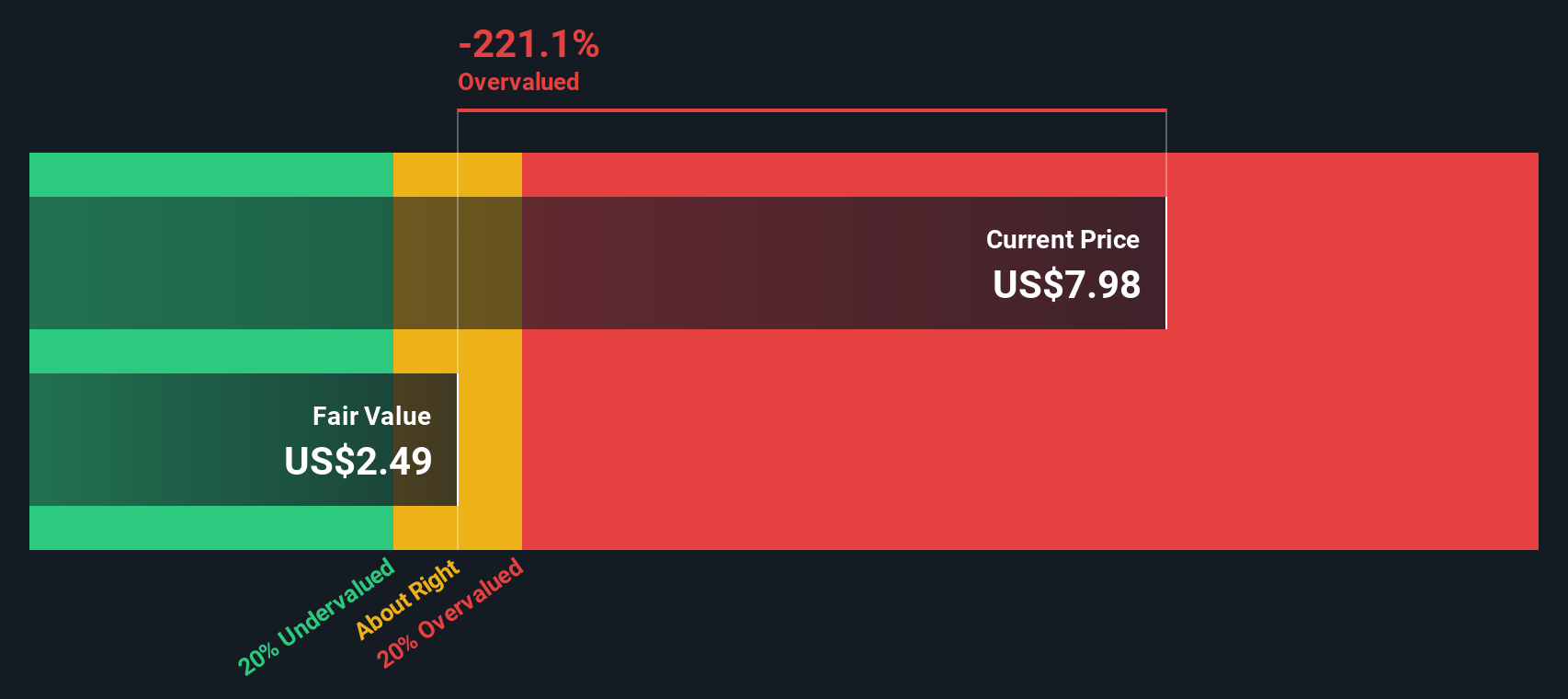

Switching gears from a market multiples perspective, the Simply Wall St DCF model paints a less optimistic picture. This approach suggests Novavax could be overvalued compared to its long-term cash flow potential. Which view will prove right as the market evolves?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Novavax Narrative

If you have a different take or want to dig into the details, you can shape your own perspective in just a matter of minutes. Do it your way.

A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't limit your opportunities to just one stock. Tap into new market movers with cutting-edge research tools and access companies that are transforming their industries. Get ahead of the curve and make your next big investment count.

- Uncover fast-moving companies aiming for disruption. Spot tomorrow's biggest winners among penny stocks with strong financials making headlines for strong fundamentals.

- Strengthen your portfolio with future-focused healthcare innovations. Track breakthroughs in medicine and patient care using our healthcare AI stocks screener.

- Unlock reliable income streams. Filter for top picks featuring dividend stocks with yields > 3% and never miss out on attractive yield opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives