- United States

- /

- Biotech

- /

- NasdaqGM:LRMR

Do Positive Friedreich's Ataxia Study Results Shift Larimar Therapeutics’ (LRMR) Long-Term Value Proposition?

Reviewed by Sasha Jovanovic

- Larimar Therapeutics recently announced positive data from its long-term open-label study evaluating daily subcutaneous injections of nomlabofusp in patients with Friedreich's Ataxia, alongside an update on its development program.

- This milestone highlights progress in advancing novel treatments for a rare neurological disease, capturing interest among rare disease and biotech stakeholders.

- We’ll explore how the encouraging clinical results for nomlabofusp are influencing Larimar Therapeutics’ investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Larimar Therapeutics' Investment Narrative?

Owning shares in Larimar Therapeutics means believing in the potential of its lead asset, nomlabofusp, to address the significant unmet medical need in Friedreich's Ataxia, a rare, progressive neurological disease. The recent news of positive long-term open-label study results for nomlabofusp directly impacts the company's most important short-term catalyst: supporting their pursuit of accelerated FDA approval, now targeted for mid-2026. This update could strengthen confidence in the development pipeline and potentially shift analyst attention back to regulatory and commercial milestones. However, it's important to weigh this against persistent risks: Larimar continues to post rising net losses, with revenue at zero, and will likely require more funding, particularly given its history of shareholder dilution. Volatile trading, an uncertain path to profitability, and ongoing regulatory hurdles remain critical factors for investors monitoring this story.

Conversely, keep a close eye on dilution risk and ongoing cash needs as the company advances its programs.

Exploring Other Perspectives

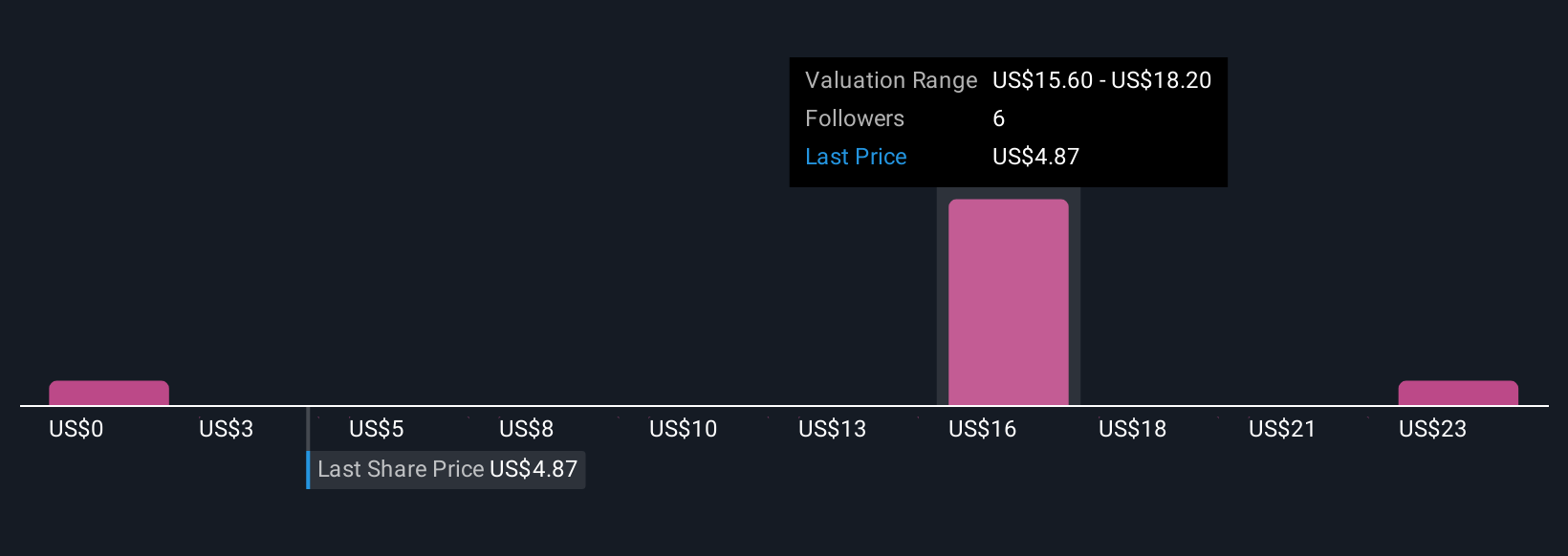

Explore 3 other fair value estimates on Larimar Therapeutics - why the stock might be worth 39% less than the current price!

Build Your Own Larimar Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Larimar Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Larimar Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Larimar Therapeutics' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LRMR

Larimar Therapeutics

A clinical-stage biotechnology company, focuses on developing treatments for rare diseases using its novel cell penetrating peptide technology platform.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026