- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

MannKind (MNKD): Evaluating Valuation Gaps and Growth Narratives in the Biotech Sector

Reviewed by Kshitija Bhandaru

MannKind (MNKD) stock has seen mixed performance lately, with shares down over the past month but recovering during the past 3 months. Investors continue to assess the company's financials and long-term outlook in a shifting biotech landscape.

See our latest analysis for MannKind.

After a rocky start to the year, MannKind's 1-year total shareholder return stands at -24.69%. Longer-term investors have still seen a robust 59.5% gain over three years and an impressive 144% over five. The recent recovery in the 90-day share price, up 21.09%, suggests that momentum could be building after recent volatility. Market sentiment seems to be shifting in response to changing risk perceptions and growth potential in biotech.

If MannKind's recent upswing has you rethinking what's possible, now's the perfect opportunity to broaden your investing horizons and discover fast growing stocks with high insider ownership

Despite recent gains, MannKind shares trade well below analyst targets. This raises the question: is the market overlooking future upside, or is any potential growth already reflected in today’s price?

Most Popular Narrative: 53.8% Undervalued

With MannKind shares last closing at $4.88, the most widely followed narrative sees fair value at $10.57 per share. This suggests a significant gap and raises questions about what might be fueling this optimism.

Strategic non-dilutive financing from Blackstone ($500M revolver) provides the company with capital flexibility to accelerate commercialization, pipeline advancement, and business development. This enables faster capture of high-growth, high-value therapeutic opportunities and reduces the risk of equity dilution, positively impacting per-share earnings potential.

Curious why this price target stands so far above the market? Underneath, bold projections for growth, profit margins, and future earnings are setting a high benchmark. Yet the exact combination may surprise you. Want to know which financial assumptions could power a valuation almost double the stock’s recent price? Unlock the full narrative for all the details.

Result: Fair Value of $10.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges with Afrezza’s market adoption and heavy reliance on a narrow portfolio could limit MannKind’s growth potential in the future.

Find out about the key risks to this MannKind narrative.

Another View: What About Multiples?

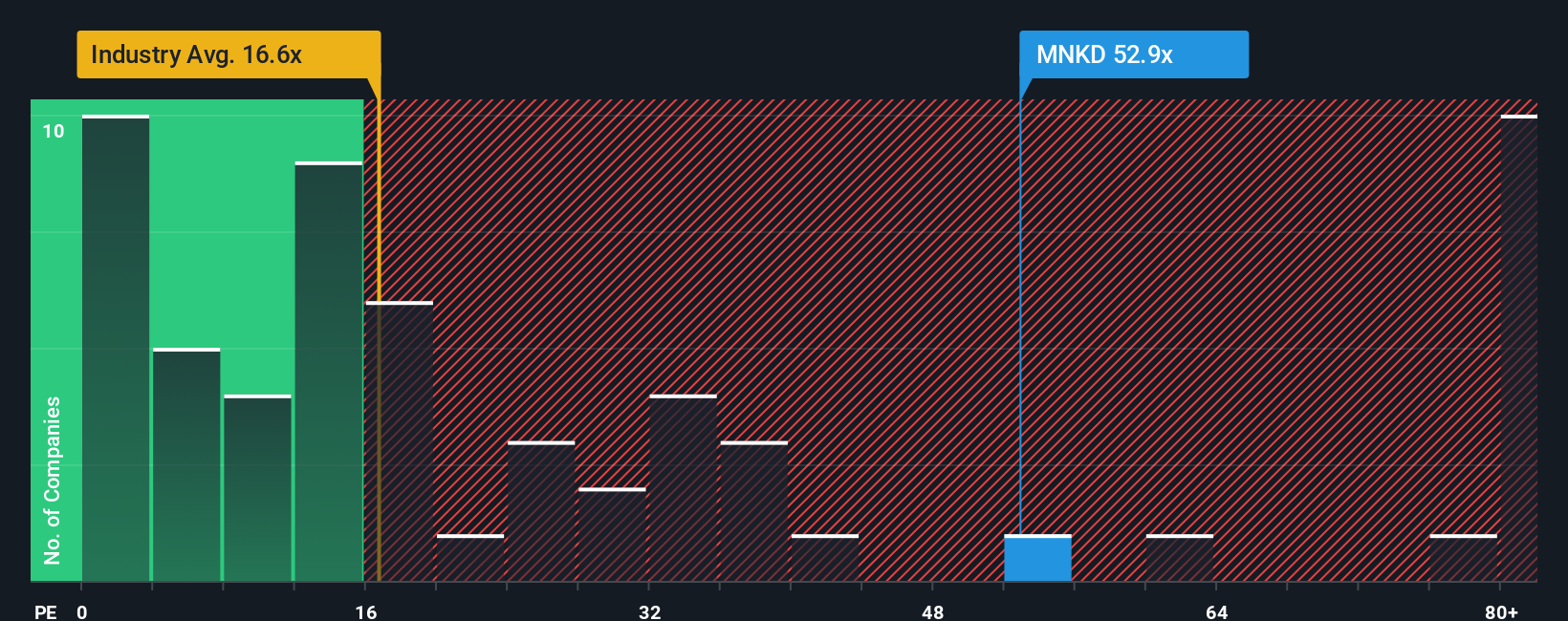

While the consensus price target offers an optimistic view, looking at price-based valuation tells a different story. MannKind’s price-to-earnings ratio stands at 45.7x, which is significantly higher than both the US Biotech industry average of 16.6x and the peer average of 14.2x. This gap suggests investors are already pricing in a lot of future growth. This raises the question of whether current optimism leaves enough room for more upside or simply adds valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MannKind Narrative

If you see the numbers differently, or want to dig into the details yourself, you can shape your own take on MannKind in just minutes and Do it your way.

A great starting point for your MannKind research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their search to just one stock. Take the next step and unlock fresh investment opportunities built on solid data and trends with these handpicked screens:

- Capitalize on futuristic breakthroughs by tapping into innovation leaders among these 26 quantum computing stocks, shaping tomorrow's technology today.

- Grow your income by targeting stability and long-term potential in proven performers. Start with these 19 dividend stocks with yields > 3%, offering attractive yields over 3%.

- Snap up bargains that others are missing and find your edge with these 892 undervalued stocks based on cash flows, featuring stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of therapeutic products and services for endocrine and orphan lung diseases in the United States.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives