- United States

- /

- Biotech

- /

- NasdaqGS:MLYS

Mineralys Therapeutics (MLYS) Is Up 10.8% After Completing Phase 2 OSA Trial Enrollment – What's Changed

Reviewed by Sasha Jovanovic

- Mineralys Therapeutics announced it has completed enrollment in its Phase 2 EXPLORE-OSA clinical trial studying lorundrostat in patients with moderate-to-severe obstructive sleep apnea and hypertension.

- This milestone sets the stage for upcoming top-line trial results in early 2026, potentially expanding lorundrostat’s utility across challenging patient populations with interconnected conditions.

- We'll explore how advancing lorundrostat toward pivotal data in OSA and hypertension could shape Mineralys’s broader investment thesis.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Mineralys Therapeutics' Investment Narrative?

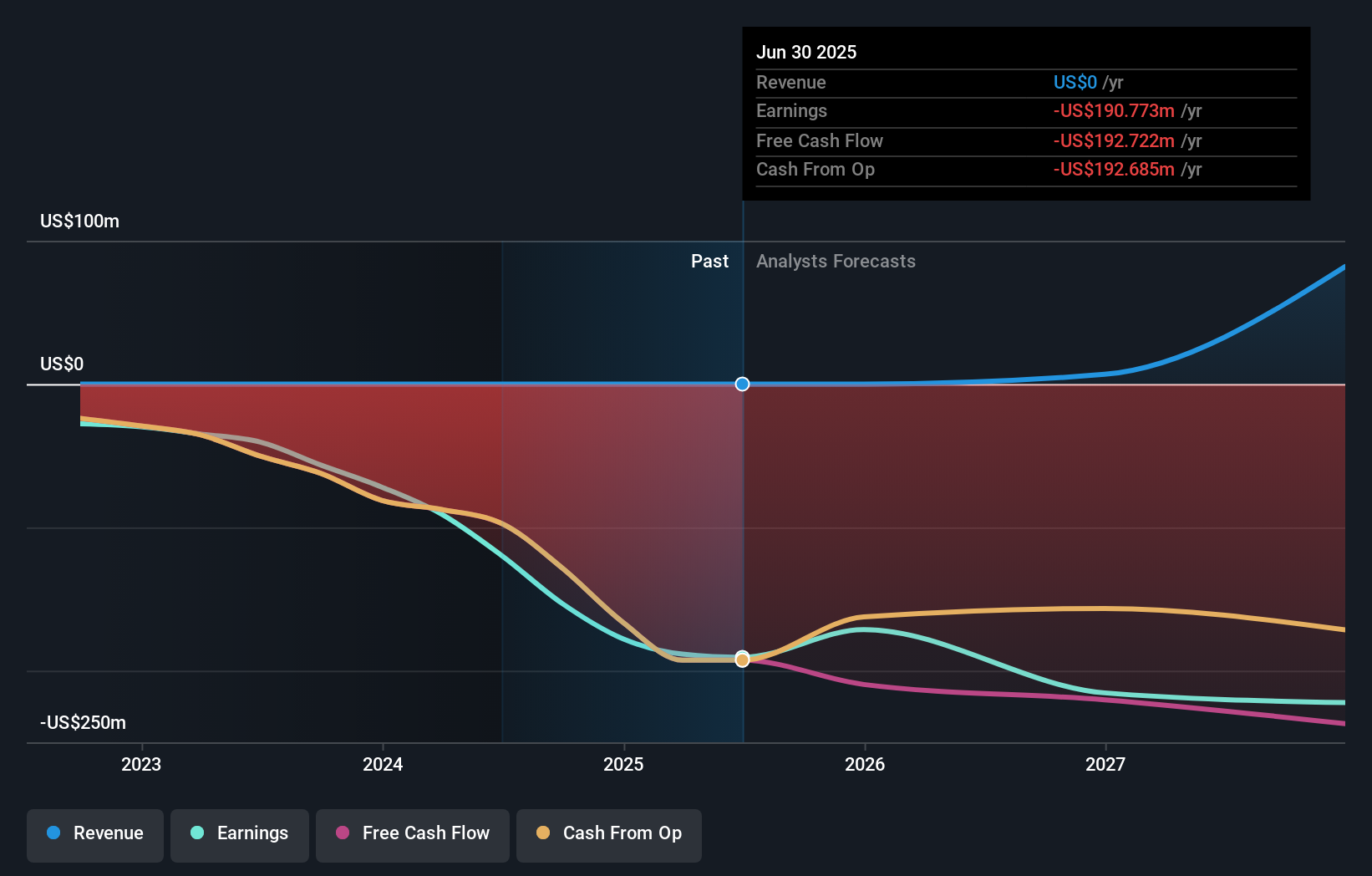

For investors considering Mineralys Therapeutics, the central thesis revolves around belief in lorundrostat's potential to address overlapping populations with hypertension and related comorbidities. The just-completed enrollment for the EXPLORE-OSA trial marks a significant step, as it sets a clear timetable for new Phase 2 results, and complements recently reported positive data in related trials. In the near term, this milestone slightly shifts the focus toward upcoming data in early 2026 as a primary catalyst, especially with management pushing for a regulatory filing strategy. However, key risks remain, including continued operating losses, recent share price volatility, and the impact of shareholder dilution following the recent US$250 million equity raise. The market reaction so far suggests the news is taken as progress, but pivotal trial outcomes remain the critical variable.

On the other hand, shareholders still face the challenge of unprofitability after several years of trial progress. Mineralys Therapeutics' shares have been on the rise but are still potentially undervalued by 48%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Mineralys Therapeutics - why the stock might be worth as much as $43.75!

Build Your Own Mineralys Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mineralys Therapeutics research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Mineralys Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mineralys Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLYS

Mineralys Therapeutics

A clinical-stage biopharmaceutical company, develops medicines to target diseases driven by dysregulated aldosterone in the United States.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives