- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NTRA): Valuation Check After ASH Signatera Lymphoma Data Fuels Hematology Growth Optimism

Reviewed by Simply Wall St

Natera (NTRA) is back in focus as investors look ahead to new Signatera data at the ASH 2025 meeting, where lymphoma studies could help clarify the stock’s long term hematology growth story.

See our latest analysis for Natera.

That optimism has already shown up in the numbers, with Natera’s share price at $236.64 after a strong 1 month share price return of 19.38 percent and a standout 3 year total shareholder return of 515.29 percent. This signals that momentum around Signatera and the broader testing portfolio is building rather than fading.

If this kind of diagnostics driven rally has your attention, it could be a good moment to explore other compelling ideas across healthcare stocks for your watchlist.

Yet with shares hovering near Wall Street’s target and trading on big expectations for Signatera’s hematology runway, investors now face a tougher call: is Natera still mispriced, or is the market already baking in the next leg of growth?

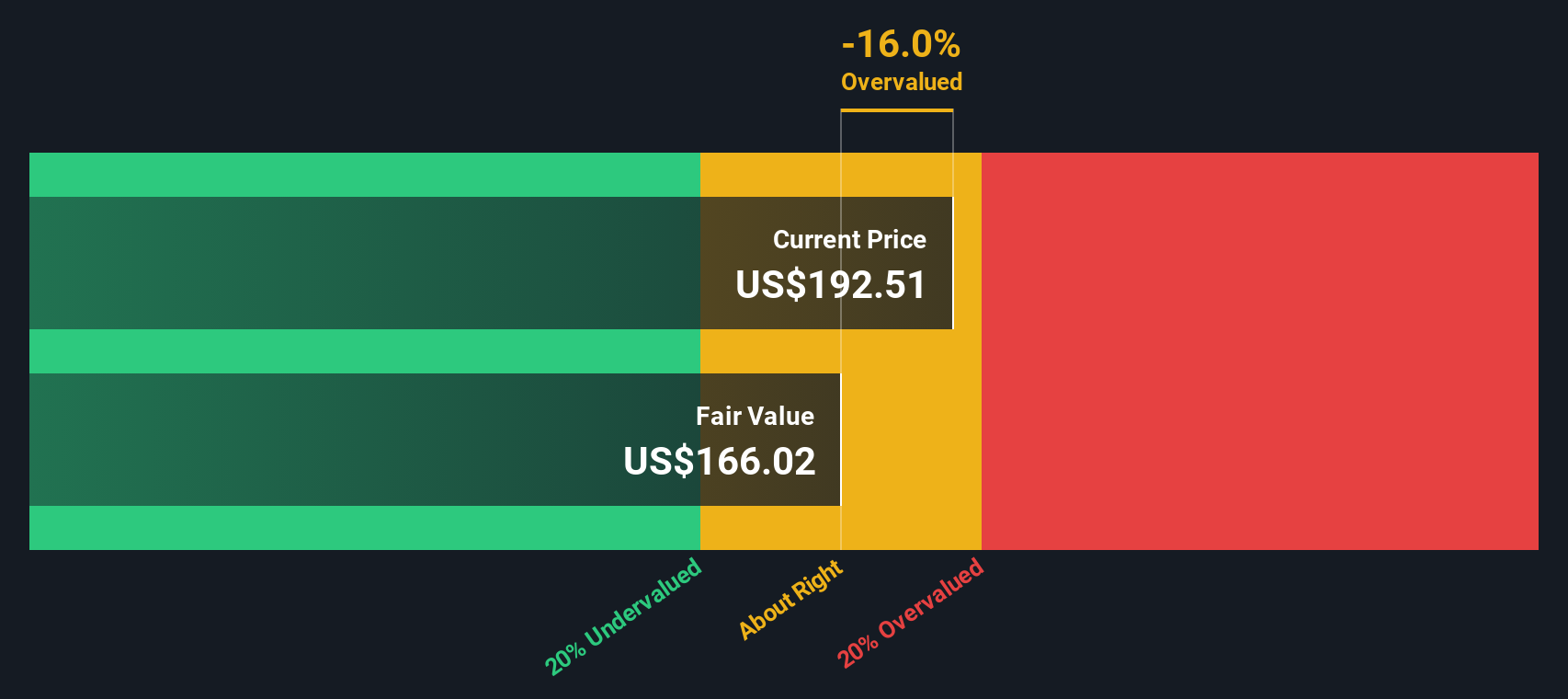

Most Popular Narrative Narrative: 0.8% Overvalued

With Natera last closing at $236.64 against a narrative fair value of $234.68, expectations for future growth are running slightly ahead of price.

Investment in new product launches (e.g., Fetal Focus NIPT, Signatera Genome, AI based biomarkers) and a robust R&D pipeline positions Natera to capture growth from long term trends in personalized medicine and early detection, underpinning future revenue expansion. Natera is managing operating expenses while scaling up (e.g., commercial hiring in oncology, AI technical staff). Near term OpEx increases are not yet impacting revenue but are described as setting up a slingshot effect expected to drive meaningful revenue and margin improvements beginning in late 2025 and 2026.

Want to see how aggressive revenue growth, shifting margins, and a bold long term profit outlook combine into one punchy valuation story? The full narrative lays out the exact assumptions behind that near at market fair value, including how much earnings power needs to materialize, how fast revenues must scale, and what kind of premium multiple the market is expected to pay for Natera’s diagnostics leadership.

Result: Fair Value of $234.68 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained trial setbacks or slower than expected reimbursement wins for new indications could quickly challenge today’s bullish growth and margin assumptions.

Find out about the key risks to this Natera narrative.

Another View: DCF Points to Upside

While the narrative fair value suggests Natera is about fully priced, our DCF model tells a different story, indicating the shares trade around 6 percent below a fair value of roughly $252.49. If cash flows are the anchor, is the market still underestimating the runway?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Natera for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Natera Narrative

If you want to dig into the numbers yourself or challenge these assumptions, you can spin up a personalized narrative in just minutes: Do it your way.

A great starting point for your Natera research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in fresh opportunities by using the Simply Wall Street Screener to uncover compelling stocks that could transform your portfolio’s next chapter.

- Capture underappreciated value by targeting companies flagged as potentially mispriced through these 926 undervalued stocks based on cash flows that might not stay cheap for long.

- Capitalize on breakthrough innovation by scanning these 24 AI penny stocks where advancing algorithms and real world adoption are already reshaping entire industries.

- Boost your income potential by filtering for reliable payouts using these 14 dividend stocks with yields > 3% that can reinforce returns even when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026