- United States

- /

- Software

- /

- NasdaqGS:CCCS

High Growth US Tech Stocks To Watch In June 2025

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has experienced a notable 9.9% rise in the last year, with earnings projected to grow by 15% annually. In this context, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation and scalability potential, aligning well with current market dynamics.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 21.03% | 60.42% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.36% | 60.93% | ★★★★★★ |

| Blueprint Medicines | 21.12% | 60.77% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.63% | 60.71% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Applied Optoelectronics (AAOI)

Simply Wall St Growth Rating: ★★★★★☆

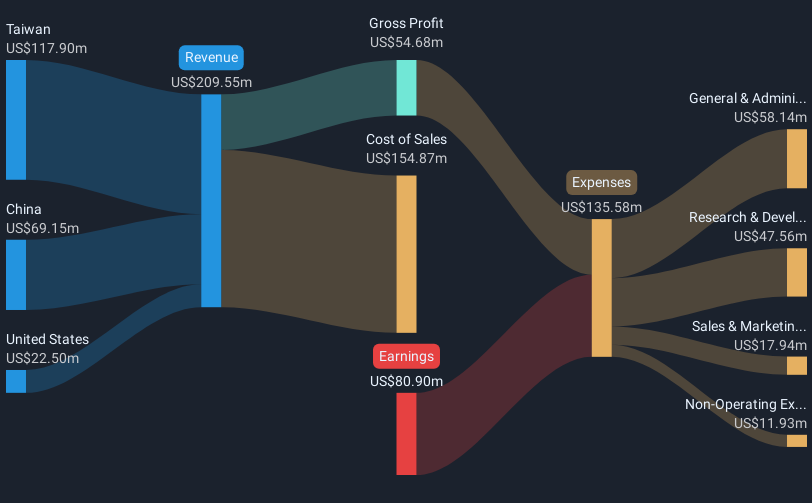

Overview: Applied Optoelectronics, Inc. designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China with a market cap of $942.01 million.

Operations: The company generates revenue primarily from its optical networking equipment segment, totaling $308.55 million.

Applied Optoelectronics, a player in the high-speed data transmission sector, is navigating a transformative phase with strategic movements including a significant share increase and re-engagement with major hyperscale data center customers. The company recently reported a substantial reduction in net loss from $23.17 million to $9.17 million year-over-year and anticipates revenue between $100 million to $110 million for the upcoming quarter, reflecting an aggressive pursuit of growth in its niche market. Additionally, their recent follow-on equity offerings totaling over $200 million underscore efforts to fuel expansion and innovation amidst challenging market conditions marked by volatile share prices and insider selling activities. These steps are pivotal as Applied Optoelectronics strides towards profitability, projected through an impressive annual earnings growth forecast of 162.45%, significantly outpacing broader market expectations.

- Take a closer look at Applied Optoelectronics' potential here in our health report.

Explore historical data to track Applied Optoelectronics' performance over time in our Past section.

CCC Intelligent Solutions Holdings (CCCS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CCC Intelligent Solutions Holdings Inc. is a SaaS company serving the property and casualty insurance sectors in the United States and China, with a market cap of $5.99 billion.

Operations: The company generates revenue primarily through its Software & Programming segment, which amounts to $969.13 million. As a SaaS provider, it focuses on delivering solutions tailored for the property and casualty insurance industry across the U.S. and China.

CCC Intelligent Solutions, a frontrunner in AI-driven solutions for the P&C insurance sector, is making significant strides in enhancing automotive post-collision processes. The company's recent collaboration with BMW to streamline repair and claims procedures exemplifies its commitment to integrating innovative technology into everyday consumer interactions. With a projected annual revenue growth of 9.3% and an impressive earnings forecast increase of 75.7%, CCC is not just growing; it's also enhancing its technological offerings significantly, as evidenced by their AI advancements and strategic partnerships like the one with BMW. This positions CCC uniquely within the high-growth tech landscape, leveraging deep industry relationships and advanced AI capabilities to transform customer experiences fundamentally.

Natera (NTRA)

Simply Wall St Growth Rating: ★★★★☆☆

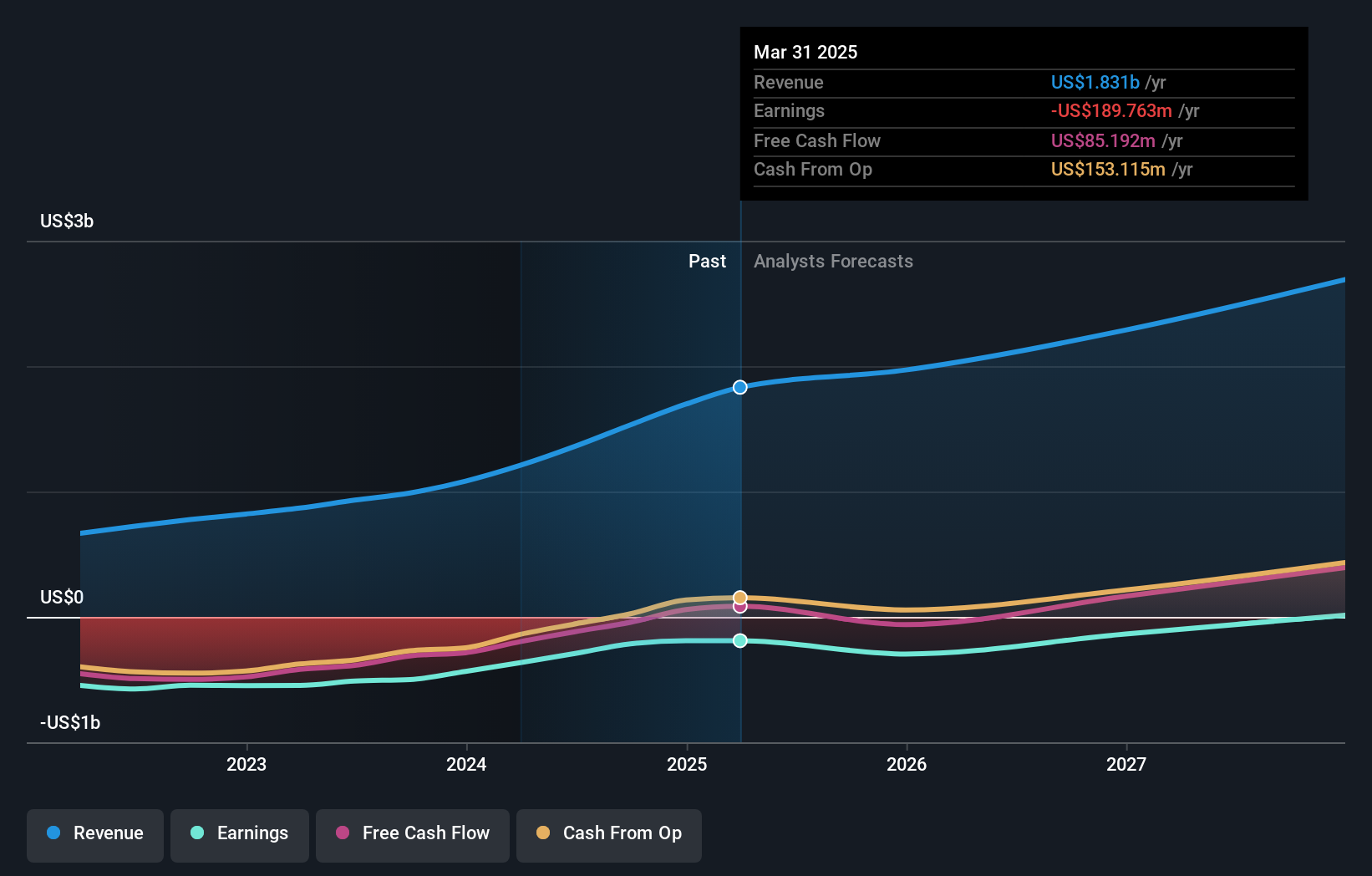

Overview: Natera, Inc. is a diagnostics company that offers molecular testing services globally, with a market capitalization of $22.88 billion.

Operations: The company generates revenue primarily from the development and commercialization of molecular testing services, amounting to $1.83 billion.

Natera, a leader in personalized genetic testing, is making significant strides with its Signatera MRD assay, now covered by Medicare for various cancers. This endorsement underscores the assay's robust clinical validation across over 100 studies. At recent conferences, Natera showcased its pioneering mPCR-NGS technology in large-scale studies, demonstrating high sensitivity and specificity in cancer detection. With a revenue forecast of $1.94 billion to $2.02 billion for 2025 and recent quarterly revenue up from the previous year to $501.83 million, Natera is poised for growth amidst expanding market acceptance of precision medicine technologies.

- Click to explore a detailed breakdown of our findings in Natera's health report.

Understand Natera's track record by examining our Past report.

Make It Happen

- Discover the full array of 229 US High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCCS

CCC Intelligent Solutions Holdings

Operates as a software as a service (SaaS) company for the property and casualty insurance economy in the United States and China.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives