- United States

- /

- Biotech

- /

- NasdaqGS:KPTI

Investors Don't See Light At End Of Karyopharm Therapeutics Inc.'s (NASDAQ:KPTI) Tunnel And Push Stock Down 27%

Unfortunately for some shareholders, the Karyopharm Therapeutics Inc. (NASDAQ:KPTI) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 71% loss during that time.

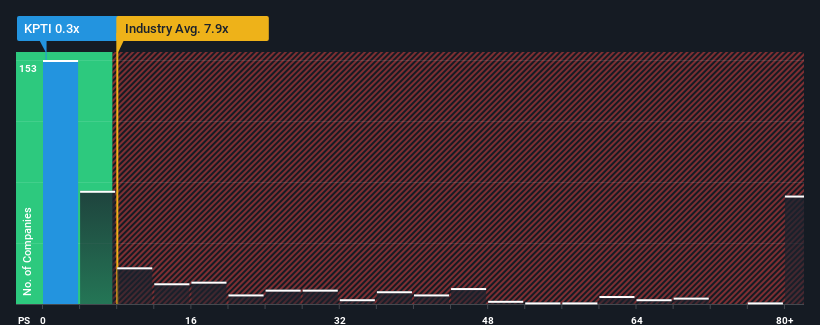

Since its price has dipped substantially, Karyopharm Therapeutics may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 7.9x and even P/S higher than 46x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Karyopharm Therapeutics

How Karyopharm Therapeutics Has Been Performing

Recent times haven't been great for Karyopharm Therapeutics as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Karyopharm Therapeutics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Karyopharm Therapeutics' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 39% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 25% per annum as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 163% each year growth forecast for the broader industry.

With this in consideration, its clear as to why Karyopharm Therapeutics' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Karyopharm Therapeutics' P/S Mean For Investors?

Having almost fallen off a cliff, Karyopharm Therapeutics' share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Karyopharm Therapeutics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 6 warning signs for Karyopharm Therapeutics (3 are potentially serious!) that we have uncovered.

If you're unsure about the strength of Karyopharm Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Karyopharm Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Karyopharm Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KPTI

Karyopharm Therapeutics

A commercial-stage pharmaceutical company, discovers, develops, and commercializes drugs directed against nuclear export for the treatment of cancer and other diseases in the United States.

Medium-low and fair value.

Similar Companies

Market Insights

Community Narratives