- United States

- /

- Biotech

- /

- NasdaqGS:NUVL

Nuvalent (NUVL): Valuation Insights Following FDA Submission for Zidesamtinib in Lung Cancer

Reviewed by Kshitija Bhandaru

Nuvalent (NUVL) just made a move that could shape its future. The company announced it has completed its New Drug Application submission to the FDA for zidesamtinib, targeting patients with advanced ROS1-positive non-small cell lung cancer who have already been treated with other kinase inhibitors. This kind of regulatory progress is often a turning point for clinical-stage biotechs, raising both investor excitement and expectations, since FDA review is a key gateway to potential commercialization.

This announcement comes at an interesting moment for the company. Over the past year, Nuvalent’s share price has seen a decline of about 18%. There has been a slight gain both month-to-date and in the past quarter. Momentum has been patchy as Nuvalent moves from pure R&D toward potential revenue generation and continues to develop its oncology pipeline. Recent appearances at sector events and a growing focus on multiple molecular targets point to a company still on the offense, even after some ups and downs in the stock price.

With the FDA submission now public and shares still lagging their high points, should investors see Nuvalent as undervalued at this stage, or is the market already anticipating future growth from its drug pipeline?

Price-to-Book of 6.2x: Is it justified?

Nuvalent is currently trading at a price-to-book ratio of 6.2x, which is significantly higher than both its peer average of 5.1x and the broader US Biotechs industry average of 2.3x. This suggests the market is assigning a premium valuation relative to assets on the balance sheet compared to sector norms.

The price-to-book multiple is an important measure for biotech firms, especially those without meaningful revenues yet. It allows investors to assess whether the market value accurately reflects the company’s tangible net assets and future prospects. For a company like Nuvalent, a high multiple can signal strong expectations for future growth or successful drug commercialization, even in the absence of current profitability.

However, trading at a noticeable premium to both direct peers and the wider industry raises the question of whether these optimistic expectations are justified by pipeline progress, management track record, or upcoming catalysts. Investors should weigh whether the company’s innovation and potential are sufficient to support this elevated valuation.

Result: Fair Value of $81.39 (OVERVALUED)

See our latest analysis for Nuvalent.However, risks remain if Nuvalent’s clinical development faces unexpected setbacks or if broader biotech sentiment continues to pressure valuations in the near term.

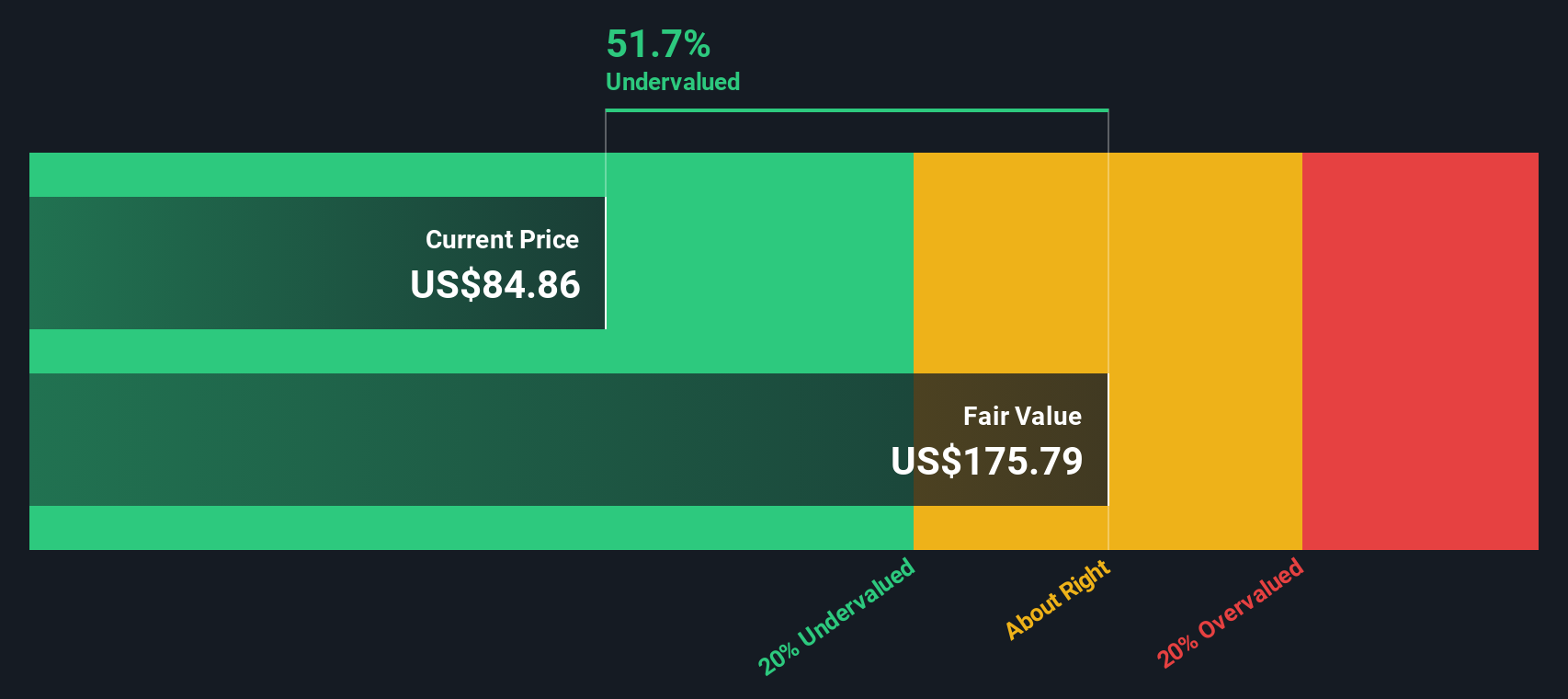

Find out about the key risks to this Nuvalent narrative.Another View: Our DCF Model Signals Undervaluation

While the current market price looks steep compared to industry assets, our DCF model sends a very different message and suggests the shares may be undervalued. Why is there such a gap in results? Which method better reflects Nuvalent's potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nuvalent Narrative

If you see the story differently or would rather draw your own conclusions from the data, you can put together your personal narrative in just a few minutes as well. Do it your way

A great starting point for your Nuvalent research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t just watch from the sidelines when the next wave of growth is taking shape. Seek out companies positioned for the future using these targeted ideas. Your next favorite stock could be just one smart click away.

- Capitalize on the AI transformation by checking out companies at the forefront of intelligent automation and innovation through the AI penny stocks.

- Secure income potential with leading businesses offering high-yield payouts by starting with our lineup of dividend stocks with yields > 3%.

- Get ahead of the curve by pinpointing undervalued stocks primed for a turnaround using our curated selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvalent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NUVL

Nuvalent

A clinical-stage biopharmaceutical company, engages in the development of therapies for patients with cancer.

Excellent balance sheet and fair value.

Market Insights

Community Narratives