- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

How Investors Are Reacting To Nektar Therapeutics (NKTR) Securing FDA Fast Track For Eczema Drug Candidate

Reviewed by Sasha Jovanovic

- In recent news, Nektar Therapeutics announced that its lead candidate, rezpegaldesleukin, received Fast Track Designation from the FDA following strong performance in phase 2 studies for eczema treatment. This regulatory advancement could accelerate the path to potential approval as the company prepares to share full 52-week trial data and initiate late-stage studies in the coming year.

- Fast Track Designation underlines the FDA's support for expedited development, highlighting rezpegaldesleukin's potential to address unmet needs in eczema treatment and bolstering Nektar's clinical progress at a pivotal stage.

- We'll examine how the FDA's Fast Track support for rezpegaldesleukin may reshape Nektar's investment narrative and future outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nektar Therapeutics Investment Narrative Recap

To be a shareholder in Nektar Therapeutics, you need to believe in the clinical and commercial promise of rezpegaldesleukin, the company’s lead candidate, as pivotal to unlocking significant long-term value. The FDA’s Fast Track Designation for eczema builds momentum around the upcoming 52-week trial results, confirming the late-stage data as the most important near-term catalyst, but meaningful risk remains, as positive regulation does not reduce the chance of late-stage clinical failure.

Of the company’s recent announcements, the new Phase 2b data presentation at the 2025 EADV Congress is most connected to this momentum. These clinical updates provide potentially pivotal insights into safety and efficacy, which are central to driving regulatory progress and may directly impact the timing and confidence behind future late-stage trial initiations.

However, in contrast to the optimism surrounding regulatory progress, the financial and execution risk at this stage is something every investor should be aware of, especially as...

Read the full narrative on Nektar Therapeutics (it's free!)

Nektar Therapeutics' narrative projects $40.9 million revenue and $9.5 million earnings by 2028. This requires an 18.3% annual revenue decline and a $131.8 million earnings increase from -$122.3 million.

Uncover how Nektar Therapeutics' forecasts yield a $101.17 fair value, a 76% upside to its current price.

Exploring Other Perspectives

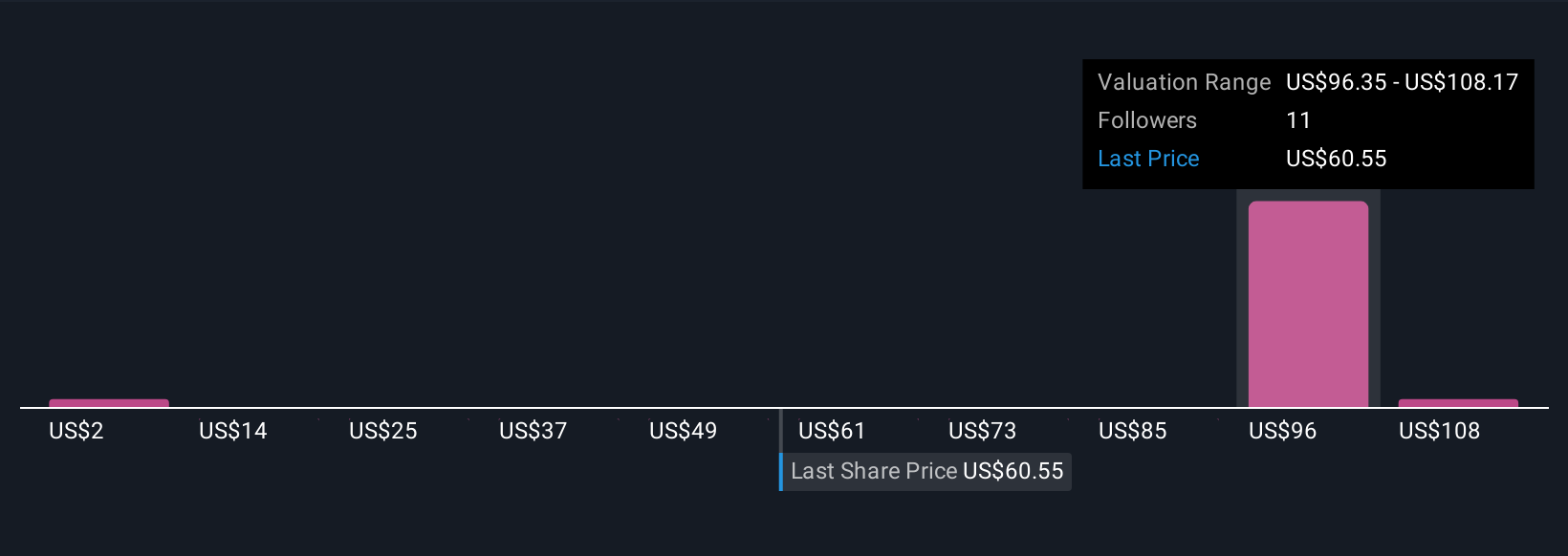

Fair value estimates from four Simply Wall St Community members range from US$1.74 to US$120 per share, highlighting wide gaps in expectations. With clinical milestones now accelerating, your view on late-stage study success will likely shape how you interpret this broad range of opinions.

Explore 4 other fair value estimates on Nektar Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Nektar Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nektar Therapeutics research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Nektar Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nektar Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Medium-low risk and overvalued.

Similar Companies

Market Insights

Community Narratives