- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

Did Business Growth Power MannKind's (NASDAQ:MNKD) Share Price Gain of 293%?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the MannKind Corporation (NASDAQ:MNKD) share price has soared 293% in the last year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 100% gain in the last three months. And shareholders have also done well over the long term, with an increase of 102% in the last three years.

See our latest analysis for MannKind

MannKind isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year MannKind saw its revenue shrink by 0.6%. We're a little surprised to see the share price pop 293% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

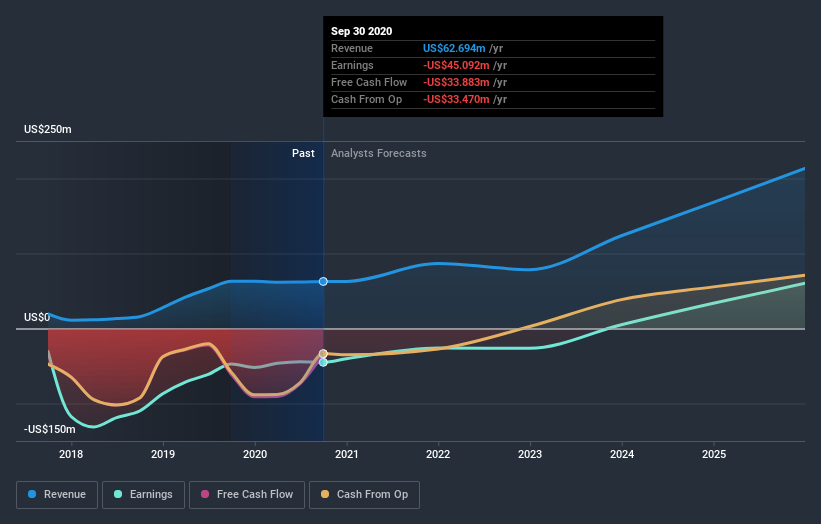

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling MannKind stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that MannKind shareholders have received a total shareholder return of 293% over the last year. That gain is better than the annual TSR over five years, which is 4%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with MannKind (including 1 which is a bit concerning) .

MannKind is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade MannKind, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of inhaled therapeutic products for endocrine and orphan lung diseases in the United States.

Reasonable growth potential and fair value.

Market Insights

Community Narratives