- United States

- /

- Electrical

- /

- NYSEAM:HYLN

October 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

As of October 2025, the U.S. stock market has been reaching new heights, with major indices such as the Dow Jones Industrial Average crossing significant milestones following a favorable inflation report. In this context, penny stocks—often representing smaller or newer companies—continue to capture investor interest due to their potential for growth at lower price points. Despite their somewhat outdated label, these stocks can offer intriguing opportunities when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.89 | $405.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.78 | $643.76M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.50 | $260.1M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.18 | $203.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.335 | $1.41B | ✅ 3 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $5.00 | $56.69M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $2.03 | $25.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.95 | $6.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.45 | $76.58M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 355 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Neumora Therapeutics (NMRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Neumora Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing therapeutic treatments for brain diseases, neuropsychiatric disorders, and neurodegenerative diseases in the United States, with a market cap of $425.92 million.

Operations: Neumora Therapeutics, Inc. currently does not report any revenue segments as it is a clinical-stage biopharmaceutical company concentrating on therapeutic treatments for brain diseases and related disorders in the United States.

Market Cap: $425.92M

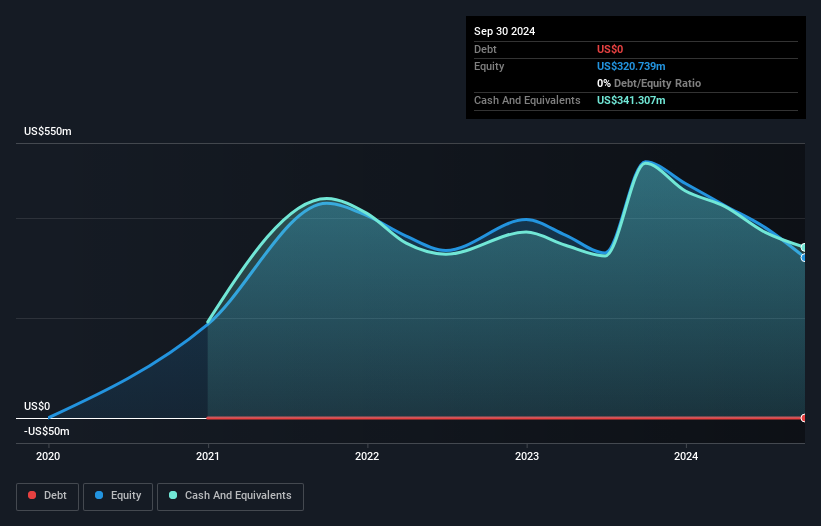

Neumora Therapeutics, a clinical-stage biopharmaceutical company with a market cap of US$425.92 million, operates as a pre-revenue entity focusing on innovative treatments for brain diseases. The company has more cash than debt and its short-term assets significantly outweigh both short and long-term liabilities, providing financial stability. Neumora's stock has experienced high volatility over the past three months and remains unprofitable with increasing losses over the past five years. Recent developments include prioritizing NMRA-215 for obesity treatment, supported by promising preclinical results in animal models, with clinical trials expected to commence in early 2026.

- Navigate through the intricacies of Neumora Therapeutics with our comprehensive balance sheet health report here.

- Understand Neumora Therapeutics' earnings outlook by examining our growth report.

Viomi Technology (VIOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Viomi Technology Co., Ltd, with a market cap of $229.72 million, develops and sells IoT-enabled smart home products in the People's Republic of China through its subsidiaries.

Operations: The company's revenue primarily comes from online retailers, totaling CN¥2.12 billion.

Market Cap: $229.72M

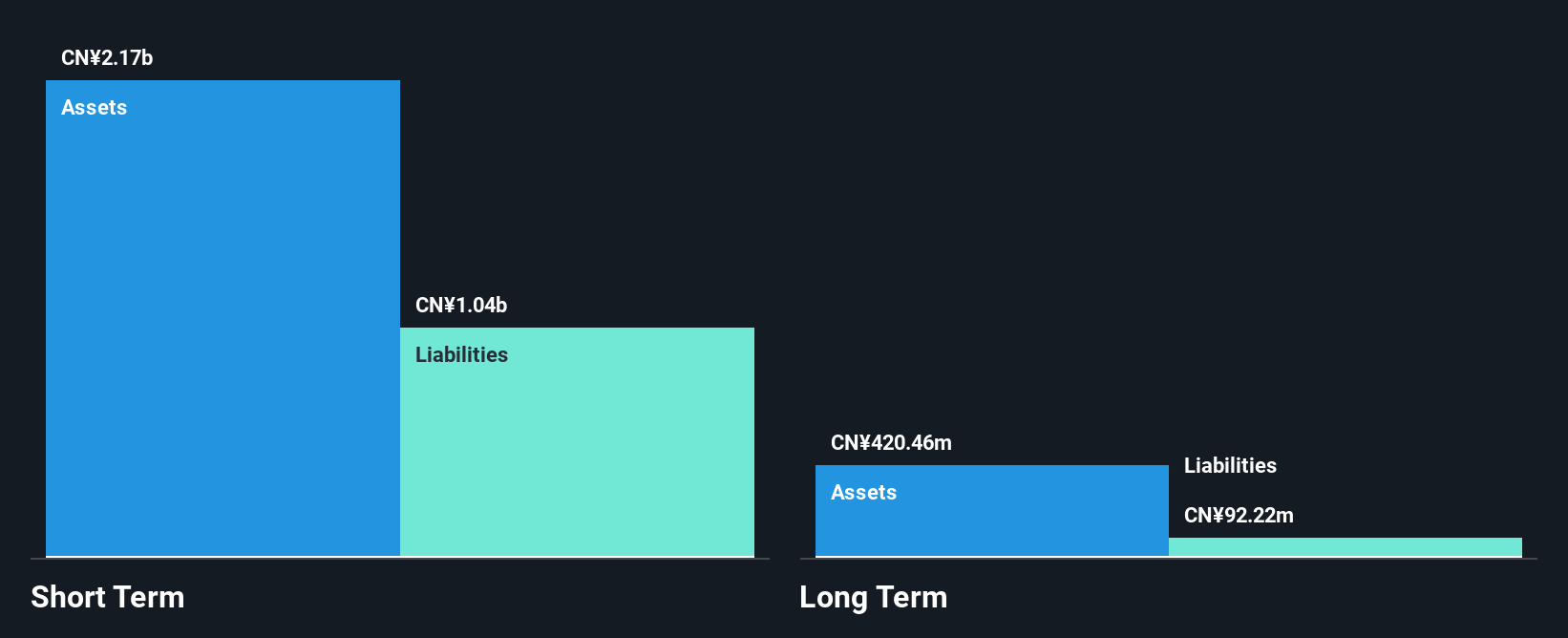

Viomi Technology, with a market cap of $229.72 million, is actively enhancing shareholder value through a $20 million share repurchase program funded by existing cash reserves. The company has launched innovative AI-powered water purifiers in Malaysia and the U.S., marking strategic global expansion efforts. Despite a volatile stock price and low return on equity (10%), Viomi's earnings grew 20.3% last year, outperforming its industry. Short-term assets exceed both short and long-term liabilities, ensuring financial stability. While past five-year earnings declined significantly, current growth forecasts remain positive at 18.95% annually, driven by strong product demand and national subsidies in China.

- Get an in-depth perspective on Viomi Technology's performance by reading our balance sheet health report here.

- Assess Viomi Technology's future earnings estimates with our detailed growth reports.

Hyliion Holdings (HYLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hyliion Holdings Corp. designs and develops power generators for stationary and mobile applications, with a market cap of approximately $400 million.

Operations: Hyliion Holdings Corp. currently does not report any revenue segments.

Market Cap: $400M

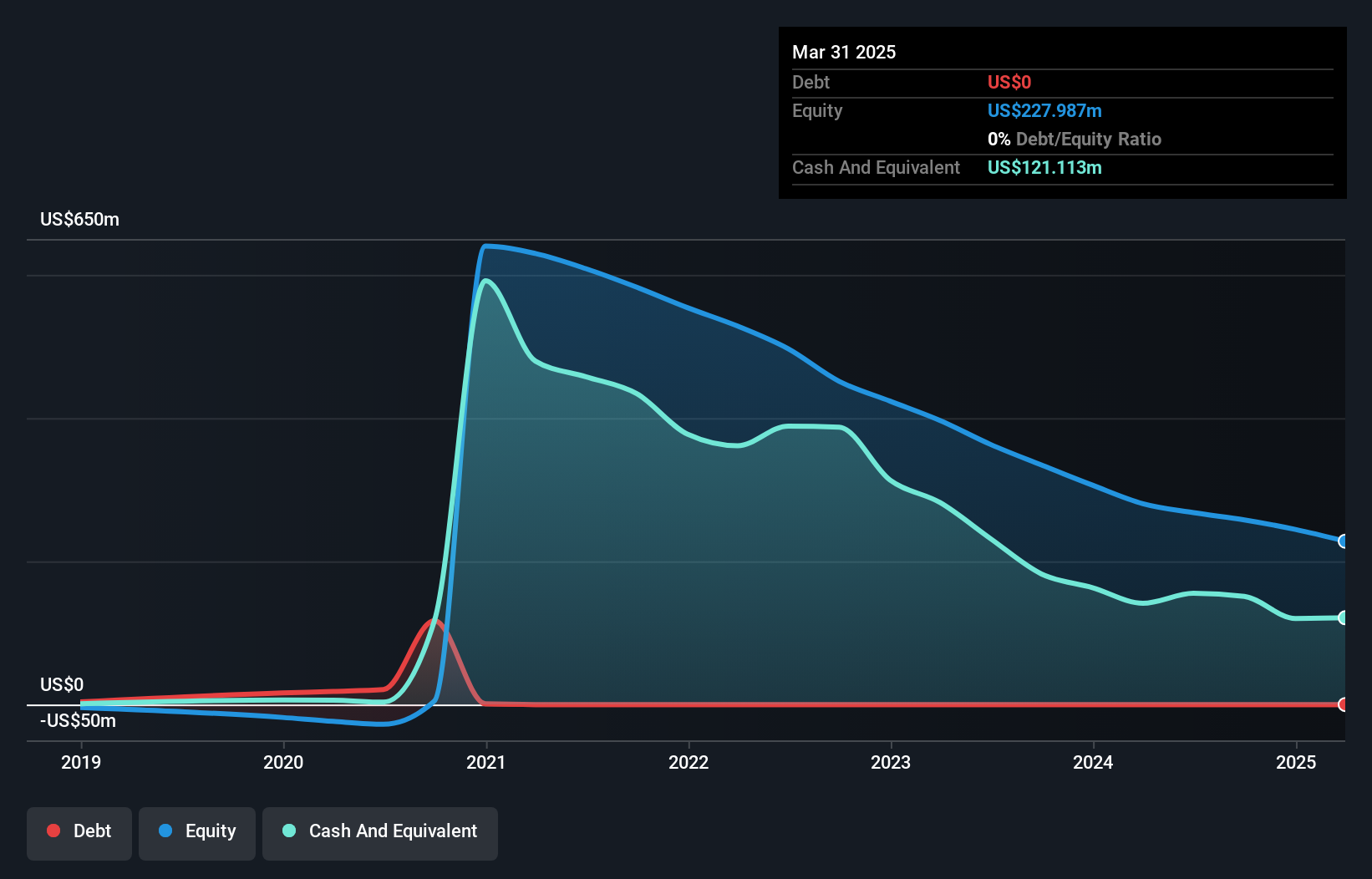

Hyliion Holdings, with a market cap of US$400 million, is currently pre-revenue but has achieved significant milestones in emissions testing for its KARNO Power Module. The module's innovative design meets stringent air-quality standards without requiring federal approvals, enhancing its commercial prospects. Despite being debt-free and having sufficient cash runway for over a year, Hyliion remains unprofitable with increasing losses. Recent guidance adjusted revenue forecasts to between US$5 million and US$10 million for 2025. The company's volatile share price reflects these challenges but also underscores potential growth as it advances towards commercialization in diverse markets.

- Click here and access our complete financial health analysis report to understand the dynamics of Hyliion Holdings.

- Explore Hyliion Holdings' analyst forecasts in our growth report.

Turning Ideas Into Actions

- Gain an insight into the universe of 355 US Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyliion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:HYLN

Hyliion Holdings

Designs and develops power generators for stationary and mobile applications.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives