- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

Assessing NewAmsterdam Pharma (NasdaqGM:NAMS): Is the Recent Valuation Premium Justified?

Reviewed by Kshitija Bhandaru

See our latest analysis for NewAmsterdam Pharma.

Zooming out, NewAmsterdam Pharma’s momentum this year has been picking up, with the recent share price bump adding to a steady climb. While the 1-year total shareholder return stands at 0.83%, cautious optimism persists as investors weigh the company's long-term potential against underlying risks and ongoing biotech sector volatility.

If today's biotech action has your attention, the next smart move might be to explore other innovators. See the full list with our See the full list for free..

Given NewAmsterdam Pharma's recent run, are investors overlooking hidden value, or is the current price already reflecting all the anticipated growth? Does this present a genuine buying opportunity, or has the market priced it all in?

Price-to-Book Ratio of 4.7x: Is It Justified?

NewAmsterdam Pharma’s shares are currently trading at a price-to-book ratio of 4.7x, which is notably higher than its US Biotechs industry peers. With a last close price of $32.48, the market values NAMS well above the sector’s average book value multiple.

The price-to-book ratio compares a company’s market value to its book value, providing investors with a rough sense of how the market perceives the firm’s assets. For biotechs like NAMS, this metric offers a snapshot of sentiment around future growth versus current financial underpinnings.

The current reading of 4.7x is elevated compared to the industry average of 2.5x and also higher than the peer group average of 3.8x. This suggests that the market is pricing in optimistic expectations for NewAmsterdam Pharma’s pipeline and long-term prospects, possibly overlooking its ongoing unprofitability. If the company is able to deliver on high growth projections, this premium could eventually be warranted. For now, the market appears ahead of the fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 4.7x (OVERVALUED)

However, sustained unprofitability and broader biotech volatility remain risks that could temper enthusiasm or undermine the current bullish outlook for NewAmsterdam Pharma.

Find out about the key risks to this NewAmsterdam Pharma narrative.

Another View: What Does the DCF Say?

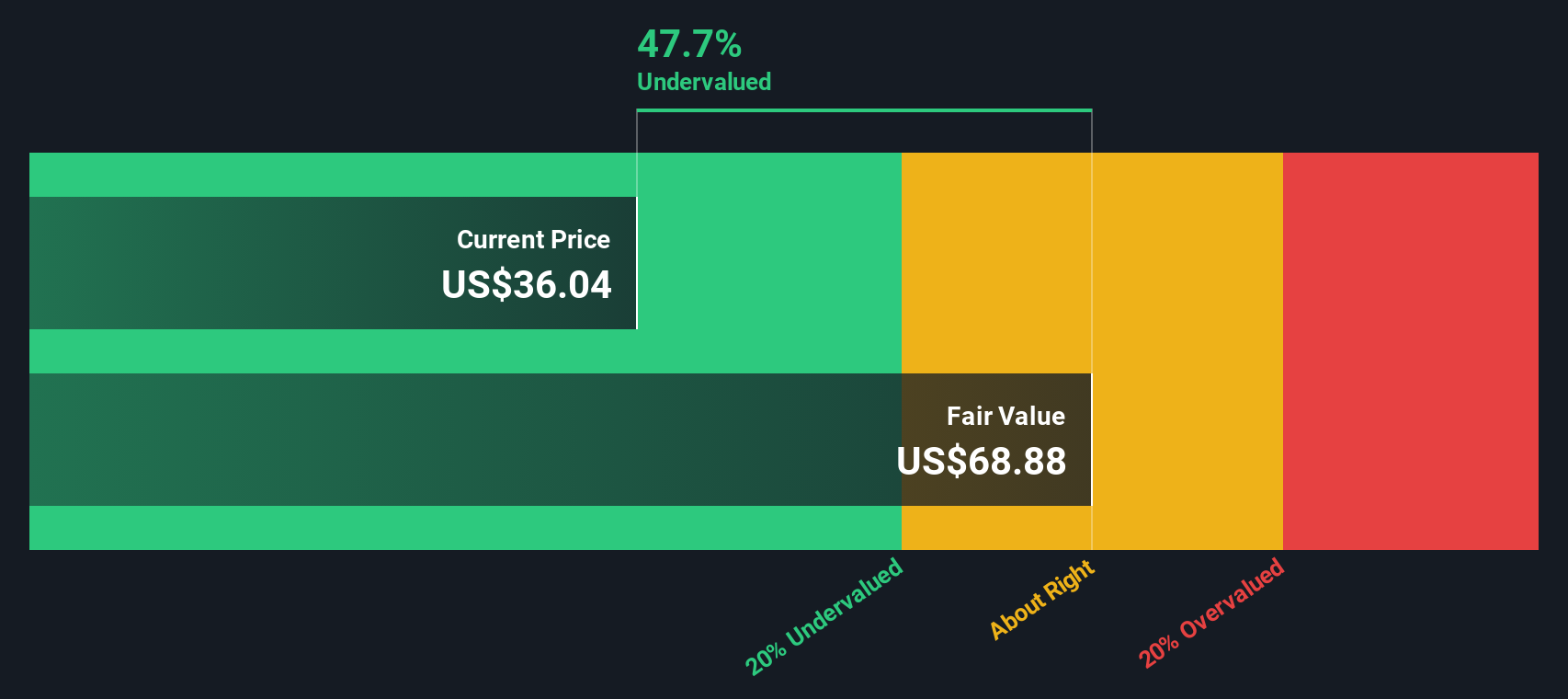

While the market puts a premium on NewAmsterdam Pharma’s assets, our DCF model tells a very different story. According to this approach, NAMS is trading at around 54% below its estimated fair value, which points to a significant undervaluation based on projected future cash flows. Does this suggest hidden upside, or are the risks simply hard to ignore?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NewAmsterdam Pharma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NewAmsterdam Pharma Narrative

If this analysis differs from your own take or you'd rather dig into the details yourself, you can craft your own view in just minutes with our Do it your way.

A great starting point for your NewAmsterdam Pharma research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip through your fingers. Expand your portfolio’s potential by checking out these exciting investment themes on Simply Wall Street:

- Tap into high yields and dependable payouts by seeing which companies stand out among these 19 dividend stocks with yields > 3%.

- Catalyze your strategy with a fresh perspective on value by uncovering hidden gems in these 895 undervalued stocks based on cash flows.

- Step ahead of the next big trend in tech by exploring the pioneers featured among these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

Excellent balance sheet with low risk.

Market Insights

Community Narratives