- United States

- /

- Biotech

- /

- NasdaqGS:KNSA

Industry Analysts Just Upgraded Their Kiniksa Pharmaceuticals, Ltd. (NASDAQ:KNSA) Revenue Forecasts By 27%

Kiniksa Pharmaceuticals, Ltd. (NASDAQ:KNSA) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline.

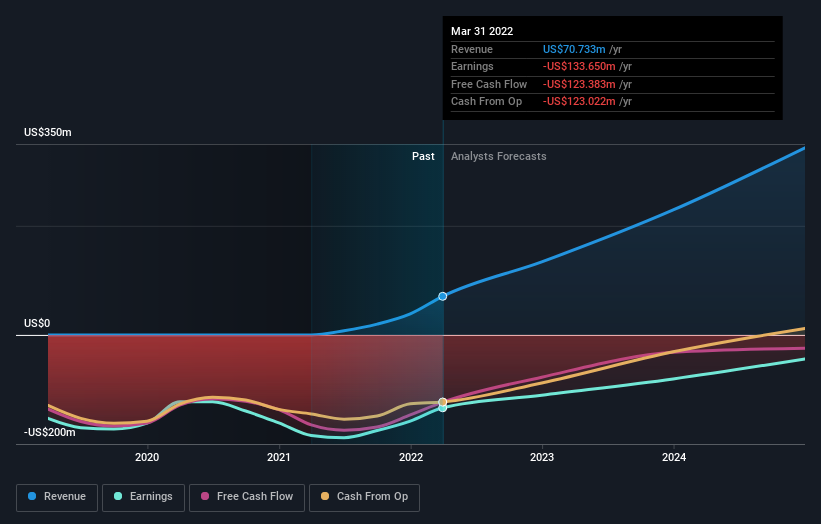

After this upgrade, Kiniksa Pharmaceuticals' four analysts are now forecasting revenues of US$169m in 2022. This would be a huge 139% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$134m in 2022. The consensus has definitely become more optimistic, showing a considerable lift to revenue forecasts.

View our latest analysis for Kiniksa Pharmaceuticals

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Kiniksa Pharmaceuticals' rate of growth is expected to accelerate meaningfully, with the forecast 5x annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 160% p.a. over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 14% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Kiniksa Pharmaceuticals is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts lifted their revenue estimates for this year. They're also forecasting more rapid revenue growth than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Kiniksa Pharmaceuticals.

Unsatisfied? At least one of Kiniksa Pharmaceuticals' four analysts has provided estimates out to 2024, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Kiniksa Pharmaceuticals International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KNSA

Kiniksa Pharmaceuticals International

A biopharmaceutical company, developing and commercializing novel therapies for diseases with unmet need and focuses on cardiovascular indications worldwide.

Very undervalued with flawless balance sheet.