- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

A Fresh Look at Madrigal Pharmaceuticals (MDGL) Valuation as Rezdiffra Demand Fuels Revenue Growth and Analyst Optimism

Reviewed by Kshitija Bhandaru

Madrigal Pharmaceuticals (MDGL) is drawing fresh interest after reporting strong demand for its lead drug, Rezdiffra, which treats metabolic dysfunction-associated steatohepatitis, or MASH. Investors are taking note of the company’s revenue momentum and rapid expansion.

See our latest analysis for Madrigal Pharmaceuticals.

Madrigal’s recent run of successes, including rapid revenue gains and new talent hires, seems to be energizing the stock. The share price has climbed steadily this year, with a remarkable 101% total shareholder return over the past 12 months and 559% over three years. This suggests that momentum may still be building as excitement around Rezdiffra grows.

If breakthrough therapies catch your interest, you might want to uncover more companies making waves in biotech and pharma. Explore See the full list for free.

With all this momentum and analyst optimism, the key question is whether Madrigal’s rapid rise means the stock offers attractive value, or if markets have already priced in the company’s future growth potential.

Most Popular Narrative: 11.5% Undervalued

Madrigal Pharmaceuticals' most-followed narrative points to a fair value that is meaningfully higher than its last close of $433.45, with the analysis hinting at substantial upside momentum based on future growth drivers. The fair value estimate reflects positive commercial trends and market expansion opportunities.

The rapid uptake and long-term patent protection of Rezdiffra, supported by a new U.S. patent that extends exclusivity to 2045, provides decades of protected revenue opportunity. This increases the likelihood of sustained top-line growth and supports margin expansion due to extended pricing power.

Curious about what supercharges this high valuation? The secret sauce is a blend of optimistic projections and unique profit drivers you might not expect. Want to find out why consensus is rallying behind this price and which bold forecasts underpin the premium? Uncover the detailed blueprint that experts believe justifies such an ambitious target.

Result: Fair Value of $489.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concerns remain around Madrigal’s reliance on a single lead drug, as well as the possibility of tougher competition impacting future growth and margins.

Find out about the key risks to this Madrigal Pharmaceuticals narrative.

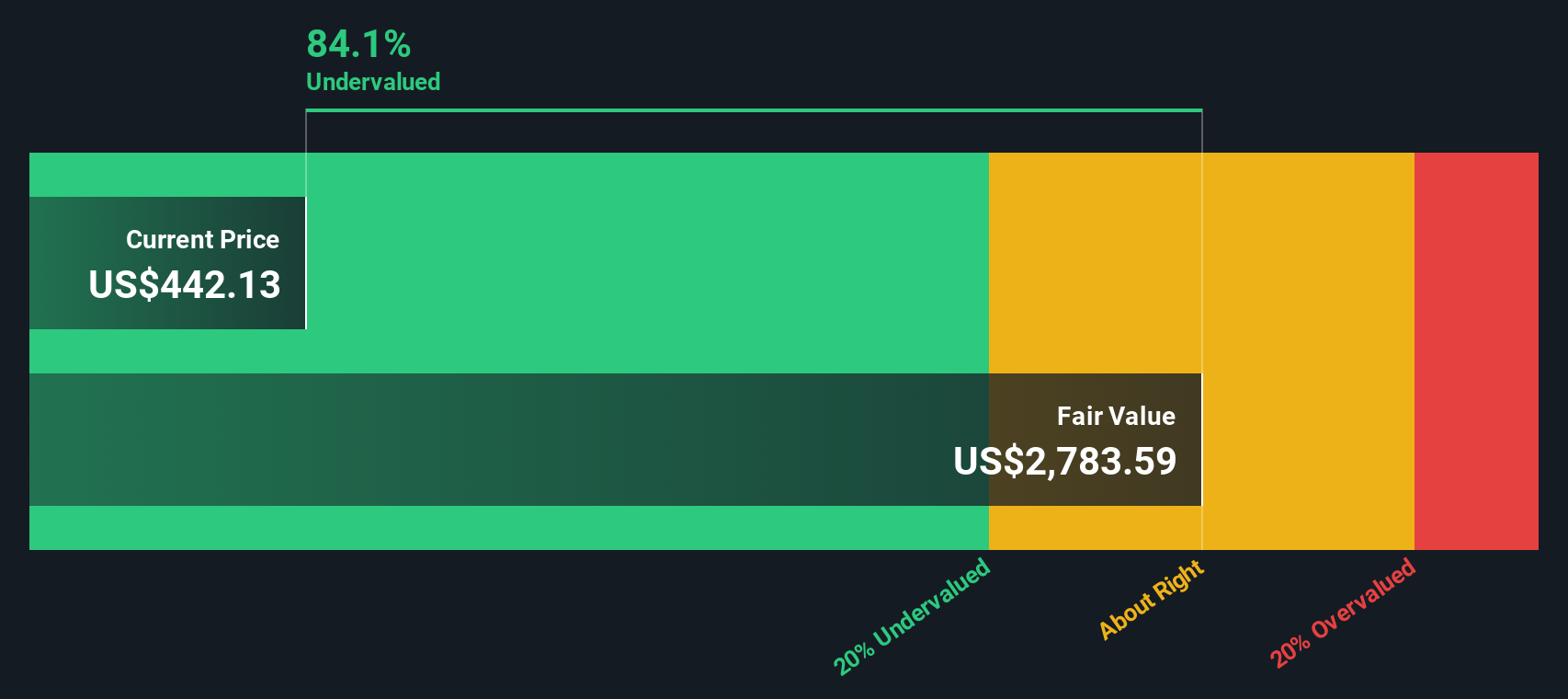

Another View: SWS DCF Model Points Much Higher

Looking at things from a different angle, our SWS DCF model values Madrigal Pharmaceuticals at $2,802.61. This is far above both the current share price and analyst estimates. This model suggests the market could be significantly underestimating long-term cash flow potential. Could this signal a hidden opportunity, or is the market being more cautious for a reason?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Madrigal Pharmaceuticals Narrative

If you see things differently or want to put your own spin on the numbers, you can dive into the data and craft your own view in just minutes. Do it your way

A great starting point for your Madrigal Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Don’t limit yourself to just one opportunity. Uncover standout stocks by using expert-curated screeners, and make sure you’re ahead of market trends before everyone else notices.

- Accelerate your search for high-potential market disruptors with these 24 AI penny stocks, which are breaking boundaries in artificial intelligence and smart automation.

- Lock in the chance for reliable returns by reviewing these 18 dividend stocks with yields > 3%, offering strong yields and resilient cash flows for income-focused investors.

- Jump on early-stage opportunities and find value among these 3562 penny stocks with strong financials, which may be poised for significant moves and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A biopharmaceutical company, focuses on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH) in the United States.

High growth potential and good value.

Market Insights

Community Narratives