- United States

- /

- Biotech

- /

- NasdaqCM:ATYR

Did You Miss aTyr Pharma's (NASDAQ:LIFE) Impressive 103% Share Price Gain?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. Take, for example aTyr Pharma, Inc. (NASDAQ:LIFE). Its share price is already up an impressive 103% in the last twelve months. Better yet, the share price has gained 161% in the last quarter. In contrast, the longer term returns are negative, since the share price is 83% lower than it was three years ago.

See our latest analysis for aTyr Pharma

aTyr Pharma isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year aTyr Pharma saw its revenue grow by 2,957%. That's stonking growth even when compared to other loss-making stocks. Meanwhile, the market has paid attention, sending the share price soaring 103% in response. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

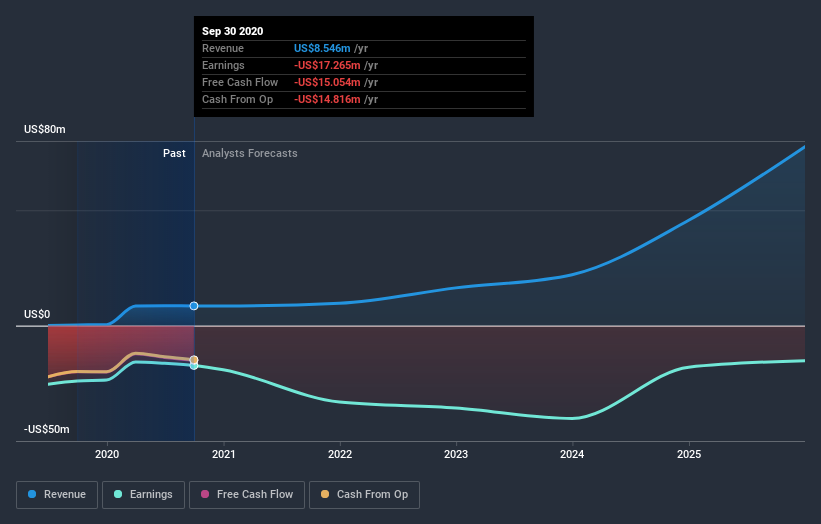

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think aTyr Pharma will earn in the future (free profit forecasts).

A Different Perspective

It's good to see that aTyr Pharma has rewarded shareholders with a total shareholder return of 103% in the last twelve months. That certainly beats the loss of about 13% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for aTyr Pharma (of which 1 shouldn't be ignored!) you should know about.

aTyr Pharma is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade aTyr Pharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ATYR

aTyr Pharma

A biotherapeutics company, engages in the discovery and development of medicines based on novel immunological pathways in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives