- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

A Closer Look at NewAmsterdam Pharma (NasdaqGM:NAMS) Valuation Following REMBRANDT Clinical Trial Collaboration

Reviewed by Kshitija Bhandaru

NewAmsterdam Pharma (NAMS) saw attention after Caristo Diagnostics was selected as the global imaging core lab for its REMBRANDT Cardiovascular Imaging Trial. This partnership represents progress in advancing the trial’s drug development process.

See our latest analysis for NewAmsterdam Pharma.

The momentum behind NewAmsterdam Pharma has been impressive lately, with a 53.6% share price return over the past month and a standout 93.9% total shareholder return in the last 12 months. The recent partnership announcement has fueled already building optimism, as investors seem to be recognizing both short-term milestones and longer-term potential in the company's pipeline.

If recent breakthroughs in clinical trials have sparked your curiosity, it might be the perfect time to explore more innovative biotech and pharma stocks with our See the full list for free.

But with the stock already soaring on strong returns and recent breakthroughs, investors are left wondering whether NewAmsterdam Pharma is still undervalued or if the market has already priced in its future growth potential.

Price-to-Book Ratio of 5.4x: Is it justified?

NewAmsterdam Pharma’s shares are currently trading at a price-to-book (P/B) ratio of 5.4x, well above both industry and peer averages. This metric helps investors gauge how the market is valuing the company compared to its net asset value, offering a window into expectations about growth and profitability.

The P/B ratio is a widely used valuation benchmark, especially for biotechs and pharma companies where tangible assets and intangible pipeline value play a major role. A higher P/B suggests the market is willing to pay a premium for the expected future earnings or breakthrough innovations. It can also signal overheating if not supported by fundamentals.

Compared to the US Biotechs industry average of 2.5x and the peer average of 4.2x, NewAmsterdam Pharma stands out as more expensive. This premium valuation reflects strong market optimism around upcoming clinical milestones and rapid revenue growth expectations. It may also raise questions about whether the current price already factors in much of the future upside.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.4x (OVERVALUED)

However, potential regulatory hurdles or setbacks in upcoming clinical trials could quickly dampen the bullish outlook surrounding NewAmsterdam Pharma’s recent momentum.

Find out about the key risks to this NewAmsterdam Pharma narrative.

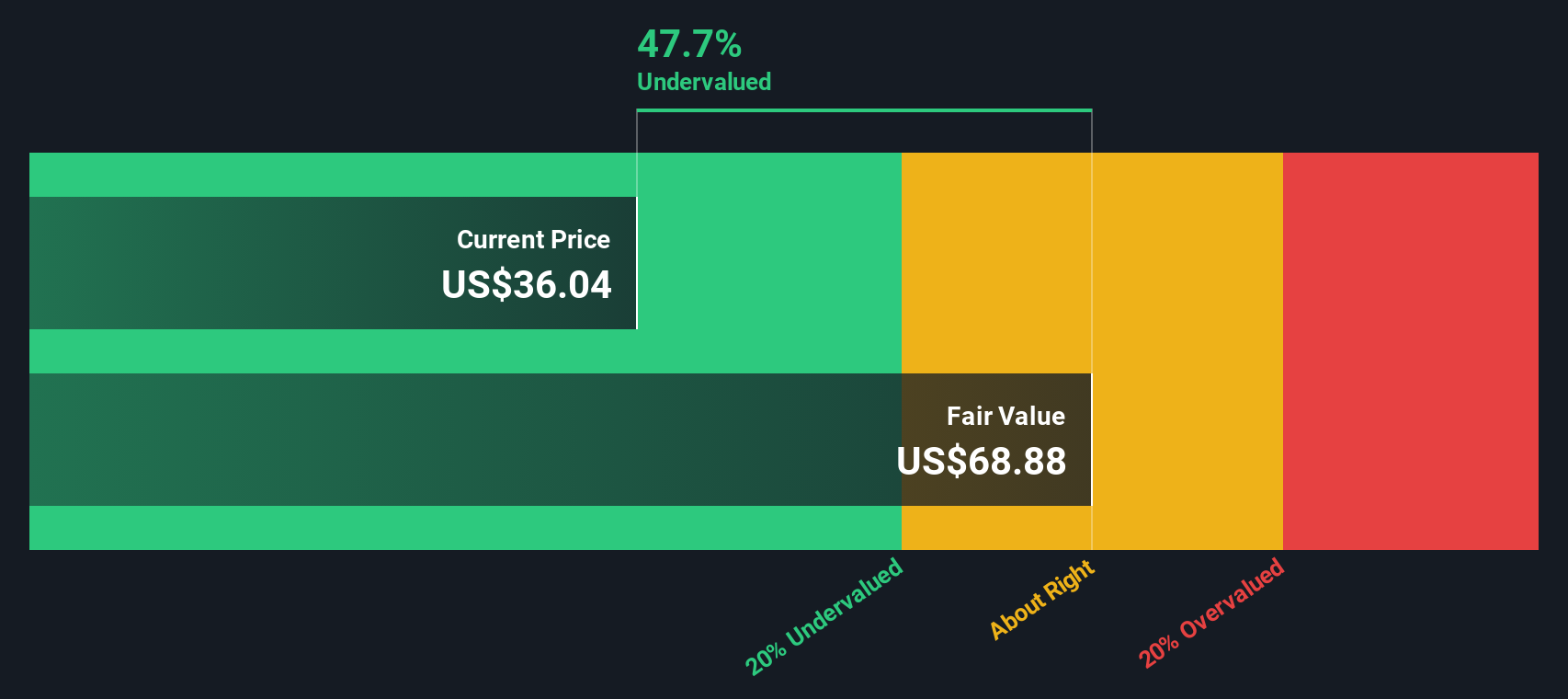

Another View: DCF Suggests Undervaluation

While the price-to-book ratio paints NewAmsterdam Pharma as expensive, our DCF model tells a different story. It indicates shares trade about 47% below estimated fair value. This wide difference between market sentiment and projected intrinsic value could signal either overlooked opportunity or heightened risk. Which view will the market side with next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NewAmsterdam Pharma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NewAmsterdam Pharma Narrative

If you enjoy digging into the numbers and want a fresh perspective, you can easily craft your own view of NewAmsterdam Pharma in just a few minutes, or Do it your way.

A great starting point for your NewAmsterdam Pharma research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead by scanning the market for overlooked gems and timely opportunities that could fit your investment strategy and boost your confidence with every move.

- Capture the potential in tomorrow’s innovators by checking out these 25 AI penny stocks as they reshape the business landscape through artificial intelligence.

- Tap into future growth by researching these 26 quantum computing stocks focused on quantum breakthroughs and the next wave of technological progress.

- Unlock steady returns by finding these 18 dividend stocks with yields > 3% with yields above 3%, which may be suitable for building income over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

Excellent balance sheet with low risk.

Market Insights

Community Narratives