- United States

- /

- Biotech

- /

- NasdaqGM:NRIX

Nurix Therapeutics (NRIX): Losses Deepen, Challenging Growth-Driven Bull Narratives Despite Rapid Revenue Forecasts

Reviewed by Simply Wall St

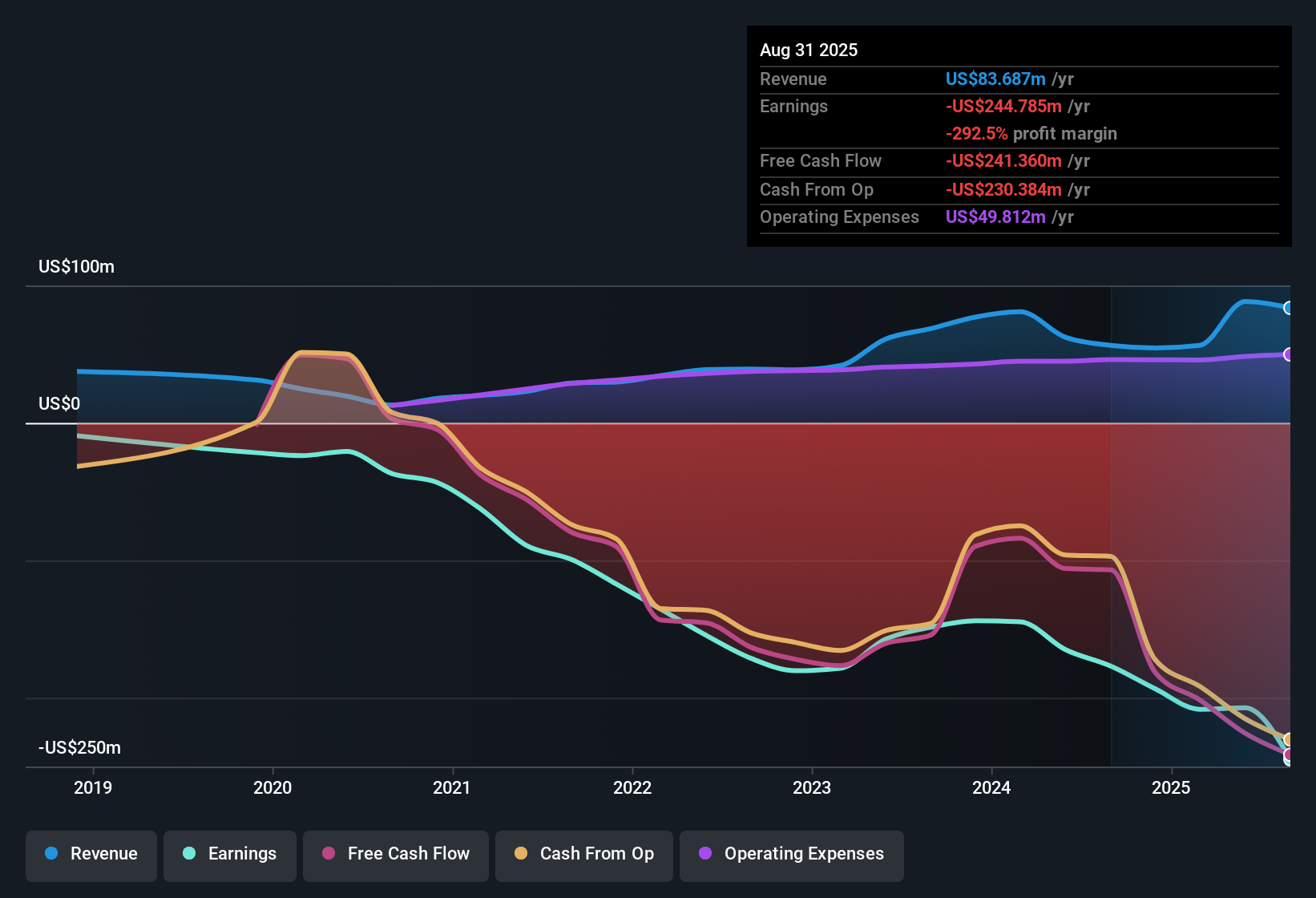

Nurix Therapeutics (NRIX) remains unprofitable, with net losses widening at a rate of 21.7% per year over the last five years. Despite an unchanged net profit margin and no expectation of profitability within the next three years, the company is set to outpace the US market with forecasted annual revenue growth of 33.3%. Investors are weighing the appeal of strong top-line momentum against persistent and increasing losses, as the company trades at a Price-To-Sales ratio of 9x, which is below the biotech peer and industry averages.

See our full analysis for Nurix Therapeutics.Next, we will put these headline results up against the widely followed market narratives to see which stories are supported and which get pushed back.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Accelerate Despite Faster Sales

- Net profit margin failed to improve, with losses expanding by 21.7% per year over five years. This indicates that revenue growth has not yet translated into earnings progress.

- What is striking is that, even with above-market revenue forecasts, ongoing losses challenge hopes for near-term profitability.

- The gap between sales expansion and sustained losses puts the focus on whether management can eventually convert growth into positive margins.

- This tension shapes the debate, as investors tempted by top-line momentum face a company with profitability still out of reach for at least the next three years.

Sales Multiple Offers Relative Discount

- Nurix trades at a Price-To-Sales ratio of 9x, lower than both the US biotech industry (10.4x) and peer average (17.9x). This highlights its discounted valuation on current sales.

- Prevailing market analysis spotlights the company’s valuation as more appealing than many biotech peers, especially for those seeking growth exposure at a lower entry multiple.

- Despite sector volatility, the sub-industry’s higher multiples mean Nurix could catch up if its top-line outperformance sustains. This offers potential share price upside compared to more expensive peers.

- Still, some investors worry the discount is justified by unprofitable operations and the lack of expected profits for years. This tempers excitement despite the attractive multiple.

Growth Story Competes with Risk

- Revenue is forecast to grow at 33.3% annually, far outpacing the broader US market average of 10%. This sets Nurix apart for investors focused on aggressive expansion stories.

- The prevailing view weighs this outsized growth against the real risk of persistent losses.

- Bulls are drawn to the potential for sales acceleration well above the norm, hoping it signals future scale benefits.

- Bears, however, point out that unless the company can meaningfully shift margins, top-line gains alone may not be enough to rerate the stock in line with higher-priced peers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nurix Therapeutics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Nurix’s lack of profitability, persistent net losses, and margin pressure raise real questions about financial health and long-term sustainability.

If you want to focus on companies with more robust balance sheets and stronger fundamentals, check out solid balance sheet and fundamentals stocks screener for ideas offering better financial stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nurix Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NRIX

Nurix Therapeutics

A clinical stage biopharmaceutical company, focuses on the discovery, development, and commercialization of small molecule and antibody therapies for the treatment of cancer, inflammatory conditions, and other diseases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives