- United States

- /

- Biotech

- /

- NasdaqGS:MGTX

Strong week for MeiraGTx Holdings (NASDAQ:MGTX) shareholders doesn't alleviate pain of five-year loss

MeiraGTx Holdings plc (NASDAQ:MGTX) shareholders should be happy to see the share price up 10% in the last week. But that doesn't change the fact that the returns over the last half decade have been disappointing. In fact, the share price has declined rather badly, down some 68% in that time. So we're not so sure if the recent bounce should be celebrated. Of course, this could be the start of a turnaround.

While the last five years has been tough for MeiraGTx Holdings shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for MeiraGTx Holdings

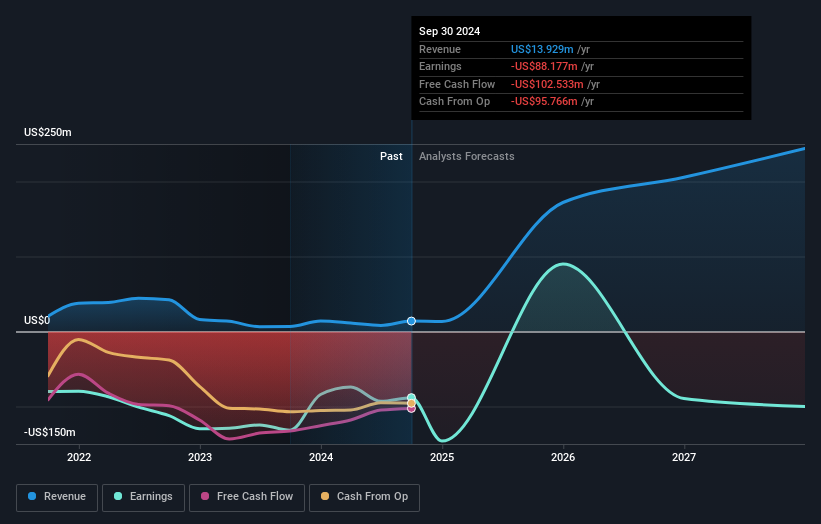

Given that MeiraGTx Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last five years MeiraGTx Holdings saw its revenue shrink by 3.3% per year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 11% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on MeiraGTx Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

MeiraGTx Holdings shareholders gained a total return of 5.9% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 11% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that MeiraGTx Holdings is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MGTX

MeiraGTx Holdings

A clinical stage gene therapy company, focusing on developing treatments for patients with serious diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives