- United States

- /

- Life Sciences

- /

- NasdaqGS:MRVI

Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI) shares have continued their recent momentum with a 28% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 45% in the last twelve months.

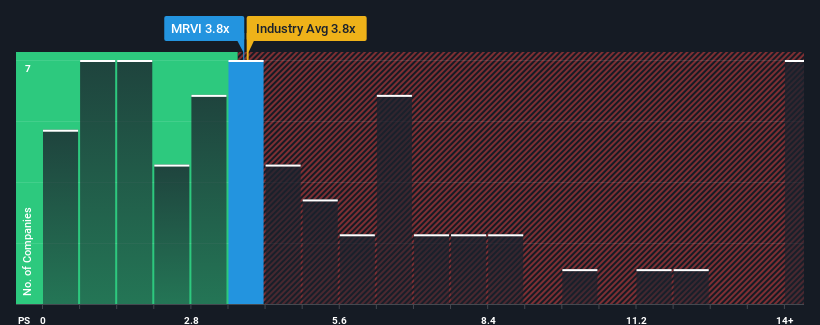

In spite of the firm bounce in price, it's still not a stretch to say that Maravai LifeSciences Holdings' price-to-sales (or "P/S") ratio of 3.8x right now seems quite "middle-of-the-road" compared to the Life Sciences industry in the United States, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Maravai LifeSciences Holdings

What Does Maravai LifeSciences Holdings' P/S Mean For Shareholders?

Maravai LifeSciences Holdings has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Maravai LifeSciences Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Maravai LifeSciences Holdings would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 67%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.2% per year during the coming three years according to the twelve analysts following the company. That's shaping up to be similar to the 6.5% per year growth forecast for the broader industry.

With this information, we can see why Maravai LifeSciences Holdings is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Maravai LifeSciences Holdings' P/S Mean For Investors?

Maravai LifeSciences Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Maravai LifeSciences Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Life Sciences industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you settle on your opinion, we've discovered 1 warning sign for Maravai LifeSciences Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Maravai LifeSciences Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MRVI

Maravai LifeSciences Holdings

A life sciences company, provides products that enable the development of drug therapies, vaccines, drug therapies, cell and gene therapies, and diagnostics North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin and Central America.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives