- United States

- /

- Biotech

- /

- NasdaqGS:KNSA

Kiniksa Pharmaceuticals (KNSA): Valuation in Focus Following Upbeat 2025 Revenue Guidance and Arcalyst Growth Momentum

Reviewed by Kshitija Bhandaru

Kiniksa Pharmaceuticals (KNSA) just raised its 2025 net product revenue guidance, highlighting both the momentum behind its Arcalyst launch and clear signs of rising market demand. This new outlook points to better-than-expected product performance, fueling optimism among investors.

See our latest analysis for Kiniksa Pharmaceuticals International.

Kiniksa Pharmaceuticals International has enjoyed standout momentum, with its share price climbing 90% year-to-date and a striking 33% gain over the past three months. That surge in share price follows a string of positive catalysts, from Arcalyst’s commercial progress to upbeat revenue guidance. Investors are clearly rewarding both short-term execution and the company’s improved outlook, bolstered by a 40% total shareholder return in the past year. With both recent and multi-year returns well above the industry norm, momentum appears firmly on Kiniksa’s side.

If strong pharma launches make you curious about what else is performing, it might be time to check out See the full list for free.

But with share prices soaring and analysts lifting their targets, is Kiniksa still trading at an attractive valuation, or have expectations already been fully priced in? This leaves investors to consider if there is true upside left.

Most Popular Narrative: 22.4% Undervalued

The latest narrative suggests Kiniksa Pharmaceuticals’ fair value sits well above the current market price, hinting at significant upside according to consensus assumptions. With analyst projections guiding the fair value, this framework brings growth expectations and commercial execution into sharp focus.

Significant expansion opportunities for ARCALYST remain. Market penetration into the recurrent pericarditis population is still only 15%, with a large additional segment (first recurrence patients) representing another untapped 26,000 patients. This could continue to accelerate topline revenue growth as adoption widens across a growing addressable market due to population aging and rising prevalence of autoimmune and inflammatory disorders.

Curious how analysts arrive at such a bullish price estimate? The crux of this narrative is ambitious future growth targets and a profit outlook that rivals leading large-cap biotech firms. Want to learn the top-line and bottom-line forecasts that justify this target? Unlock the core assumptions and get the full inside track by reading the full narrative.

Result: Fair Value of $48.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Kiniksa's heavy reliance on Arcalyst and exposure to rising competition could quickly challenge its growth narrative if market dynamics shift.

Find out about the key risks to this Kiniksa Pharmaceuticals International narrative.

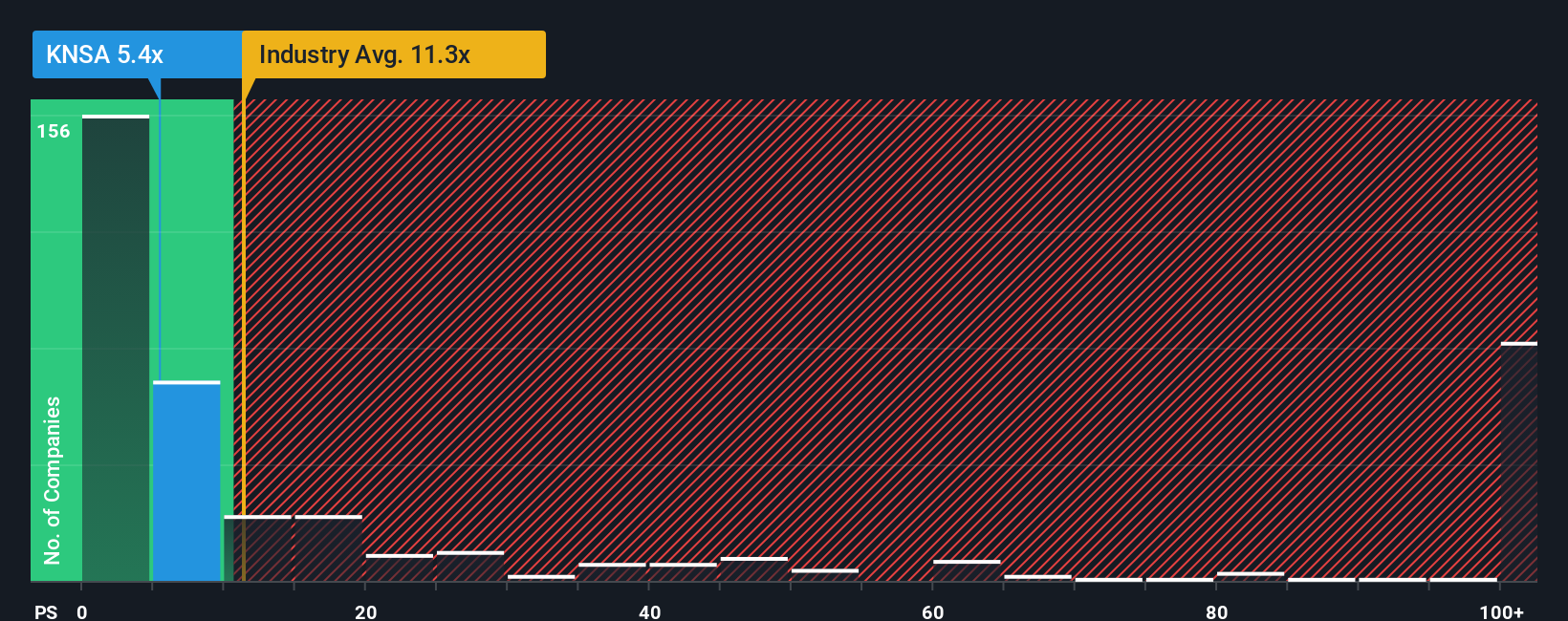

Another View: Ratios Show Relative Value

Kiniksa trades at a price-to-sales ratio of 5.3x, which is well below the US Biotechs industry average of 10.3x and its closest peer average of 17.5x. However, it sits above its fair ratio of 4.7x. This gap suggests Kiniksa is attractively valued relative to many competitors, yet could still be exposed if the market starts to pull multiples down to more conservative levels. Does this leave room for upside, or is it a sign to tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kiniksa Pharmaceuticals International Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kiniksa Pharmaceuticals International.

Looking for more investment ideas?

Unlock the smartest moves with tailored stock picks that you won’t want to miss. Opportunities like these are rare, so seize your edge now.

- Jump into AI’s hottest growth story by following these 25 AI penny stocks and tap into companies pushing the boundaries of innovation and intelligent automation.

- Boost your portfolio’s income with these 18 dividend stocks with yields > 3%; start earning from a select group of businesses delivering yields that outshine the market average.

- Be ahead of the next wave of value with these 881 undervalued stocks based on cash flows and seek out stocks trading well below their intrinsic worth before the rest of the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiniksa Pharmaceuticals International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KNSA

Kiniksa Pharmaceuticals International

A biopharmaceutical company, developing and commercializing novel therapies for diseases with unmet need and focuses on cardiovascular indications worldwide.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives