- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX) Valuation: Assessing the Shift to Partnerships and an R&D-Focused Strategy

Reviewed by Simply Wall St

Novavax (NVAX) is shaking up its strategy, shifting away from direct COVID-19 product sales to focus more on research and development and collaborations, particularly with partners like Sanofi. Investors are paying close attention after management raised their 2025 revenue outlook.

See our latest analysis for Novavax.

Novavax’s stock has seen plenty of volatility lately. This week brought a near 10% increase in share price. However, momentum has faded overall with a 1-year total shareholder return of -19% and a steep 3-year loss of nearly 58%. The shift in business strategy has provided some optimism, but long-term investors are still waiting for a more sustained turnaround before sentiment really changes.

If today’s news has you rethinking your approach, now’s the perfect time to explore See the full list for free.

With shares still trading far below previous highs and analysts setting price targets nearly double the current level, the question remains: is Novavax undervalued at this stage, or is the market already pricing in every bit of future growth potential?

Most Popular Narrative: 47% Undervalued

The most widely followed narrative suggests that Novavax’s intrinsic fair value is $13.11 per share, sharply higher than the last closing price of $6.95. This fair value estimate stands out amidst recent volatility and provides a bullish perspective through which analysts are evaluating Novavax’s pivot to a licensing-led business model.

The global vaccine market is expected to increase significantly, driven by factors such as aging populations and emerging infectious diseases. This trend expands Novavax's addressable market and supports long-term revenue growth.

If you want to see the narrative's underlying assumptions, you may be interested to learn how much the expected drop in sales and margins matters. There are some bold earnings projections ahead, and a valuation multiple that draws attention even among growth stocks. Discover what supports this high-stakes story and whether analyst optimism is warranted. The full narrative breaks it down.

Result: Fair Value of $13.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on milestone payments from partners and reliance on a single approved vaccine could put pressure on Novavax's long-term stability.

Find out about the key risks to this Novavax narrative.

Another View: DCF Model Adds a Cautious Note

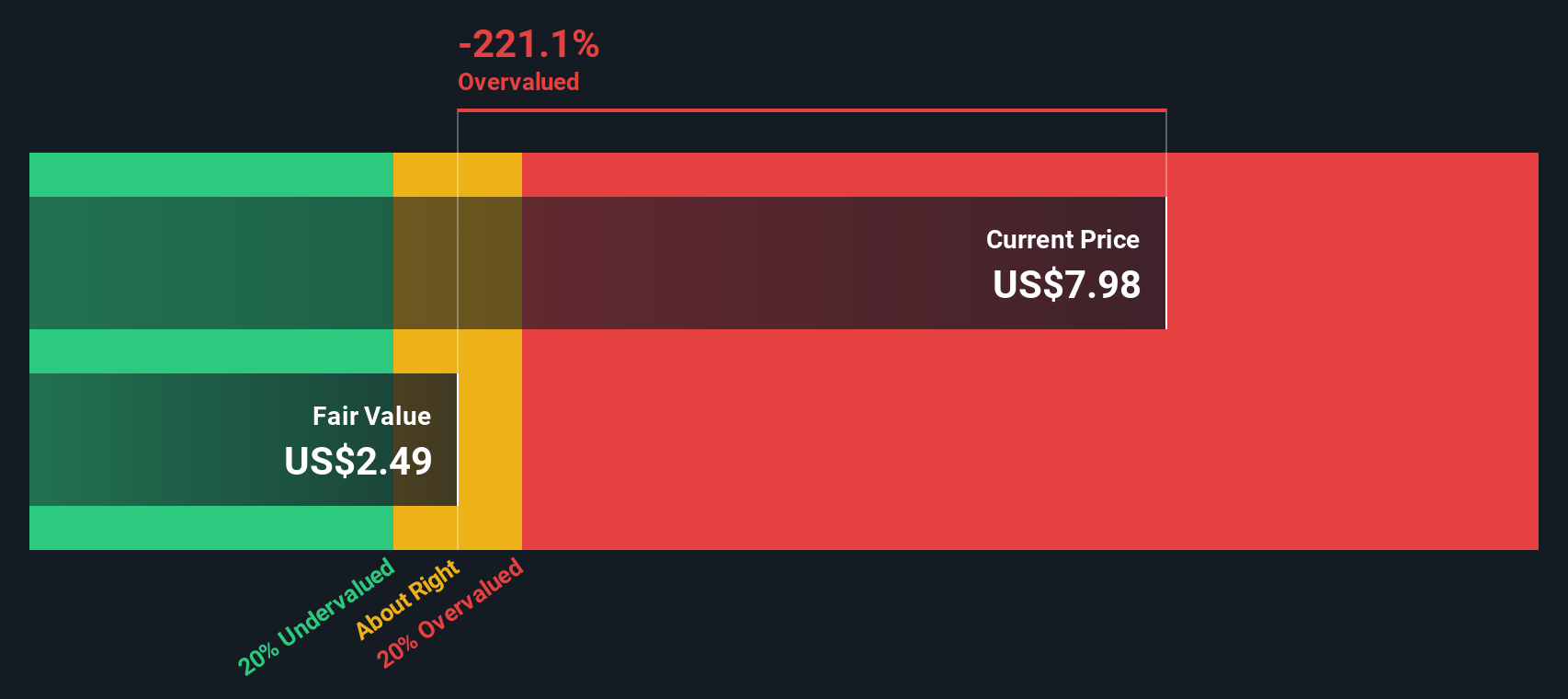

While analysts see upside based on future earnings, our SWS DCF model comes to a different conclusion. It suggests Novavax is trading above its estimated fair value of $4.59 per share. This implies the market may be overestimating long-term cash flows. Is optimism really justified, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novavax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novavax Narrative

If you prefer to dig into the numbers yourself or challenge the existing consensus, it takes just a few minutes to shape your own perspective. Do it your way

A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Sharper Investment Ideas?

Give yourself the edge. Why settle for the familiar when there are so many smart opportunities just waiting to be found? Use Simply Wall Street’s powerful screeners to uncover the next big thing and avoid missing out on hidden winners.

- Uncover fresh opportunities by targeting these 932 undervalued stocks based on cash flows with potential for strong cash flow gains and built-in value.

- Tap into the fast-moving world of innovation by selecting these 25 AI penny stocks focused on artificial intelligence and automation breakthroughs driving tomorrow's growth.

- Capture reliable income streams by tracking these 15 dividend stocks with yields > 3% offering attractive yields and robust financials that can strengthen your portfolio's stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.