- United States

- /

- Life Sciences

- /

- NasdaqCM:NAGE

Market Participants Recognise Niagen Bioscience, Inc.'s (NASDAQ:NAGE) Revenues Pushing Shares 29% Higher

Niagen Bioscience, Inc. (NASDAQ:NAGE) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days were the cherry on top of the stock's 378% gain in the last year, which is nothing short of spectacular.

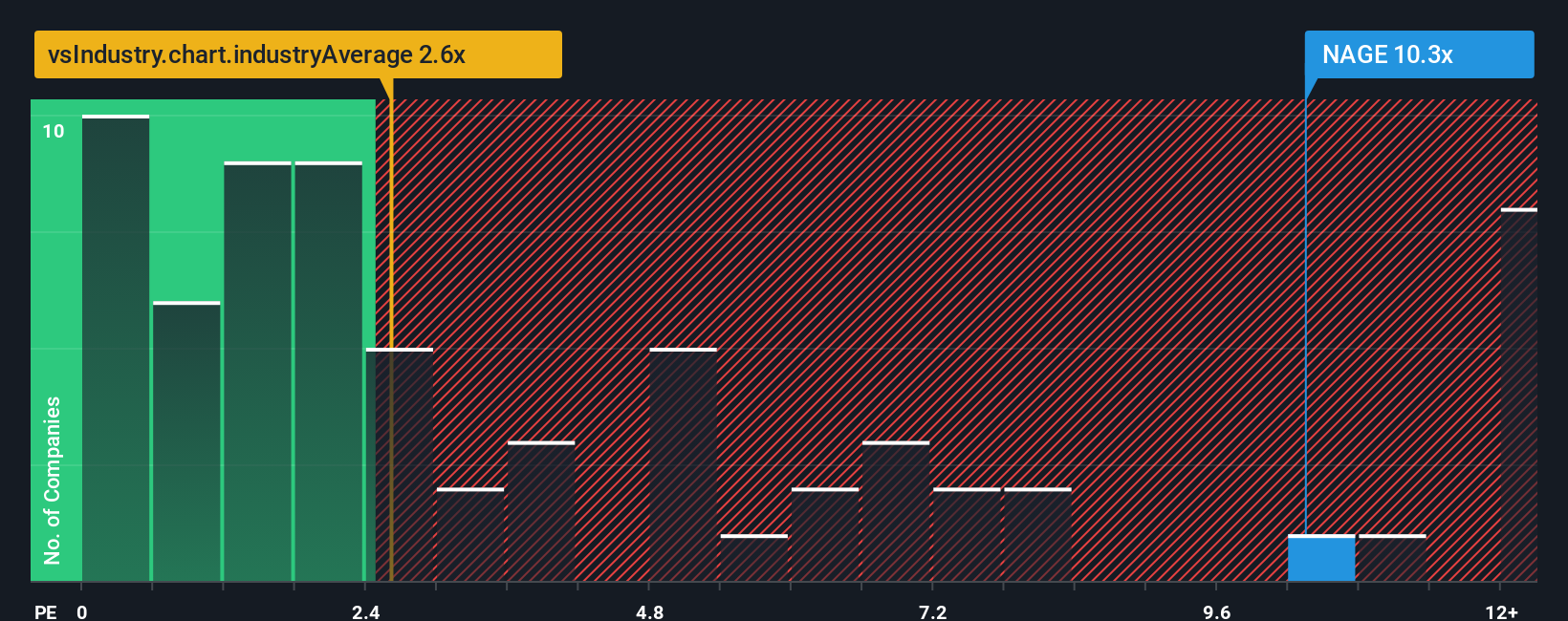

Since its price has surged higher, when almost half of the companies in the United States' Life Sciences industry have price-to-sales ratios (or "P/S") below 2.6x, you may consider Niagen Bioscience as a stock not worth researching with its 10.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Niagen Bioscience

What Does Niagen Bioscience's P/S Mean For Shareholders?

Niagen Bioscience certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Niagen Bioscience will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Niagen Bioscience would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. The latest three year period has also seen an excellent 54% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 20% over the next year. With the industry only predicted to deliver 5.4%, the company is positioned for a stronger revenue result.

With this information, we can see why Niagen Bioscience is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Niagen Bioscience's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Niagen Bioscience maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Life Sciences industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Niagen Bioscience with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Niagen Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NAGE

Niagen Bioscience

Operates as a bioscience company engages in developing healthy aging products.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.