- United States

- /

- Pharma

- /

- NasdaqGS:JAZZ

Jazz Pharmaceuticals plc's (NASDAQ:JAZZ) Price Is Right But Growth Is Lacking

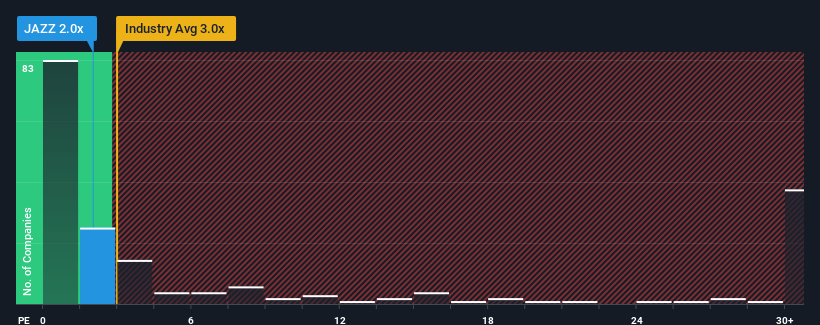

Jazz Pharmaceuticals plc's (NASDAQ:JAZZ) price-to-sales (or "P/S") ratio of 2x might make it look like a buy right now compared to the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 3x and even P/S above 20x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Jazz Pharmaceuticals

How Has Jazz Pharmaceuticals Performed Recently?

Jazz Pharmaceuticals could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jazz Pharmaceuticals.How Is Jazz Pharmaceuticals' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Jazz Pharmaceuticals' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.9% last year. The latest three year period has also seen an excellent 66% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 5.3% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 53% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why Jazz Pharmaceuticals is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Jazz Pharmaceuticals' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Jazz Pharmaceuticals' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Jazz Pharmaceuticals, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Jazz Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:JAZZ

Jazz Pharmaceuticals

Jazz Pharmaceuticals plc identifies, develops, and commercializes pharmaceutical products for unmet medical needs in the United States, Europe, and internationally.

Undervalued with acceptable track record.