- United States

- /

- Life Sciences

- /

- OTCPK:NSTG.Q

Investors Give NanoString Technologies, Inc. (NASDAQ:NSTG) Shares A 58% Hiding

The NanoString Technologies, Inc. (NASDAQ:NSTG) share price has fared very poorly over the last month, falling by a substantial 58%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 93% loss during that time.

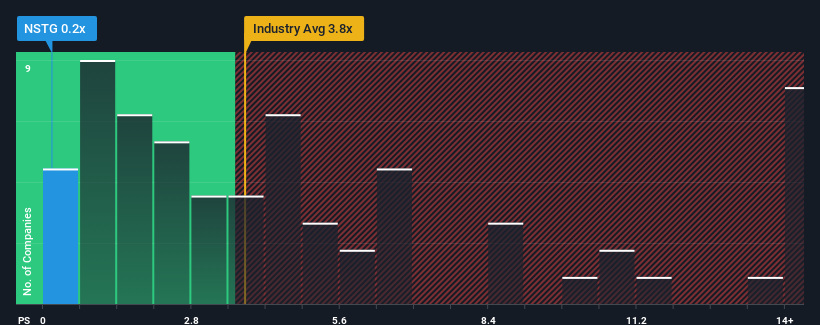

After such a large drop in price, NanoString Technologies may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.8x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for NanoString Technologies

How NanoString Technologies Has Been Performing

Recent times have been pleasing for NanoString Technologies as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on NanoString Technologies will be hoping that this isn't the case and the company continues to beat out the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NanoString Technologies.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, NanoString Technologies would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The strong recent performance means it was also able to grow revenue by 38% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 21% per year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.6% per annum, which is noticeably less attractive.

With this information, we find it odd that NanoString Technologies is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

NanoString Technologies' P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

NanoString Technologies' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 6 warning signs for NanoString Technologies (2 shouldn't be ignored!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if NS Wind Down might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:NSTG.Q

NS Wind Down

Develops, manufactures, and sells technology for scientific and clinical information in the fields of genomics and proteomics in the Americas, Europe, the Middle East, and the Asia Pacific.

Slightly overvalued with weak fundamentals.

Similar Companies

Market Insights

Community Narratives