- United States

- /

- Biotech

- /

- NasdaqGS:MGNX

MacroGenics, Inc.'s (NASDAQ:MGNX) Share Price Boosted 30% But Its Business Prospects Need A Lift Too

MacroGenics, Inc. (NASDAQ:MGNX) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

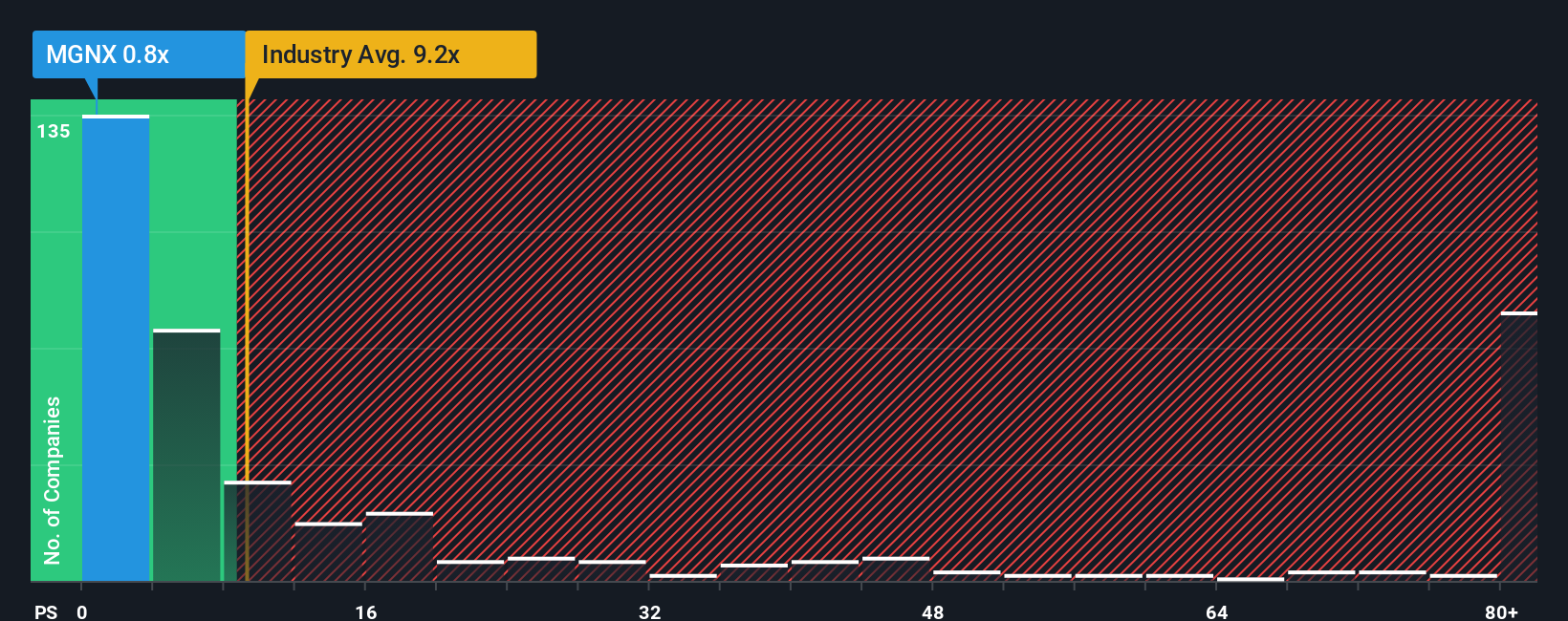

Although its price has surged higher, MacroGenics may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 9.2x and even P/S higher than 69x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for MacroGenics

How MacroGenics Has Been Performing

With revenue growth that's superior to most other companies of late, MacroGenics has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think MacroGenics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For MacroGenics?

MacroGenics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Pleasingly, revenue has also lifted 147% in aggregate from three years ago, thanks to the last 12 months of explosive growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 20% each year during the coming three years according to the five analysts following the company. That's not great when the rest of the industry is expected to grow by 118% each year.

With this information, we are not surprised that MacroGenics is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Even after such a strong price move, MacroGenics' P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of MacroGenics' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, MacroGenics' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for MacroGenics (of which 1 makes us a bit uncomfortable!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MGNX

MacroGenics

A clinical-stage biopharmaceutical company, discovers, develops, manufactures, and commercializes antibody-based therapeutics to treat cancer in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives