- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NTRA): Exploring Valuation as Share Price Pulls Back Despite Strong Growth

Reviewed by Kshitija Bhandaru

Natera (NTRA) shares have pulled back by roughly 5% over the past month, even after reporting double-digit annual revenue growth and significant improvements in annual net income. Investors seem to be weighing these fundamentals in light of the current market backdrop.

See our latest analysis for Natera.

Despite some recent volatility, Natera's share price has generally gained ground over the past year as investors respond to both robust revenue growth and a string of operational improvements. With a 1-year total shareholder return of nearly 27%, momentum appears to be building for the stock as fundamentals continue to strengthen.

If you’re curious to see how other fast movers are being valued right now, take the opportunity to discover fast growing stocks with high insider ownership.

With shares still trading at a slight discount to consensus analyst price targets and fundamentals improving, the question arises: are investors overlooking an opportunity, or is the current price already factoring in all of Natera's future upside?

Most Popular Narrative: 17.3% Undervalued

Natera's latest fair value estimate indicates the stock trades 17.3% below where most analysts see its true worth, offering a notable disconnect with the current share price. This provides a springboard for deeper debate around the bold assumptions powering the target valuation.

Accelerated integration of AI and automation into diagnostic processes and revenue cycle management is providing greater operating leverage and efficiency, resulting in lower COGS and improving operating margins and net earnings over time.

How are these ambitious growth forecasts even possible? The current fair value hinges on optimistic projections for revenue, margins, and profits that could rewrite Natera’s growth story. The full narrative reveals the unseen assumptions and bold targets shaping this intriguing valuation.

Result: Fair Value of $193.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high R&D spending and the need for ongoing regulatory approvals could disrupt Natera’s ambitious growth projections and reduce investor enthusiasm.

Find out about the key risks to this Natera narrative.

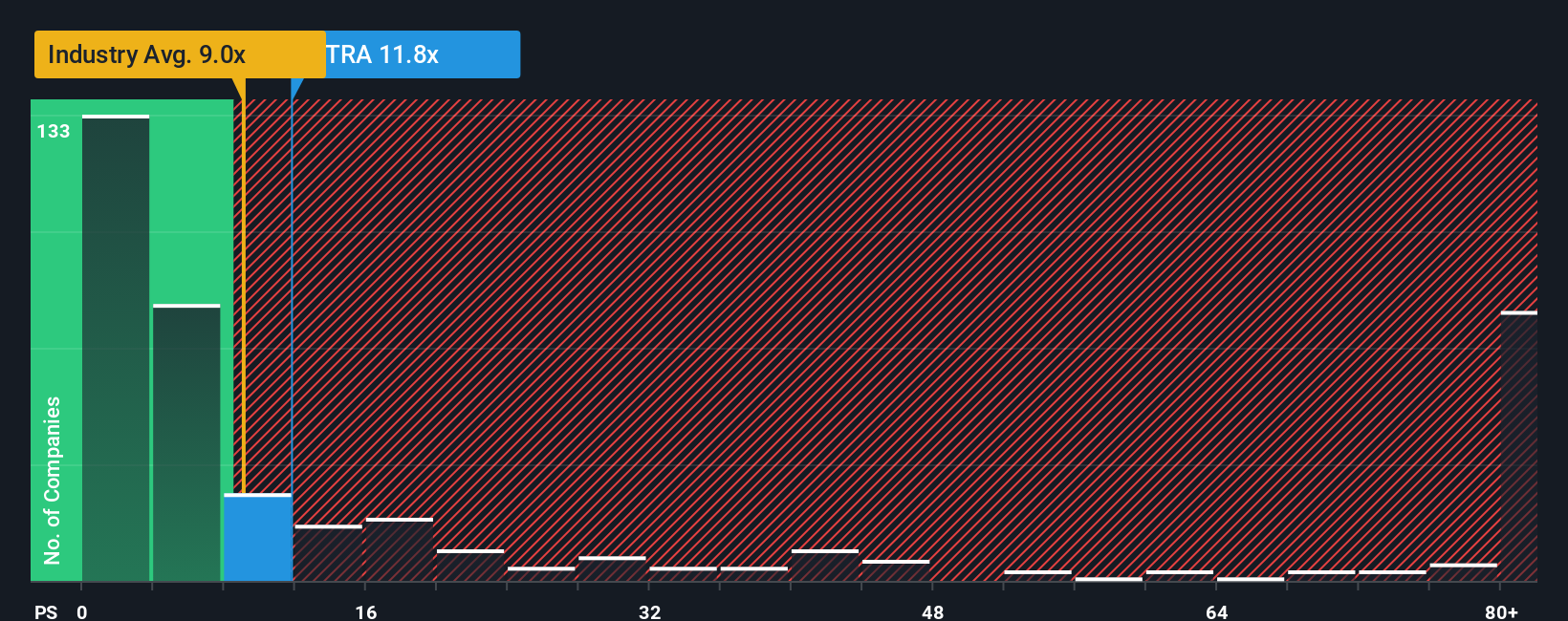

Another View: Market Multiples Raise Red Flags

While discounted cash flow analysis points to Natera as undervalued, looking through the lens of its sales ratio tells a different story. Natera's ratio sits at 11.2 times sales, which is not only pricier than the industry average of 9.7 but also much higher than the peer group average at 6. Even its fair ratio, estimated at 7.1, suggests the market could decline toward that level. These wide gaps highlight just how much optimism is already built into the share price, raising questions about the risks investors are taking if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Natera Narrative

If you prefer to take a hands-on approach or want to challenge these perspectives, digging into the data lets you craft your own view in just minutes. Do it your way.

A great starting point for your Natera research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart market moves start with the right information, and Simply Wall Street’s screeners are built to help you spot tomorrow’s leaders today. Don’t limit your research; be the first to spot new opportunities others might overlook.

- Uncover high-yield potential by reviewing these 19 dividend stocks with yields > 3% paying over 3%, giving your portfolio a steady income stream plus growth prospects.

- Leap ahead of the curve with these 24 AI penny stocks, where the latest artificial intelligence innovators are creating fresh possibilities in dynamic industries.

- Catch undervalued gems before the market does by tapping into these 904 undervalued stocks based on cash flows, perfect for value-focused investors ready to capitalize on tomorrow’s opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026