- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX) Is Up 14.5% After Sanofi Expands Use of Matrix-M Adjuvant Technology - What's Changed

Reviewed by Sasha Jovanovic

- Sanofi recently announced an expanded agreement with Novavax, granting broader rights to use Novavax’s Matrix-M adjuvant in the early-stage development of its pandemic influenza vaccine candidates, supported by U.S. government funding.

- This collaboration may position Novavax for new milestone payments and future royalties, highlighting increased adoption of its vaccine technology by a major pharmaceutical partner.

- We'll look at how Sanofi’s increased adoption of Matrix-M technology could impact Novavax's long-term revenue prospects and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Novavax Investment Narrative Recap

For investors considering Novavax, the central premise is that broad adoption of its Matrix-M platform by established partners such as Sanofi can help the company offset dependence on legacy COVID-19 vaccine revenues. The recent expansion of the Sanofi agreement reinforces demand for Novavax technology and may introduce new revenue streams through milestone and royalty payments, but it does not fundamentally shift the immediate catalysts or primary risk; Novavax remains reliant on the pace and success of partner-driven commercialization and milestone recognition.

The most relevant recent announcement is the milestone payment triggered by Takeda's regulatory approval of Nuvaxovid for the Omicron variant, reflecting Novavax’s ongoing execution on partnership milestones. This kind of news complements the Sanofi expansion by supporting near-term revenues and highlighting how Novavax’s strategy hinges on successful external commercialization efforts and regulatory progress.

However, in contrast, investors should be mindful that milestone payments are contingent on partner commercialization timelines, which…

Read the full narrative on Novavax (it's free!)

Novavax's narrative projects $348.5 million in revenue and $55.9 million in earnings by 2028. This requires a 31.4% annual revenue decline and a $366.9 million decrease in earnings from $422.8 million today.

Uncover how Novavax's forecasts yield a $12.50 fair value, a 31% upside to its current price.

Exploring Other Perspectives

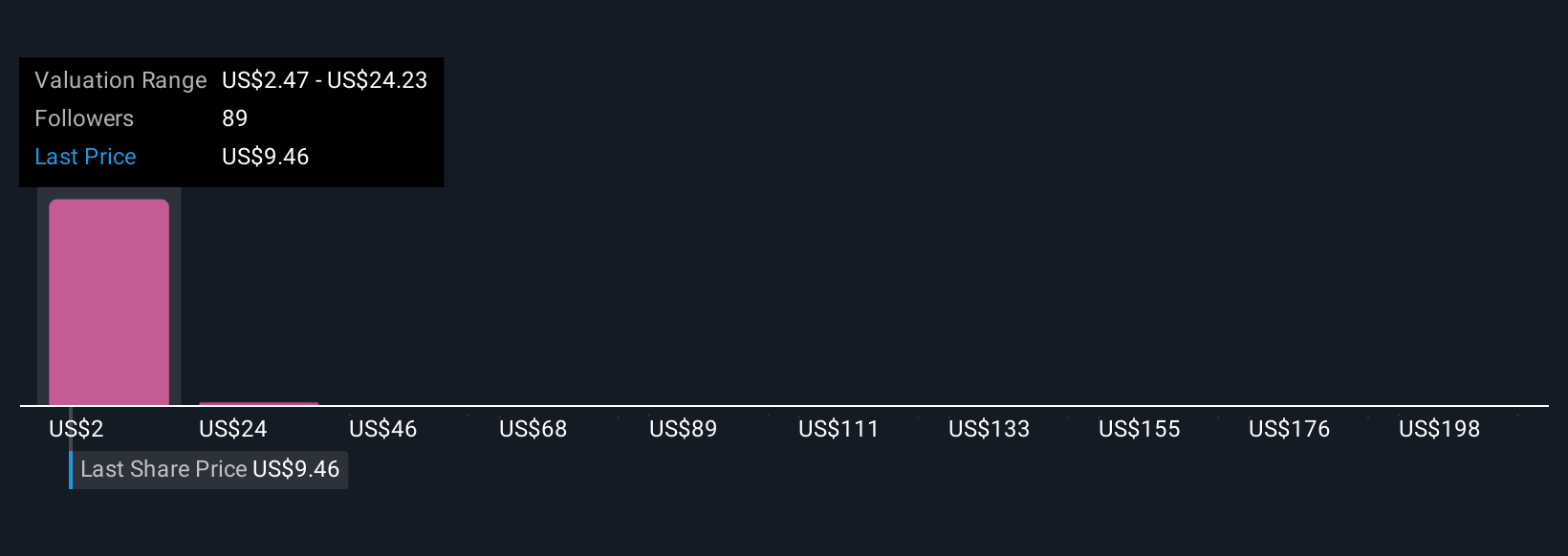

Community valuations for Novavax range widely, from US$2.48 to US$220, across 13 individual Simply Wall St Community submissions. Revenue timing risk tied to partner milestones continues to shape the outlook for future performance, consider the range of views and explore more perspectives for a fuller picture.

Explore 13 other fair value estimates on Novavax - why the stock might be a potential multi-bagger!

Build Your Own Novavax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Novavax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novavax's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives