- United States

- /

- Biotech

- /

- NasdaqCM:KTTA

Pasithea Therapeutics Reaches US$104m Market Cap Benefiting Insider Stock Buying

Insiders who bought Pasithea Therapeutics Corp. (NASDAQ:KTTA) stock in the last 12 months were richly rewarded last week. The company's market value increased by US$94m as a result of the stock's 10% gain over the same period. As a result, the stock they originally bought for US$150.0k is now worth US$234.0k.

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

The Last 12 Months Of Insider Transactions At Pasithea Therapeutics

Notably, that recent purchase by Lawrence Steinman is the biggest insider purchase of Pasithea Therapeutics shares that we've seen in the last year. We do like to see buying, but this purchase was made at well below the current price of US$1.17. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

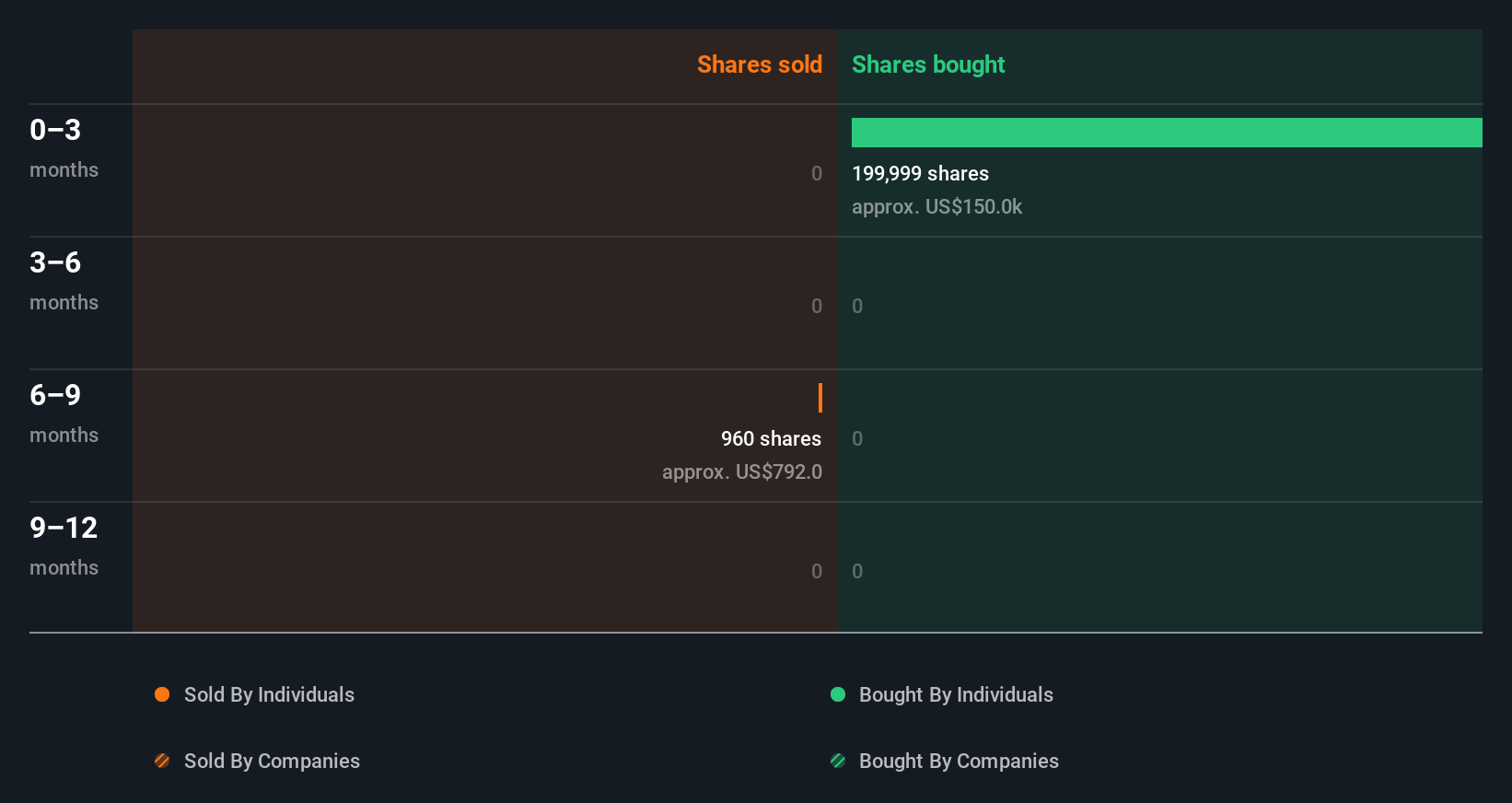

Over the last year, we can see that insiders have bought 200.00k shares worth US$150k. But insiders sold 960.00 shares worth US$792. In total, Pasithea Therapeutics insiders bought more than they sold over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

Check out our latest analysis for Pasithea Therapeutics

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Pasithea Therapeutics Insiders Bought Stock Recently

It's good to see that Pasithea Therapeutics insiders have made notable investments in the company's shares. Not only was there no selling that we can see, but they collectively bought US$150k worth of shares. This could be interpreted as suggesting a positive outlook.

Does Pasithea Therapeutics Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Our data isn't picking up on much insider ownership at Pasithea Therapeutics, though insiders do hold about US$443k worth of shares. It's always possible we are missing something but from our data, it looks like insider ownership is minimal.

What Might The Insider Transactions At Pasithea Therapeutics Tell Us?

It's certainly positive to see the recent insider purchases. We also take confidence from the longer term picture of insider transactions. But we don't feel the same about the fact the company is making losses. We would certainly prefer see higher levels of insider ownership but analysis of the insider transactions suggests that Pasithea Therapeutics insiders are expecting a bright future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. You'd be interested to know, that we found 4 warning signs for Pasithea Therapeutics and we suggest you have a look.

Of course Pasithea Therapeutics may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KTTA

Pasithea Therapeutics

A clinical-stage biotechnology company, focuses on the discovery, research, and development of treatments for central nervous system (CNS) disorders, RASopathies, and cancers.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026