- United States

- /

- Biotech

- /

- NasdaqGM:PTGX

Exploring Three High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has shown a positive trend, climbing 1.4% in the last week and rising 12% over the past year, with earnings projected to grow by 15% annually in the coming years. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.64% | 61.12% | ★★★★★★ |

| Ascendis Pharma | 35.15% | 60.20% | ★★★★★★ |

| Lumentum Holdings | 22.24% | 111.72% | ★★★★★★ |

Click here to see the full list of 228 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Protagonist Therapeutics (PTGX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Protagonist Therapeutics, Inc. is a biopharmaceutical company focused on developing peptide therapeutics for hematology and blood disorders, as well as inflammatory and immunomodulatory diseases, with a market cap of $3.16 billion.

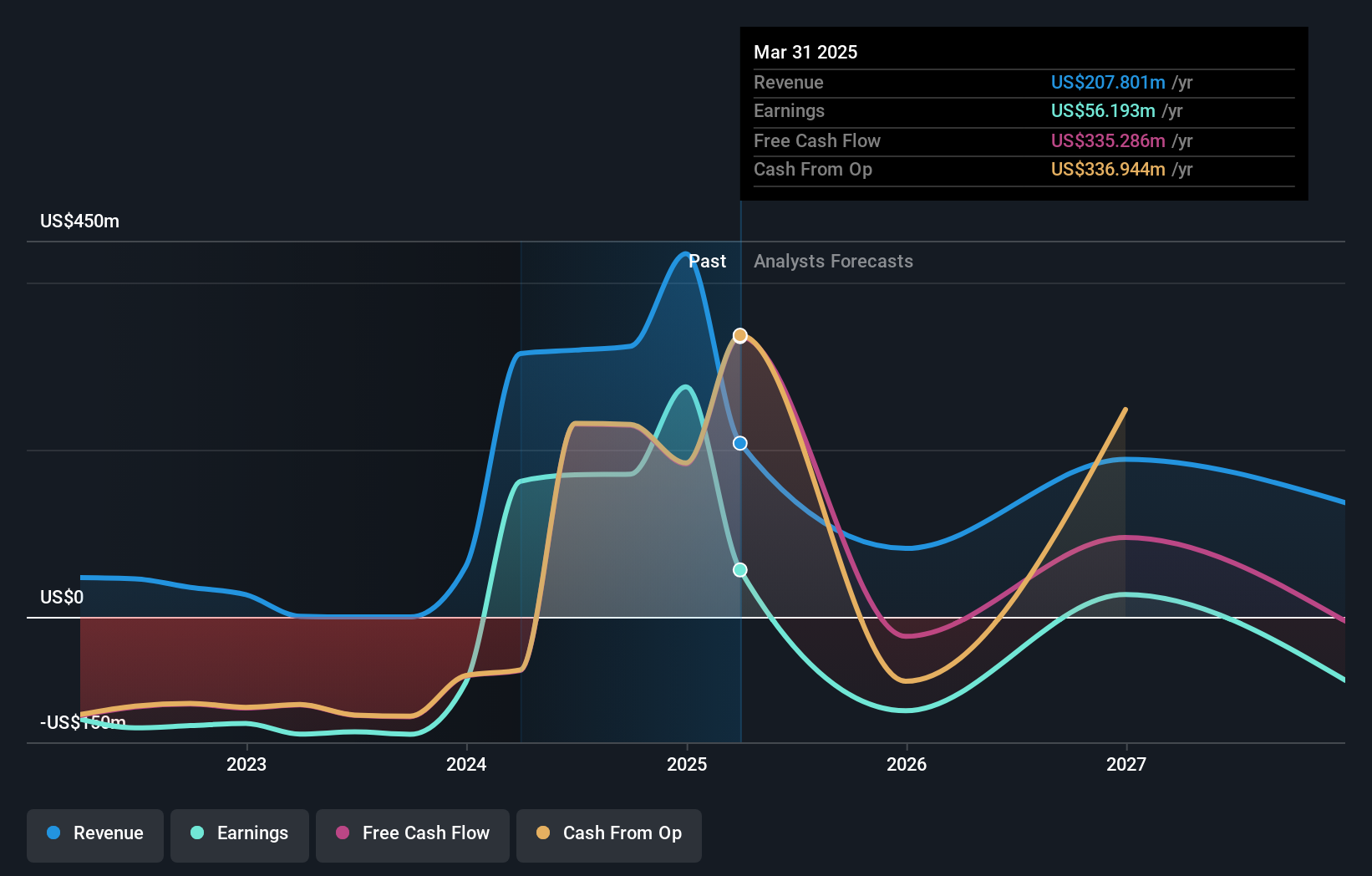

Operations: Protagonist Therapeutics develops peptide therapeutics primarily targeting hematology and blood disorders, alongside inflammatory and immunomodulatory diseases. The company generates revenue from its biotechnology segment, amounting to $207.80 million.

Protagonist Therapeutics has recently demonstrated significant strides in its clinical programs, notably with rusfertide in polycythemia vera, showing promising results at the ASCO Annual Meeting. Despite a challenging fiscal quarter with a net loss of $11.66 million compared to the previous year's net income of $207.34 million, the company's commitment to R&D is evident and pivotal for future growth; this aligns with an aggressive revenue growth forecast of 21.1% annually. The biotech firm's focus on innovative oral treatments in competitive segments like psoriasis underscores its potential to reshape treatment paradigms, despite current profitability challenges and a highly volatile share price.

- Unlock comprehensive insights into our analysis of Protagonist Therapeutics stock in this health report.

Evaluate Protagonist Therapeutics' historical performance by accessing our past performance report.

Core Scientific (CORZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Core Scientific, Inc. is a company that offers digital asset mining services in the United States with a market capitalization of $3.51 billion.

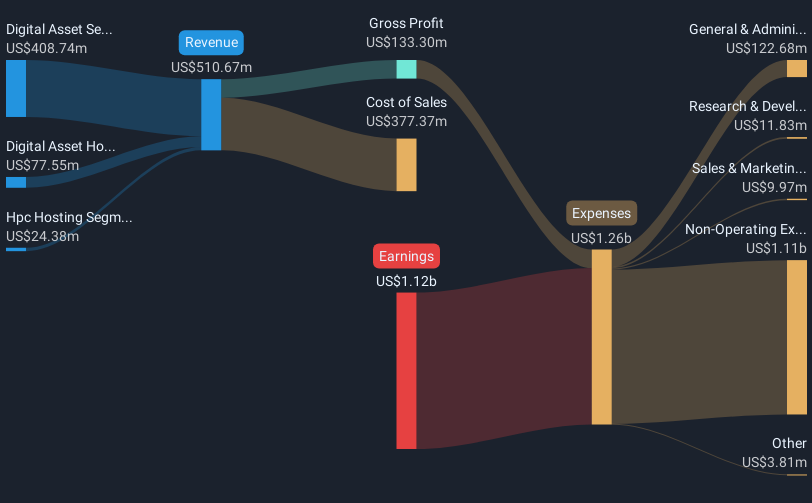

Operations: The company generates revenue primarily through its Digital Asset Self-Mining Segment, which contributes $325.96 million, and its Digital Asset Hosted Mining Segment, contributing $51.99 million.

Core Scientific, despite its unprofitable status, is poised for significant growth with a projected revenue increase of 29.9% per year and an anticipated shift to profitability within three years. This growth trajectory is notably higher than the broader US market's average of 8.6% annually. Recent strategic moves, including a substantial shelf registration of $519.84 million for potential future expansions and operational adjustments like the declassification of its board to enhance governance flexibility, underscore its aggressive approach towards scaling operations. Furthermore, the company's heavy investment in R&D aligns with its forward-looking stance in the tech sector, crucial for sustaining long-term competitiveness and innovation in high-growth environments.

Krystal Biotech (KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on the discovery, development, manufacturing, and commercialization of genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of approximately $3.78 billion.

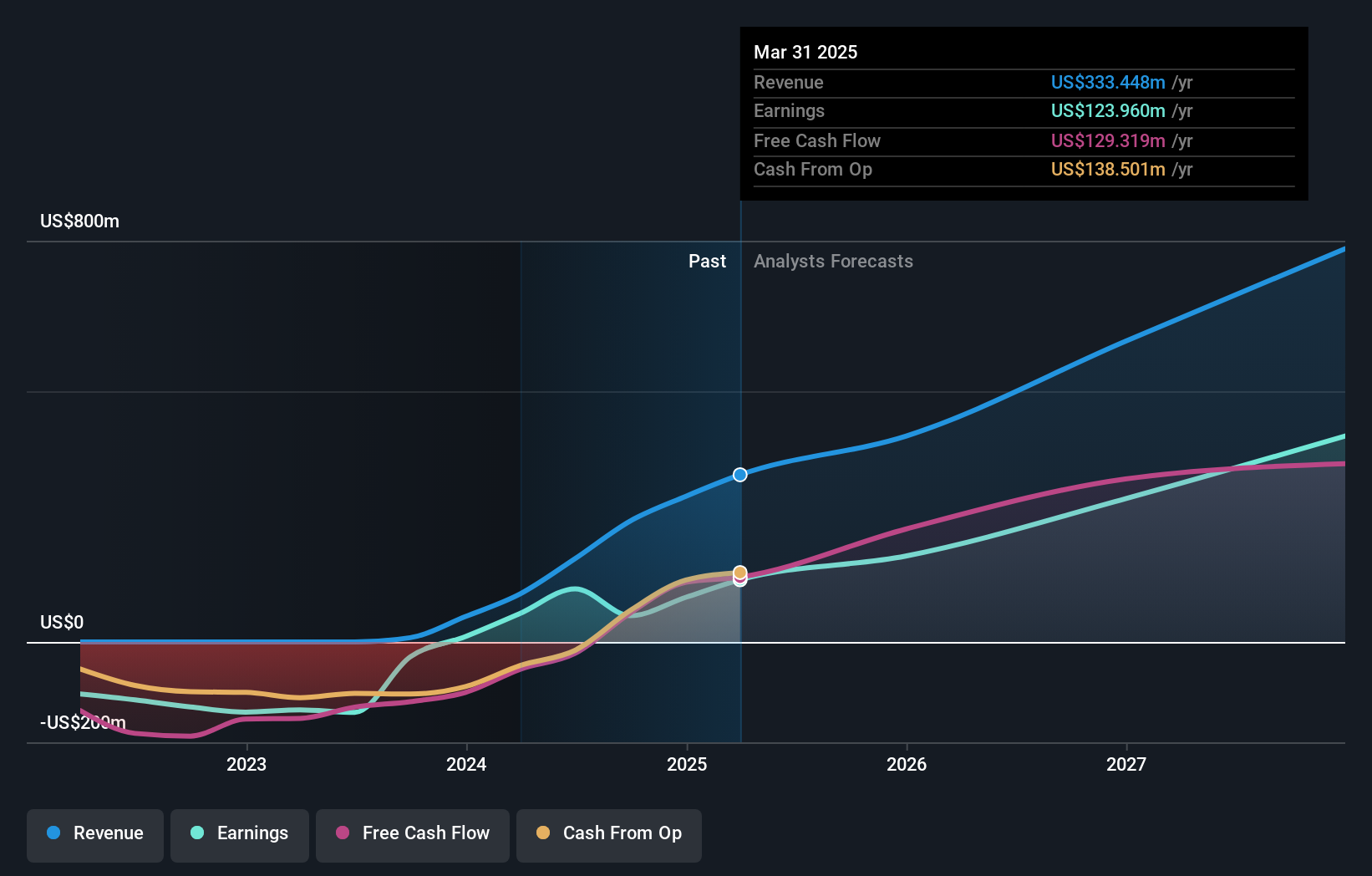

Operations: The company generates revenue primarily through the development and commercialization of pharmaceuticals, amounting to $333.45 million. With a focus on genetic medicines, it addresses diseases with significant unmet medical needs in the U.S.

Krystal Biotech stands out in the high-growth tech landscape with its impressive earnings growth of 116.9% over the past year, significantly outpacing the biotech industry's average of 21.7%. This performance is underpinned by robust revenue projections, expected to surge by 26.1% annually, dwarfing the broader US market forecast of 8.6%. The firm's strategic focus on innovation is evident from its recent clinical updates and product launches, including the European Commission approval for VYJUVEK®, a pioneering gene therapy for dystrophic epidermolysis bullosa. With a net profit margin improvement to 37.2%, despite a decrease from last year’s 59.6%, and ongoing investments in R&D to fuel future growth, Krystal Biotech is well-positioned to maintain its trajectory in cutting-edge medical technology advancements.

- Get an in-depth perspective on Krystal Biotech's performance by reading our health report here.

Examine Krystal Biotech's past performance report to understand how it has performed in the past.

Make It Happen

- Access the full spectrum of 228 US High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PTGX

Protagonist Therapeutics

A biopharmaceutical company, develops peptide therapeutics for hematology and blood disorders, and inflammatory and immunomodulatory diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives