- United States

- /

- Biotech

- /

- NasdaqGS:MCRB

Lacklustre Performance Is Driving Seres Therapeutics, Inc.'s (NASDAQ:MCRB) 30% Price Drop

To the annoyance of some shareholders, Seres Therapeutics, Inc. (NASDAQ:MCRB) shares are down a considerable 30% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 81% share price decline.

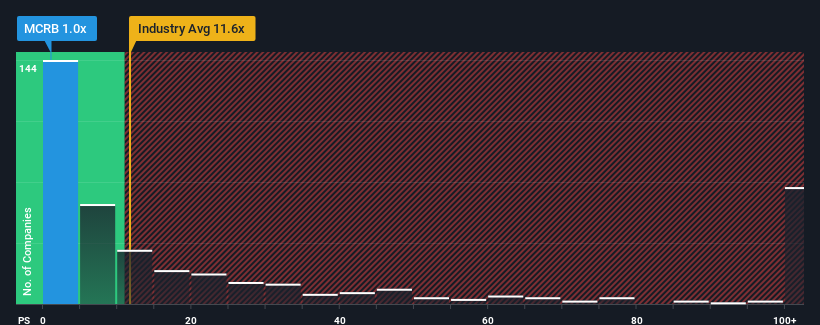

After such a large drop in price, Seres Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.6x and even P/S higher than 49x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Seres Therapeutics

What Does Seres Therapeutics' P/S Mean For Shareholders?

Seres Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Seres Therapeutics.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Seres Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The amazing performance means it was also able to deliver huge revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 19% each year as estimated by the seven analysts watching the company. Meanwhile, the broader industry is forecast to expand by 221% per annum, which paints a poor picture.

With this in consideration, we find it intriguing that Seres Therapeutics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Having almost fallen off a cliff, Seres Therapeutics' share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Seres Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you settle on your opinion, we've discovered 3 warning signs for Seres Therapeutics (2 shouldn't be ignored!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MCRB

Seres Therapeutics

A clinical-stage company, focuses on developing biotherapeutics for serious diseases.

Medium-low with mediocre balance sheet.

Market Insights

Community Narratives