- United States

- /

- Biotech

- /

- NasdaqGS:MRNA

Moderna (NasdaqGS:MRNA) Reports Decrease in Q1 Revenue and Net Loss

Reviewed by Simply Wall St

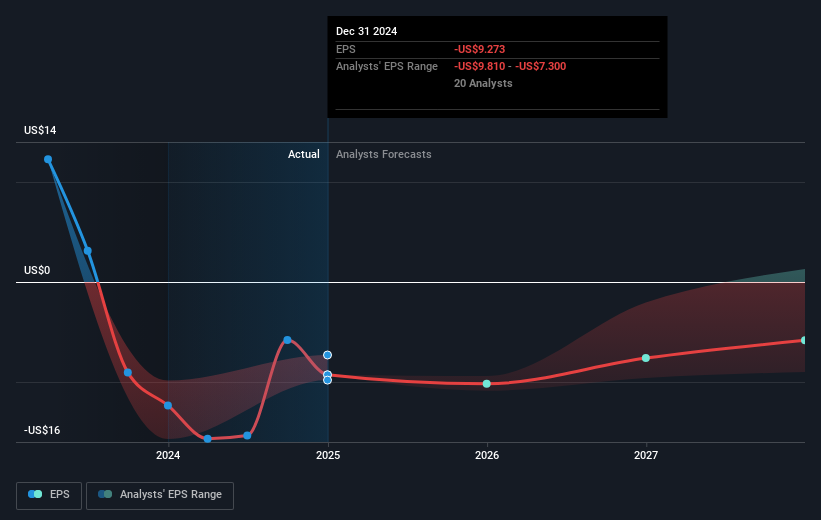

Moderna (NasdaqGS:MRNA) recently reported a decline in revenue for Q1 2025, but managed to reduce its net loss and improve its loss per share. Despite this, the company's stock price was relatively flat over the last month. This performance aligns with broader market trends, which saw significant gains due to strong job reports and positive sentiment from potential U.S.-China trade talks. While Moderna's financial results may have added weight to broader market optimism, the stock's minimal price change suggests its influence was not substantial in either countering or enhancing market movements.

Buy, Hold or Sell Moderna? View our complete analysis and fair value estimate and you decide.

The recent news regarding Moderna's Q1 2025 results, marked by a revenue decline and a better net loss performance, suggests efforts to stabilize its financial trajectory. This aligns with its broader focus on diversifying revenue away from COVID-19 products, which holds promise for future growth, though uncertainties remain. Over the past five years, however, the company's total shareholder return is a considerable decline of 49.18%, highlighting the challenges faced by the firm amidst shifting market dynamics and internal cost pressures. This long-term performance contrasts markedly with broader market rallies in the last month spurred by positive economic indicators.

In a contrasting one-year timeframe, Moderna underperformed compared to the US Biotechs industry, which experienced a 6.6% decline. This indicates a tougher ride for Moderna relative to its peers. The current revenue guidance and cost optimization endeavors may support improved forecasts but remain subject to the outcome of vaccine development and approval processes. Of note, the company's current share price of US$27.82 presents a significant discount to the consensus price target of US$49.57, reflecting investors' cautious outlook concerning its growth execution and market transformations. For a more informed view, investors should weigh these projections against their own assumptions about Moderna's potential to realize projected revenue and profitability levels.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRNA

Moderna

A biotechnology company, provides messenger RNA medicines in the United States, Europe, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Is Global Payments (NYSE:GPN) The Undervalued Cash Cow Your Portfolio Needs?

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026