- United States

- /

- Biotech

- /

- NasdaqCM:ATYR

Is aTyr Pharma (NASDAQ:LIFE) In A Good Position To Deliver On Growth Plans?

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether aTyr Pharma (NASDAQ:LIFE) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for aTyr Pharma

Does aTyr Pharma Have A Long Cash Runway?

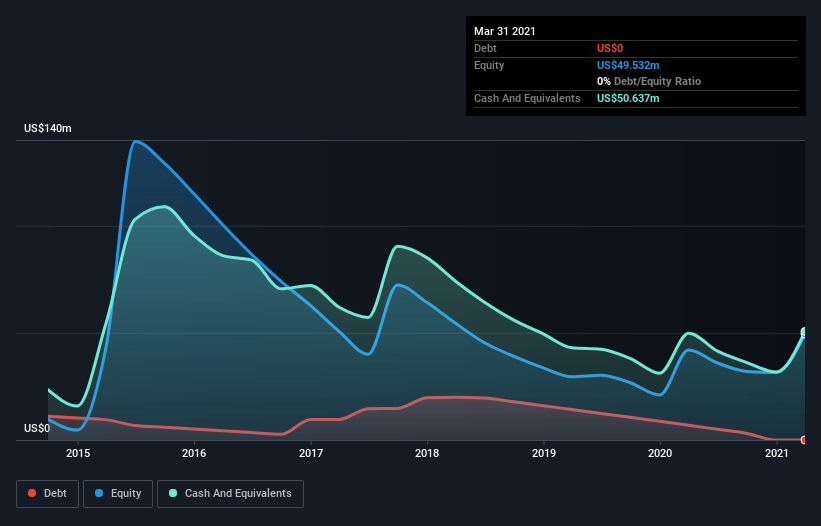

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When aTyr Pharma last reported its balance sheet in March 2021, it had zero debt and cash worth US$51m. Looking at the last year, the company burnt through US$23m. That means it had a cash runway of about 2.2 years as of March 2021. Importantly, analysts think that aTyr Pharma will reach cashflow breakeven in 4 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is aTyr Pharma Growing?

aTyr Pharma actually ramped up its cash burn by a whopping 91% in the last year, which shows it is boosting investment in the business. And that is all the more of a concern in light of the fact that operating revenue was actually down by 72% in the last year, as the company no doubt scrambles to change its fortunes. Considering these two factors together makes us nervous about the direction the company seems to be heading. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can aTyr Pharma Raise Cash?

Since aTyr Pharma can't yet boast improving growth metrics, the market will likely be considering how it can raise more cash if need be. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$71m, aTyr Pharma's US$23m in cash burn equates to about 33% of its market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

Is aTyr Pharma's Cash Burn A Worry?

On this analysis of aTyr Pharma's cash burn, we think its cash runway was reassuring, while its falling revenue has us a bit worried. One real positive is that analysts are forecasting that the company will reach breakeven. Summing up, we think the aTyr Pharma's cash burn is a risk, based on the factors we mentioned in this article. Separately, we looked at different risks affecting the company and spotted 6 warning signs for aTyr Pharma (of which 2 are concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

When trading aTyr Pharma or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ATYR

aTyr Pharma

A biotherapeutics company, engages in the discovery and development of medicines based on novel immunological pathways in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives