- United States

- /

- Biotech

- /

- NasdaqGS:MRSN

Investors Don't See Light At End Of Mersana Therapeutics, Inc.'s (NASDAQ:MRSN) Tunnel And Push Stock Down 32%

Unfortunately for some shareholders, the Mersana Therapeutics, Inc. (NASDAQ:MRSN) share price has dived 32% in the last thirty days, prolonging recent pain. The last month has meant the stock is now only up 8.4% during the last year.

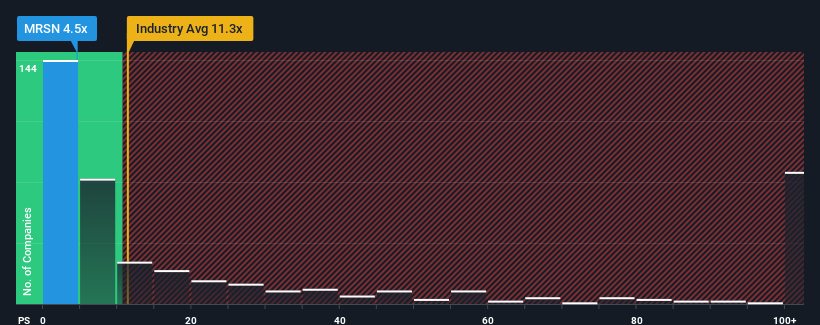

Since its price has dipped substantially, Mersana Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4.5x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.3x and even P/S higher than 59x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Mersana Therapeutics

What Does Mersana Therapeutics' Recent Performance Look Like?

Recent times haven't been great for Mersana Therapeutics as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mersana Therapeutics.How Is Mersana Therapeutics' Revenue Growth Trending?

In order to justify its P/S ratio, Mersana Therapeutics would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 11% per annum over the next three years. That's shaping up to be materially lower than the 139% each year growth forecast for the broader industry.

With this in consideration, its clear as to why Mersana Therapeutics' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Mersana Therapeutics' P/S

Having almost fallen off a cliff, Mersana Therapeutics' share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Mersana Therapeutics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Mersana Therapeutics that we have uncovered.

If you're unsure about the strength of Mersana Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MRSN

Mersana Therapeutics

A clinical-stage biopharmaceutical company, develops antibody-drug conjugates (ADC) for cancer patients with unmet needs.

Good value slight.

Market Insights

Community Narratives