- United States

- /

- Biotech

- /

- NasdaqGM:MENS

Examining Jyong Biotech (NasdaqGM:MENS) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

If you have been watching Jyong Biotech (NasdaqGM:MENS) lately, you are not alone. The latest move in the share price might leave investors wondering if something is brewing, or if it is simply the market shifting its view on potential growth. There's no headline-making news to dissect, but any swing in biotech stocks tends to spark curiosity about whether this is the start of a trend or just day-to-day noise.

Over the year, Jyong Biotech's stock has seen momentum pick up and drop off at different moments, a pattern not unusual for early-stage biotech companies. Shares jumped 17% over the past week and have climbed nearly 67% during the last month, which is a notable snapback compared to recent lulls. With broader biotech sentiment fluctuating, it makes sense for investors to ask how these moves fit into the long-term story, especially with no fundamental news breaking to anchor the action.

With shares rallying so sharply in the past month, is the market missing something about Jyong Biotech’s prospects, or has every bit of future growth already been factored in?

Price-to-Book Ratio of -125x: Is it justified?

Jyong Biotech stands out for its negative price-to-book ratio of -125x. This is a sharp contrast to the average price-to-book multiples of the US Biotech industry and its peers. Such a deeply negative figure can make it difficult to draw meaningful conclusions about the company’s valuation using this metric alone.

The price-to-book ratio compares a company's market value to its book value. In the case of Jyong Biotech, negative shareholders’ equity drives this ratio far below industry norms and highlights underlying financial challenges. In the biotech sector, book value can be a less reliable indicator, as R&D spending and future potential often play a much larger role compared to established assets.

With negative equity and no significant revenue, the market appears to be pricing in high risk or potential future dilution, rather than near-term profitability or asset value. This raises questions about whether investors are being overly optimistic or accurately reflecting the company’s financial foundation.

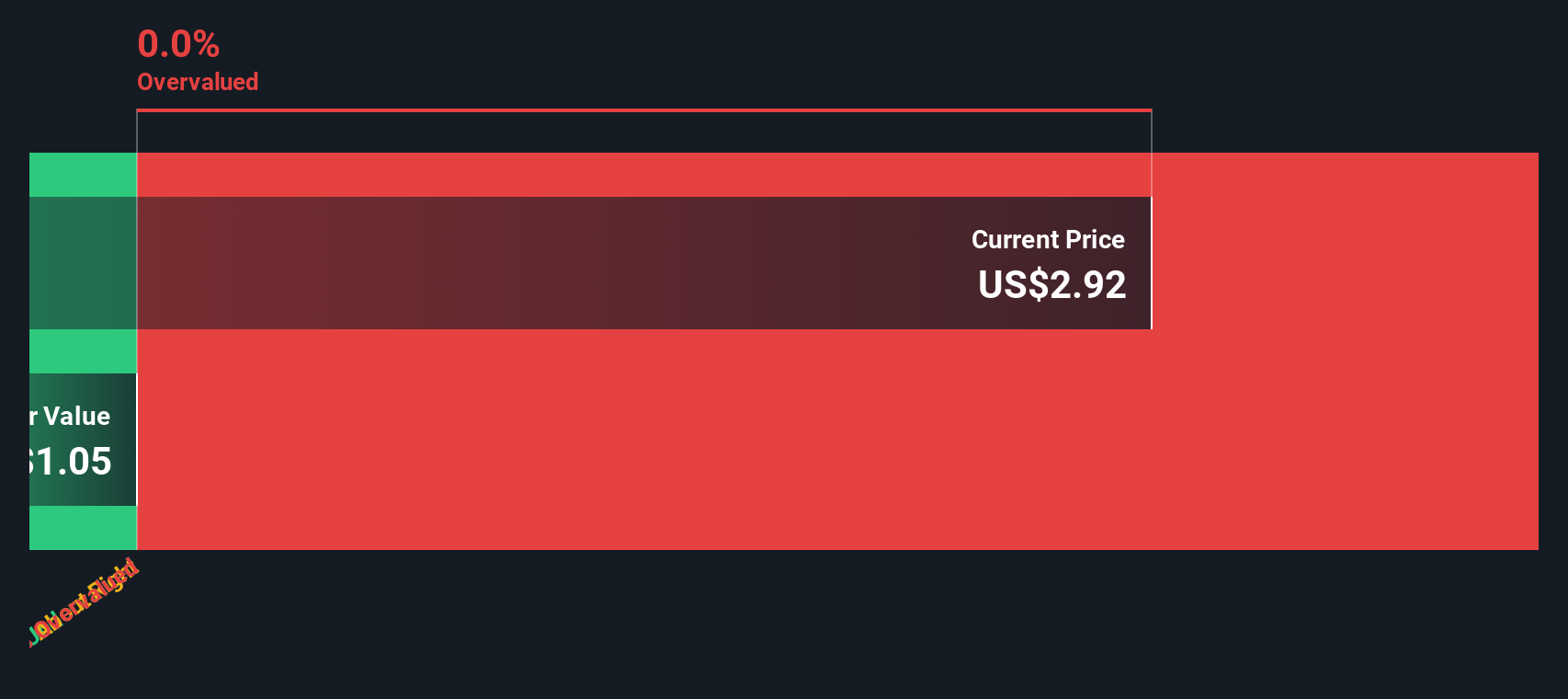

Result: Fair Value of $0 (OVERVALUED)

See our latest analysis for Jyong Biotech.However, risks remain, such as negative earnings and a lack of revenue. These factors could quickly dampen optimism if market sentiment shifts.

Find out about the key risks to this Jyong Biotech narrative.Another View: Our DCF Model’s Take

Switching perspective, our DCF model also signals that Jyong Biotech is overvalued. This offers little evidence to challenge the concerns from the book value multiples. Does any method capture the company’s real prospects?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Jyong Biotech Narrative

If you see the data differently or want to dig into the numbers yourself, you have the option to explore your own view in just a few minutes. Do it your way

A great starting point for your Jyong Biotech research is our analysis highlighting 5 important warning signs that could impact your investment decision.

Looking for more powerful investment ideas?

Great opportunities are just a click away. Don’t let your next big move slip through your fingers. There is a world of standout companies you could be ahead of right now. Use these top screens to upgrade your investing strategy today:

- Uncover potential in fast-rising technology with AI penny stocks and ride the innovation boom shaping tomorrow’s markets.

- Target stability and regular income by checking out dividend stocks with yields > 3% and put the power of strong dividend yields in your corner.

- Catch undervalued gems before the crowd by leveraging undervalued stocks based on cash flows for stocks with upside based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MENS

Jyong Biotech

A science-driven biotechnology company, develops and commercializes plant-derived drugs for the treatment of urinary system diseases in the United States, the European Union, and Asia.

Moderate risk with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion