- United States

- /

- Life Sciences

- /

- NasdaqGS:MRVI

Revenues Working Against Maravai LifeSciences Holdings, Inc.'s (NASDAQ:MRVI) Share Price

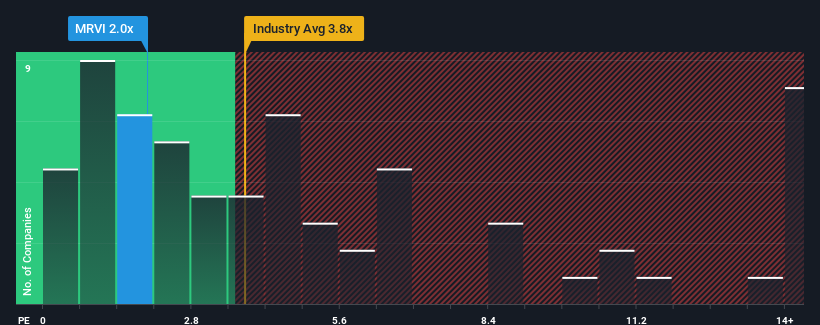

You may think that with a price-to-sales (or "P/S") ratio of 2x Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI) is a stock worth checking out, seeing as almost half of all the Life Sciences companies in the United States have P/S ratios greater than 3.8x and even P/S higher than 7x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Maravai LifeSciences Holdings

How Maravai LifeSciences Holdings Has Been Performing

With revenue that's retreating more than the industry's average of late, Maravai LifeSciences Holdings has been very sluggish. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Maravai LifeSciences Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Maravai LifeSciences Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 54%. Even so, admirably revenue has lifted 48% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 34% as estimated by the twelve analysts watching the company. The industry is also set to see revenue decline 2.1% but the stock is shaping up to perform materially worse.

With this information, it's not too hard to see why Maravai LifeSciences Holdings is trading at a lower P/S in comparison. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

What We Can Learn From Maravai LifeSciences Holdings' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Maravai LifeSciences Holdings' analyst forecasts confirms that the company's even more precarious outlook against the industry is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. In the meantime, unless the company's prospects improve they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Maravai LifeSciences Holdings you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Maravai LifeSciences Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MRVI

Maravai LifeSciences Holdings

A life sciences company, provides products that enable the development of drug therapies, vaccines, drug therapies, cell and gene therapies, and diagnostics North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin and Central America.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives