- United States

- /

- Biotech

- /

- NasdaqGM:KALV

We're Keeping An Eye On KalVista Pharmaceuticals' (NASDAQ:KALV) Cash Burn Rate

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should KalVista Pharmaceuticals (NASDAQ:KALV) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for KalVista Pharmaceuticals

Does KalVista Pharmaceuticals Have A Long Cash Runway?

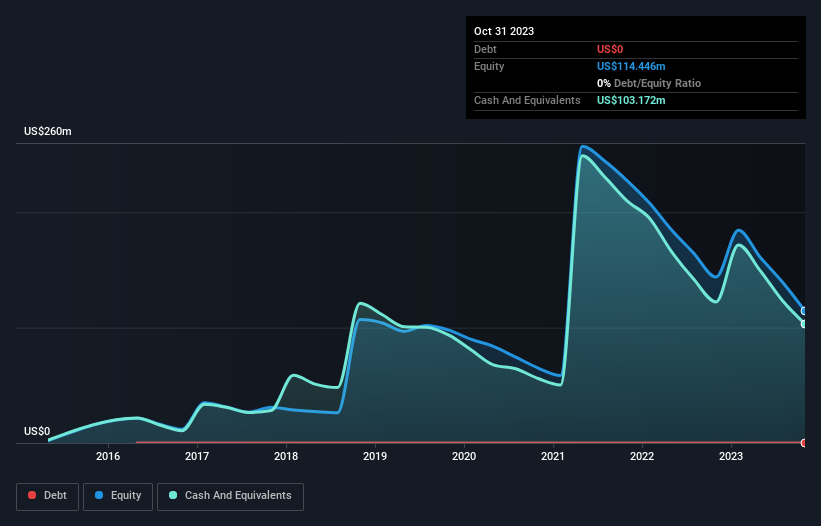

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at October 2023, KalVista Pharmaceuticals had cash of US$103m and no debt. Importantly, its cash burn was US$79m over the trailing twelve months. So it had a cash runway of approximately 16 months from October 2023. Notably, analysts forecast that KalVista Pharmaceuticals will break even (at a free cash flow level) in about 4 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. Depicted below, you can see how its cash holdings have changed over time.

How Is KalVista Pharmaceuticals' Cash Burn Changing Over Time?

KalVista Pharmaceuticals didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. With cash burn dropping by 8.0% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can KalVista Pharmaceuticals Raise More Cash Easily?

While KalVista Pharmaceuticals is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

KalVista Pharmaceuticals' cash burn of US$79m is about 17% of its US$462m market capitalisation. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About KalVista Pharmaceuticals' Cash Burn?

The good news is that in our view KalVista Pharmaceuticals' cash burn situation gives shareholders real reason for optimism. One the one hand we have its solid cash burn relative to its market cap, while on the other it can also boast very strong cash runway. One real positive is that analysts are forecasting that the company will reach breakeven. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Taking a deeper dive, we've spotted 3 warning signs for KalVista Pharmaceuticals you should be aware of, and 2 of them make us uncomfortable.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade KalVista Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KalVista Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:KALV

KalVista Pharmaceuticals

A clinical stage pharmaceutical company, engages in the discovery, development, and commercialization of drug therapies inhibitors for diseases with unmet needs.

Flawless balance sheet and fair value.

Market Insights

Community Narratives